MetWest Total Return Bond Fund Commentary – Q3 2021

Thesis

MWTIX (currently yielding 1.07%) is an actively managed fund that provides a sector-based strategy while still maintaining fundamental research driven through issue selection. When compared to the benchmark (Barclays U.S. AGG), the holdings have similar duration and exposure, yet selection is focused around areas where other managers are not looking. Through sector rotation and active weighting, we expect MWTIX to generate alpha over time.

[more]

Overview

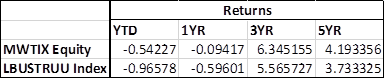

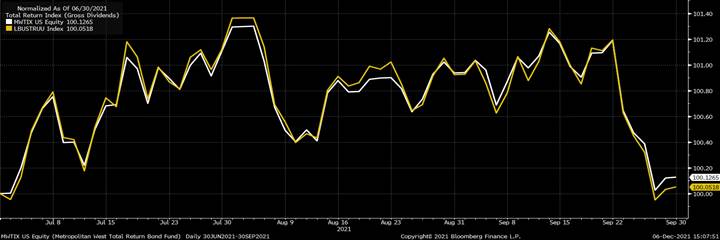

In the third quarter of 2021, MWTIX slightly outperformed the benchmark (Barclays U.S. AGG) by 7bps. Performance was largely driven by relatively beneficial positioning in corporate credit with a focus on higher yielding opportunities. An underweight to corporate credit, specifically Industrials, and an overweight to Financials contributed to overall performance. Securitized sectors were mostly flat, though non-agency MBS did provide a small tailwind to performance. Exposure to lower coupon securities and the fund’s duration positioning were the only headwinds for the quarter.

Q3 2021 Summary

- MWTIX returned 0.13%, while the U.S. AGG returned 0.05%

- Quarter-end effective duration for MWTIX was 6.29 and 6.71 for the U.S. AGG

- The team has taken action to de-risk the portfolio by moving up the quality spectrum, reducing tight commodity-exposed names/sectors, swapping into shorter-dated issues, and enhancing liquidity

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s defensive approach and minimal exposure to more vulnerable issuers and industries

- Focus remains on sectors that offer stability during volatile markets and wider spreads

- EM debt – possible opportunity based on cheaper entry points

- Securitized – preference for MBS TBAs due to better yield

- Legacy non-agency MBS – attractive from a collateral perspective

- CMBS – opportunities in AA- and A-rated starting to present itself (similar to CLOs)

- MWTIX has positioned itself defensively by maintaining a duration shorter than the index

- Risks going forward: continued volatility, higher inflation, slowing growth, elevated leverage, change in course of COVID à spread decompression, tight valuations, increased volatility

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109