Key takeaways:

Current Price: $165 Price Target: $200

Position size: 2.14% 1-Year Performance: -1.8%

- 4Q2021 results:

- Overall sales +11.6% organic, adjusted EPS +17.2%

- JNJ continues to outperform in its pharma segment, although this has been muted in part by lower consumer segment performance and reduced sales in medtech from Covid.

- There are multiple catalysts coming up for the stock this year:

- covid vaccines sales could surprise on the upside

- details on the separation of its consumer business, which should help rebase multiples for this high quality pharma name.

- Pharma segment performing well with sales +18.6% organic

- Covid vaccine sales helped top-line, as $1.62B sales beat expectations, mostly from international sales

- Overall covid vaccine sales for 2021 fell short of guidance ($2.39B vs. $2.5B)

- Oncology +12.3% growth

- Infectious diseases +168.8% from international covid vaccines

- Immunology +7.1% growth

- Pulmonary Hypertension -0.2%

- Cardiovascular/other growth -13.8% decline due to biosimilar competition

- Neuroscience +7.1%

- Expect sales to remain strong

- Consumer segment: +2.9% organic growth

- Growth driven by over-the-counter drugs

- Constraints from supply-chain issues (skincare in particular)

- Medical Devices: +5.6% organic sales growth

- Growth driven by market recovery post pandemic, new product introduction success

- Some deferrals in elective surgeries due to Omicron wave

- Supply-chain constraints

- Expect acceleration in recovery in 2H22

- This was the first call for JNJ new CEO Joaquin Duato

- JNJ announced in November 2021 the spin out of its consumer unit, leaving the more profitable pharma and medical devices unit together. JNJ is considering multiple pathways to the separation, which is planned for 2023. Next steps:

- 1H22: appointment of the consumer unit leadership team

- Mid-year: reveal of new name and headquarters location

- End of 2022: financial details provided

- 2022 initial guidance:

- Revenue $98.9B-$100.4B (consensus $98B) – includes covid vaccines of $3B-$3.5B

- Total sales growth of 7-8.5%

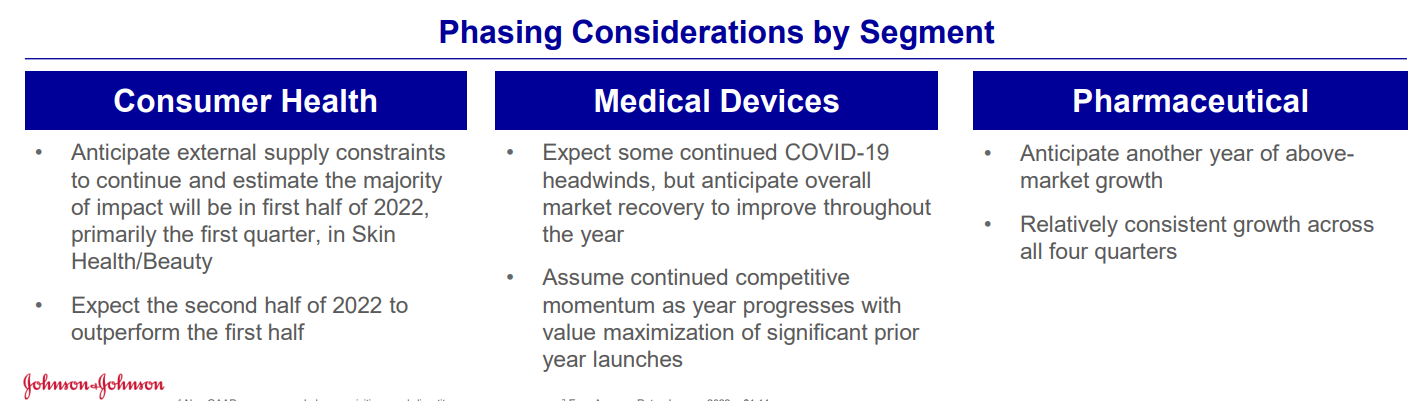

- Pharma: above market growth expected

- Medical devices: covid headwinds, with recovery later in the year

- Consumer health: supply chain constraints continue in 1H22

- 50bps operating margin expansion (includes covid vaccine)

- EPS $10.40-$10.60 vs consensus $10.35

Thesis on JNJ:

- High quality company with consistent 20% ROE, attractive FCF yield,

- Investments in the pipeline and moderating patent expirations create a profile for accelerated revenue and earnings growth

- Growth opportunity: Medical Devices and Consumer offer sustainable growth and potential for expansion internationally

- Strong balance sheet that offers opportunities for M&A.

[category Equity Earnings]

[tag JNJ]

$JNJ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109