Current Price: $294 Price Target: $375

Position Size: 7.7% TTM Performance: 27%

Key takeaways:

- Broad beat, solid Q3 guidance and commercial bookings growth.

- Revenue growth was +20% YoY revenue growth and EPS +22% YoY.

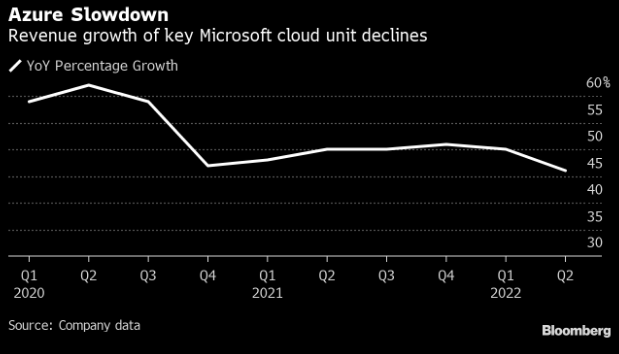

- Azure continues to be key growth driver – they saw slight deceleration (+45% from +48%), but forecasted for a re-acceleration. As I’ve noted many times, this business can be lumpy w/ an increasing amount of large contracts. While a small acceleration/deceleration here can often move the stock short-term, they key point is that they are well positioned in this business and continue to take share. This will be a solid long term growth driver for the company.

Additional Highlights:

- Quotes…

- On labor market: “We are experiencing a great reshuffle across the global labor market as more people in more places than ever rethink how, where and why they work” benefitting LinkedIn

- On the reimagined work environment: “The future of how we work, connect, and play, one thing is clear: the PC will be more critical than ever. There has been a structural shift in PC demand emerging from this pandemic.”

- On inflation: they sell products that help companies deal with inflationary pressures. “Digital technology is a deflationary force in an inflationary economy. Businesses – small and large – can improve productivity and the affordability of their products and services by building tech intensity.”

- On the metaverse: “as the digital and physical worlds come together we’re seeing real enterprise metaverse usage from smart factories to smart buildings to smart cities. We’re helping organizations use the combination of Azure IOT, digital twins and mesh to help digitize people places and things in order to visualize, simulate and analyze any business process.”

- Commercial cloud, which aggregates Azure, Office 365, the commercial portion of LinkedIn and Dynamics grew +32% YoY, closing in on a $90B annual run rate (Azure is >$40B run rate, so approaching half). They continue to see significant growth in the number of $10 million plus Azure and Microsoft 365 contracts.

- Secular growth: While Microsoft benefited from accelerated digital transformation from the pandemic, they are well positioned to capitalize on a number of long-term secular trends that will continue to drive mid-to-high teens earnings growth. Secular drivers include public cloud and SaaS adoption, continued digital transformation, AI/ML, BI/analytics, and DevOps. As organizations become increasingly digital, MSFT’s products are evolving from being primarily productivity tools to being more strategic tools. This suggests an improving value proposition to customers, which is key to the durability of their LT growth and profitability.

- Segment detail…

- Productivity and Business Processes ($16B, +19% YoY):

- LinkedIn – revenue increased 37% (up 36% in constant currency) driven by Marketing Solutions growth and an improving job market in their Talent Solutions business.

- Office 365 Commercial (rev +19%)- driven by installed base expansion as well as higher ARPU. Demand for security, compliance and voice offering drove continued momentum in E5 (highest tier) licensing.

- Dynamics 365 (rev +45%) – Power Platform (low-code, no-code tools, robotic process automation, virtual agents and business intelligence) now has >20 million monthly active users.

- Intelligent Cloud ($18B, +26% YoY):

- Server products and cloud services revenue increased 29% with Azure revenue growth of 46% driven by strong demand for their consumption based services.

- An increasing mix of large, long-term Azure contracts can drive quarterly volatility in the growth rates.

- Leader in hybrid cloud and have more datacenter regions than any other provider and continuing to add data center regions and extending their infrastructure to the 5G network edge helping operators and enterprises create new business models and deliver ultra-low latency services closer to the end-user. AT&T for example is bringing together its 5G network with MSFT’s cloud services to help General Motors deliver next generation connected vehicle solutions to drivers.

- More Personal Computing ($13.3B +12% YoY):

- Windows OEM revenue increased 25%. Seeing continued strength in PC demand despite ongoing supply chain disruptions.

- Surface revenue increased 8%

- Gaming revenue increased 8%. Xbox hardware revenue grew a 4%, driven by demand for new consoles and better than expected supply. Xbox and content and services revenue increased 10%.

- Search advertising revenue increased +32% YoY as companies pick up spending on digital advertising

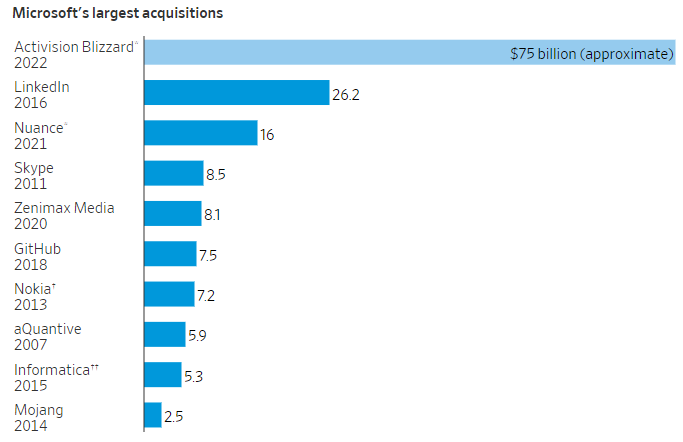

- Microsoft is looking to acquire Activision Blizzard in an all cash deal for $69B (net of ~$6B in cash). MSFT has ~$125B in cash on hand. It is expected to close by July 2023 pending approval by regulators…approval could be an issue. This acquisition would be MSFT’s largest deal ever (see chart below). This acquisition represents not only investment in their gaming business, but also in the metaverse. MSFT has been working on building their original game content and Activision Blizzard’s library of original games and game developer talent would add to that. In terms of the metaverse…video games represent key potential metaverse content and MSFT, w/ their HoloLens headset, has the #2 virtual reality hardware (second to Meta/FB’s Oculus headset) underpinning the immersive aspect of the metaverse. MSFT is focused on other metaverse aspects as well, including new collaboration capabilities (e.g. joining Teams meetings w/ avatars) and they plan to roll out software tools related to metaverse content development. “When we talk about the metaverse, we’re describing both a new platform and a new application type, similar to how we talked about the web and websites in the early ’90s” CEO Satya Nadella said. Others are investing heavily in this space as well…Google is working on hardware, Apple is also working on a VR/AR headset that could be released later this year. In October Accenture said it bought 60K Oculus headsets to train new employees.

- Valuation:

- Valuation has gotten cheaper…trading at >3% FCF yield on 2022. A premium to the S&P and of the mega cap tech names that we own, this is the most expensive…supported by a high moat, strong margins, robust secular growth and the absence of antitrust scrutiny (though their peers try to agitate to have them included).

- Recurring revenue is >60% of total, underpins most of their valuation and is resilient and poised to be a greater part of the mix. Particularly Azure, Office 365 and Dynamics 365.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109