Good morning,

Hydrogen has been talked a lot in the past couple of years. I wanted to provide a high level understanding of what it is, and its application for the vehicle market. Attached is also BMO’s primer on the subject (very dense report…) and BTIG’s initiation on PLUG.

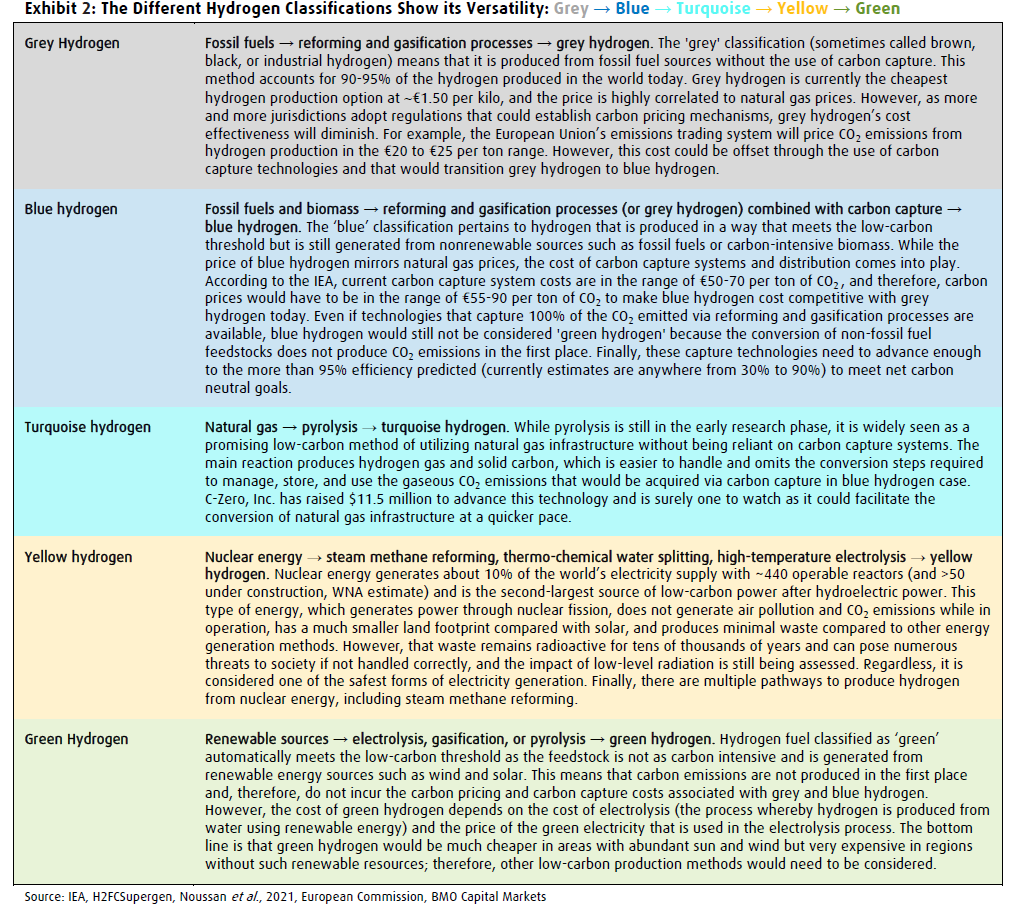

Hydrogen can be produced in various ways, see the chart below:

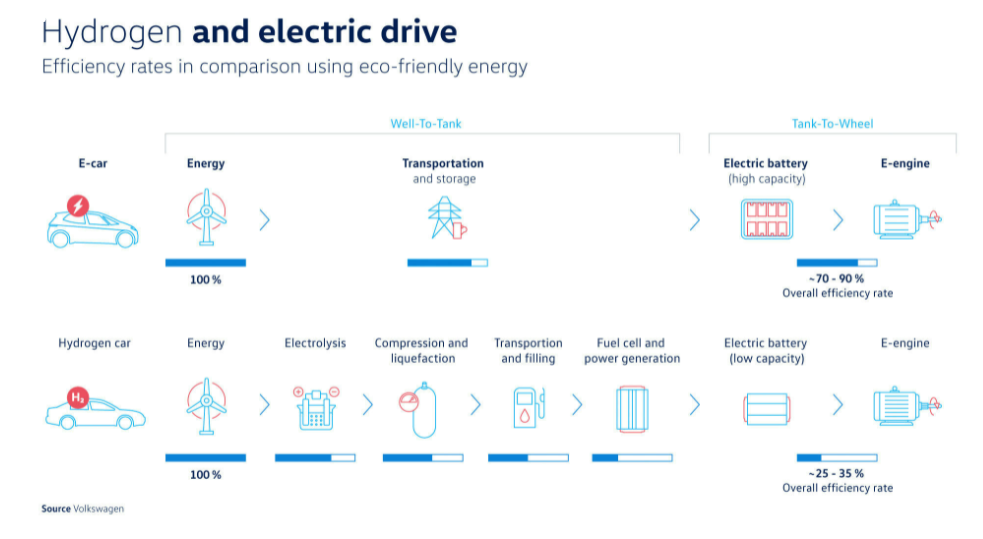

Comparison of fuel cell electric vehicles (FCEV or hydrogen), and battery electric vehicles (BEV).

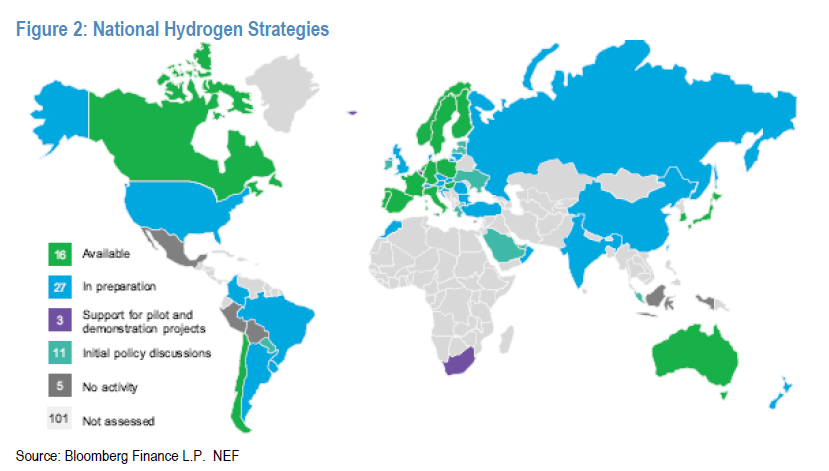

Currently there are millions of plug-in electric cars (mostly battery EV) globally vs. thousands of hydrogen cars, dominating the automotive market. Until industrial production and supply of hydrogen improves, looks like this will remain the case for cars. But for the larger vehicle and aviation markets and even in industrial and domestic heating, hydrogen could be a good alternative to meet net zero carbon emissions target. One technology is not exclusive of the other, they could both play a role in decarbonization efforts.

Who makes hydrogen fuel cell vehicles? Toyota, Honda, Hyundai. Some automakers have stopped funding hydrogen research favoring BEV, while some maintained a portion of R&D spending towards it.

Hydrogen cars:

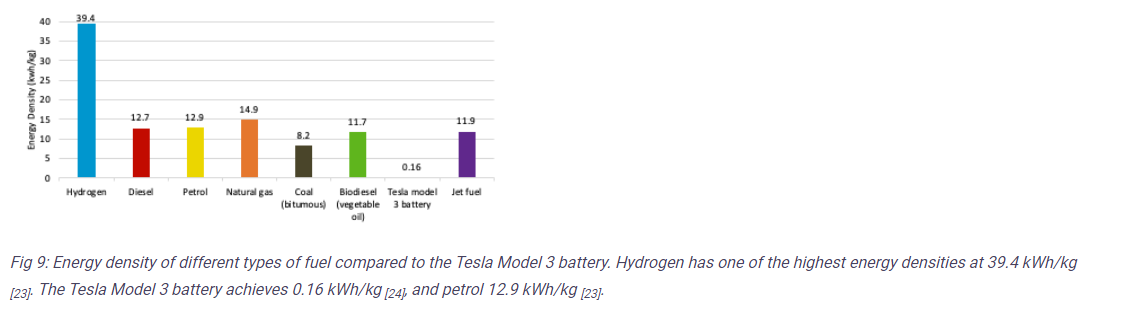

Positive of hydrogen:

- Quick to refill tank (like fossil fuel)

- Longer driving range than BEV – could be better suited for trucks with heavy loads

- Light to transport

- Great for warehouses that can refill on site quickly

- Hybrid hydrogen vehicles seems a good alternative

Negative of hydrogen:

- High risks of explosion, especially during transportation/processing – not so much during use in a car (fuel tanks are Kevlar-lined to protect from detonation.

- Processing of hydrogen is not very energy efficient, running at 25-30% efficiency vs. 70-80% for BEV due to processing & transporting it

- 95% of hydrogen comes from fossil fuel, although the technology for green hydrogen is progressing

- Infrastructure is small compared to charging stations for BEV

- Cost of hydrogen for refueling is higher than fossil fuel, although some auto manufacturers offer to pay for it (in California)

Battery EV:

Positive of electric battery:

- More energy efficient than hydrogen fuel cell cars

- Technology more suitable for mass rollout (more cost efficient to produce), resulting in accelerated production rate

Negative of electric EV:

- Time to recharge battery

- Doesn’t work well for heavy vehicles

- Battery degradation

Potential positive catalysts:

- Infrastructure bill: in the US, the trillion dollar infrastructure bill that earmarks billions for EV charging infrastructure, hydrogen production/hubs and many other programs has been held up in the House of Representatives. $15B for electrification and related services, including $7.5B for EV charging stations (500K vs 100K available today) and $9.5B for hydrogen projects including $8B for regional supply, $1B for electrolyzers and $500M for companies that innovate with hydrogen (the US DOE intends to reduce the cost of green hydrogen production to $2/kg by 2026).

- The proposed Build Back Better Act (budget reconciliation bill) has many provisions for electrification of mobility as well as a clean hydrogen production tax credit). Another key provision being discussed is a new clean hydrogen production tax credit that would offer $3/kg to hydrogen with 95% fewer lifecycle GHG emissions than hydrogen made through the currently dominant method, steam reforming.

- COP26 (ongoing this week and next): Stated goals of COP26 include securing global net-zero by mid-century and keep global warming within 1.5 degrees. Recommendations could come for phasing-out coal, reducing deforestation and accelerating EV/renewable energy.

PLUG stock comments:

Plug Power is a leading supplier of hydrogen fuel cell technology. It currently has a first-mover advantage in scaling its technology and deploying a network of hydrogen production/fueling system. It has a partnership with SK Group and Renault, Brookfield Energy, Apex to name a few. It main focus is currently large warehouses with a high number of forklifts to justify the cost of installation before accounting for CO2 emissions reductions, putting Amazon and Walmart as big customers – driving 70% of revenues (a risk in our eyes, which needs to be mitigated over time by signing on new clients).

The company also focuses on heavy duty trucks, medium duty (for example delivery vans), small robotics and aerospace UAVs. Their focus is not individual cars. Higher oil and natural gas prices are an opportunity for PLUG, with cost of ownership of diesel trucks higher than FCEV and BEV.

Valuation currently looks rich as it is not profitable (could be in 2023-24), and assumes supportive government policies. The stock is very volatile.

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109