On 1/19, Bank of America (BAC) reported strong Q4 EPS of $.82 ahead of estimates of $.76. Highlights for the quarter were 12% Net Interest Income growth, deposit growth of 15% and ROTE of 17.0%. BAC’s earnings remain levered to rising interest rates – a 100 basis point increase in yields would increase NII $6.5b.

Current Price: $44.5 Price Target: $52 (raised from $50)

Position Size: 3.5% Trailing 12-month Performance: 43.9%

Highlights:

- Revenue growth of +10% to $22.1b

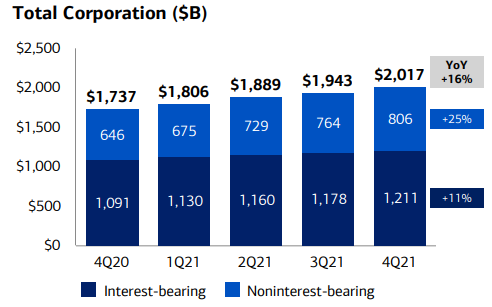

- Deposits continued their strong growth +15% YOY

- Strong metrics for loan quality throughout pandemic. BAC had a historically low loss ratio of 15 basis points.

- For the year, repurchased $25.1b of shares and dividends of $6.6b for a shareholder yield of 8.4%.

- Good expense control

Outlook:

- Set expectations for flat expense growth for 2022.

- Expects strong loan growth, and balances should return to pre-pandemic levels

- Net Interest Margin (NIM) fell slightly to 1.67% and should begin to recover with rate hikes.

- 100 basis point shift in yield curve will increase NII by $6.5b over next 12 months

- Deposits have grown 16% YOY

- Grew deposits by $270b in 2021!

- BAC ranked #1 in deposit share

- BAC pays just .05% on deposits

- BAC has managed the pandemic well with strong credit performance.

- Net charge-offs only 0.15% of loans, which is a 50-year low. Last year this ratio peaked at 0.45%. For comparison during 2010, the charge-off ratio peaked at 3.8% showing the relative severity of the Great Recession and the current strength of the U.S. banking system.

BAC Thesis:

- Over the years BAC has dramatically improved their Consumer Banking unit, leveraging technology and their digital platforms which has improved margins and driven earning’s growth.

- BAC has a high-quality loan book which was seen during the pandemic as loan loss metrics were best among peers

- BAC has strong earnings power, generating over $5b a quarter in earnings

- BAC continues to build capital which should lead to increased dividends and buybacks

- BAC’s earnings are sensitive to rate increases.

Please let me know if you have questions.

Thanks,

John

[category Equity Earnings]

[tag BAC]

$BAC.US

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109