Hartford International Value Fund Commentary – Q3 2021

Thesis

Serving as a satellite holding, HILIX is a value style fund that takes advantage names that have underperformed recently and are cheaply priced. The team generates alpha by finding companies with strong fundamentals that are overlooked during times of low consensus expectations. We like that HILIX takes advantage of extremes and gains exposure to less efficient market caps by having more holdings and moderate active bets.

[more]

Overview

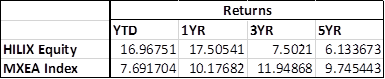

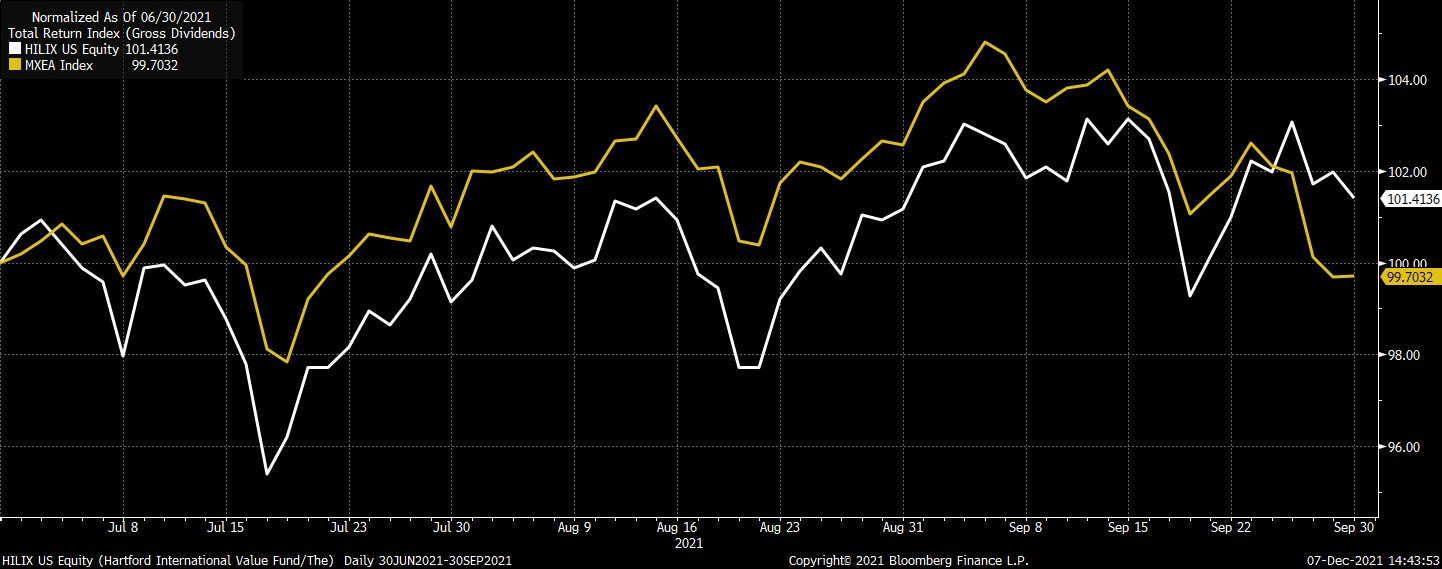

In the third quarter of 2021, HILIX outperformed the benchmark (MSCI EFEA Index) by 186bps due to strong security selection, specifically in Financials, Materials, and Energy. One the other hand, poor selection in Industrials and Information Technology detracted from returns. Allocation effect contributed to returns as well, particularly from underweights to Utilities and Health Care, and an overweight to Energy. This was slightly offset by an overweight to Consumer Discretionary and an underweight to Financials. Regionally, strong selection in North America, developed European Union and Middle East ex UK, and United Kingdom helped returns, while Japan took away from performance. Overall, Energy and Financials significantly drove performance for the International Developed markets, while Materials and Utilities detracted for the quarter.

Q3 2021 Summary

- HILIX returned 1.41%, while the MSCI EAFE Index returned (0.45%)

- Top issuer contributors

- Not owning Novartis

- Out-of-benchmark position in Gazprom

- Top issuer detractors

- Overweight to Adecco and Holcim

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s value and bottom-up, fundamental approach

- The fund has seen a strong rebound after large losses in 2020

- This fund is on our watch list as we are researching the “quality” of the underlying holdings and discussing whether a “deep” value strategy pairs well with our other funds in the asset class

- During the quarter the fund added positions in Asia Pacific, and sold/decreased positions in Europe and Asia Pacific

- Sumitomo Electric – added

- Maersk, Pacific Basin Shipping, Salzgitter – sold or reduced exposure

- The fund continues to have largest overweights to Energy and Communication Services, and most notable underweights in Health Care and Consumer Staples

- Regionally, the fund holds an overweight to EM and an underweight to Europe and Asia Pacific Ex Japan

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109