Westwood SmallCap Fund Commentary – Q3 2021

Thesis

WHGSX is our only active manager in the small cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding between 60 and 80 companies. By utilizing bottom-up fundamentals and focusing on companies with strong balance sheets, high ROIC, and consistently high FCF yield, the fund generates alpha especially during market downturns. We continue to hold WHGSX because of the team’s ability to find cheap valued stocks in the small cap space enabling them to generate strong returns over the long run.

[more]

Overview

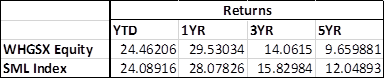

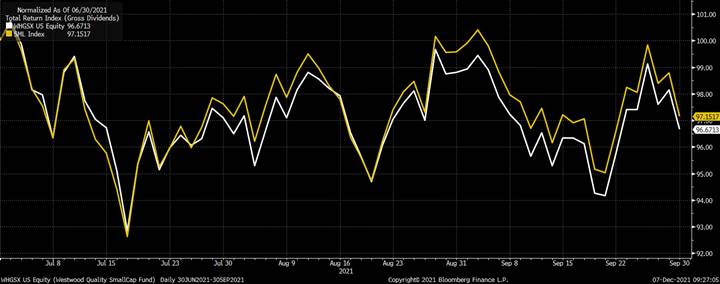

In the third quarter of 2021, WHGSX underperformed the benchmark (S&P 600 Index) by 48bps largely due to challenges within cyclical sectors outside of Energy and Financials. Industrials and Consumer Discretionary detracted from performance, mostly due to poor selection. Energy, on the other hand, was the strongest contributor for the quarter. Exposure to Communication Services and an underweight to Health Care also contributed to performance.

Q3 2021 Summary

- WHGSX returned (3.33%), while the S&P 600 Index returned (2.85%)

- Industrials – leading detractor due to concerns around slowing global growth

- Company-specific challenges and slowing foreign sales played a role in this slowdown

- Communication Services – largest contributor due to strong selection and an underweight to a “meme” stock

- Hope around 5G helped boost returns

- Health Care – underweight and positive selection within the sector helped aid fund performance

- Biotechnology saw a lot of pressure and other industries saw increases in their outlooks

- Buys: Sunstone Hotel, Triumph Bancorp, Whiting Petroleum, ADTRAN, Avanos Medical

- Sells: Healthcare Services Group, Oxford Industries, WW International, Internal Bancshares, Kaman, Summit Hotel

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the value and quality tilt strategy that has a bottom-up, fundamental focus around ROIC, FCF yields, balance sheet metrics, and companies trading at a discount

- Mixed markets during this quarter due to strong economic data and rising virus cases

- “Value” small cap stocks fell on margin, while more defensive and secular growth names rose

- Rising concerns around potential economic slowing, supply chain issues, modest employment gains, and “stagflation” may cause for a volatile market in the foreseeable future

- The fund will continue to focus on quality companies that are trading at a relatively attractive valuation – strong return and cash generation

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109