Eaton Vance Floating-Rate Fund Commentary – Q3 2021

Thesis

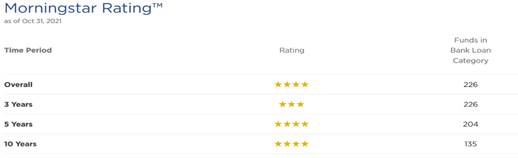

EIBLX (currently yielding 3.09%) is a large floating rate fund that has a strong historical returns and a tenured management team. By investing purely in senior bank loans, EIBLX further increases our potential upside gain, reduces our duration-risk, and decreases our interest rate risk. We like that the fund utilizes a bottom-up investment process through proprietary framework analysis, avoids high-yield corporate bonds, and allocates to relatively higher-rated securities within the floating rate security space.

[more]

Overview

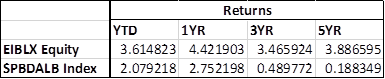

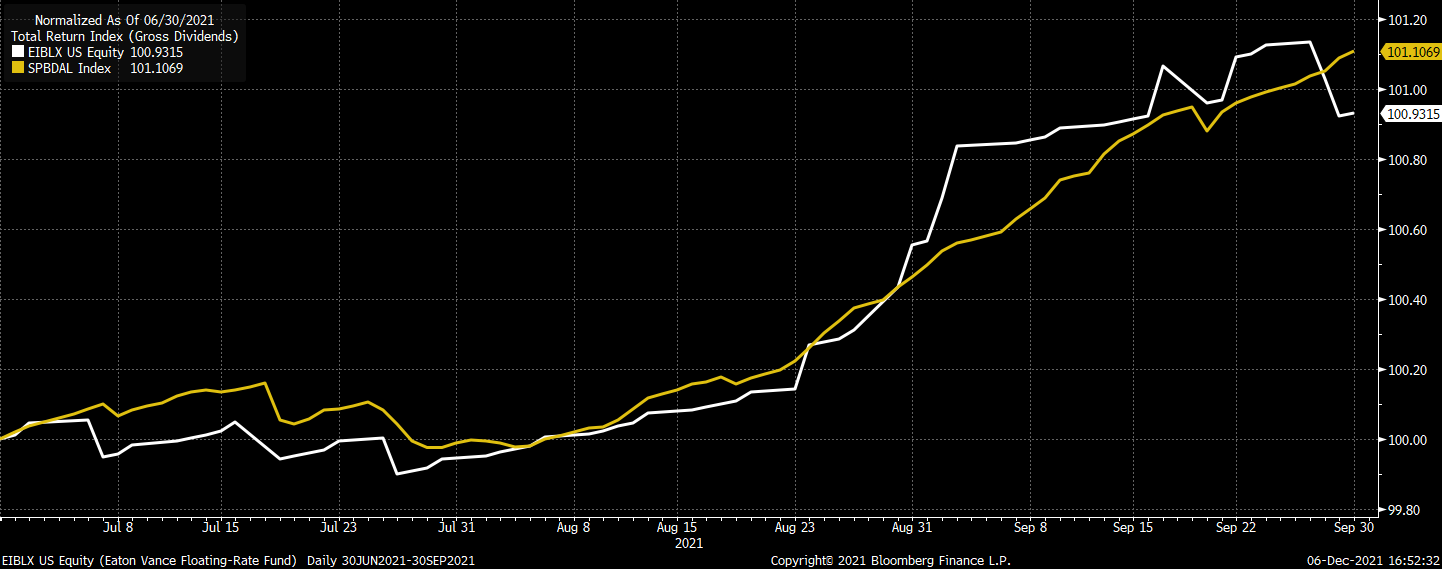

In the third quarter of 2021, EIBLX underperformed the benchmark (S&P/LSTA Leveraged Loan Index) by 21bps. Contributors to performance include an off-benchmark position in consumer goods market company, along with other holdings that added 30bps of performance. Detractors include a defense company, along with 10 other holdings that subtracted 32bps of returns. Allocation by industry and credit quality had little effect on the fund’s performance for the quarter.

Q3 2021 Summary

- EIBLX returned 0.93%, while the Leveraged Loan Index returned 1.14%

- Quarter-end effective duration for EIBLX was 0.36 and 0.07 for the Leveraged Loan Index

- Three largest contributors

- CM Acquisition Co., American Consol. Nat. Resources, IPC Corp (tied with Sunrise Oil Gas Prop)

- Three largest detractors

- IAP Worldwide Services Inc., Akorn Inc., Cash

Optimistic Outlook

- We hold this fund due to its relatively high yield and shorter duration, especially as we believe that rates will increase in the coming years

- Expecting a health credit picture along with investors’ search for yield will act as a tailwind for leveraged loans, specifically in the new-issue market

- Anticipate the default rate to continue to be low, which makes tight spreads relative to history a bit more attractive

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109