Key Takeaways:

Current price: $263 Price target: $322

Position size: 2.95% 1-year performance: +50%

- Revenue growth of +20% y/y thanks in part to the Philips recall that had a positive impact on Resmed sales, adding $80-90M. The launch of AirSense 11 is also boosting sales, while the prior model AirSense 10 has not seen a price decrease as usually would be the case, most likely due to worsening supply chain issue. Q2 and Q3 sales growth will be impacted by supply chain issues, but the company did not lower its full year sales guidance, suggesting a return to normal towards next summer.

- Devices sales lifted by competitor Philips recall:

- US devices sales were +40%

- Rest of world devices sales +24%

- Masks segment saw a sales slowdown due to lower new patient intake, but still reaching +9%

- US masks sales +4.5%, supported by their resupply program of current patients – the lower level of new patients will have an impact on future growth though

- Ex-US market +18%

- Software-as-a-service business: mid-single digits growth to increase high-single-digits throughout the year.

- Covid-driven demand for ventilator is now $4M from $40M last year.

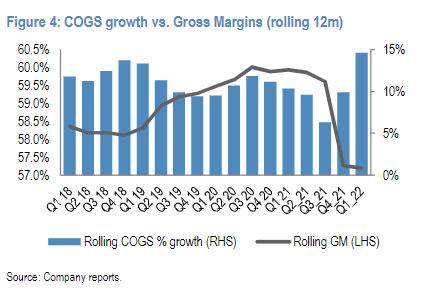

- Gross margin impacted by higher freight costs. bps y/y The launch of premium priced AirSense 11 (+15-25% per Goldman Sachs) should help gross margins in the coming quarters.

On the M&S front, RMD is under levered and has access to $1.5B in liquidity for bolt-on deals. This quarter, RMD completed the acquisition of Ectosense (a global producer of cloud-connected home sleep tests).

We think the stock is down today due to higher freight costs (profitability impact) and potential slowdown in sales in the coming quarters due to supply chain issues (by now, hopefully this is no longer a new theme to anyone!!).

Thesis on RMD:

- Leading position in the underpenetrated sleep apnea space

- Duopoly market

- New product cycle

- Returns of capital to increase: ~1% share buyback/year (back in FY18), dividend yield of 2%

$RMD.US

[category earnings] [category equity research] [tag RMD]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109