Key Takeaways:

Current Price: $96 Price Target: $108 (NEW)

Position size: 2.39% 1-Year Performance: +3%

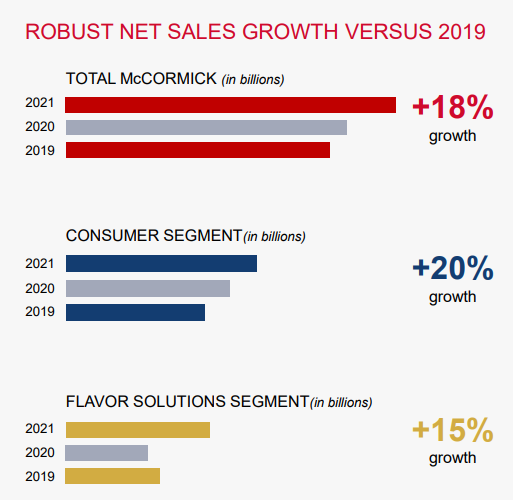

- Revenue growth of +10.2% came above expectations

- Growth driven by volume and pricing in both segments

- Consumer sales +9.2% y/y, pricing helping +2.5%, volume/mix added +4.8%

- Continued preference for cooking more at home.

- Gaining market shares

- Recent acquisition is also helping growth (Cholula brand) +1.9%

- Flavor Solutions: +12.1% – acquisitions added 7.3% to top line; price & volume added 2.3% and 2.5%

- Gross margins were down 150bps y/y due to continued cost inflation, but that was better than street expectations. Operating margin down 80bps y/y

- Cost inflation & logistics challenges had a bigger impact on margins than sales leverage and cost savings actions

- ERP investments is offset by lower COVID-19 related costs

- Started phasing in pricing actions

- Lower brand marketing spending is helping SG&A spending

- Guidance for the year is better than expected.

- Sales growth of 3-5% (FX has a -1% impact)

- Additional pricing actions to start in Q2

- Gross margins down 50bps to flat

- operating income +8% to +10%

- EPS $3.17-$3.22, above consensus of $3.09

- Long-term thesis is intact. We see the inflation situation and pressure on margin as a temporary impact, as the company will continue to raise prices to offset increased costs

- CEO quote:

- Demand: “he demand for flavor is not cyclical or […] pandemic related, but is undergirded by real demographics […] fueling that demand and we think that the […] shifted consumption at home that has happened in recent years is just a continuation of a long-term trend that supports our business from an underlying standpoint and all the things that we do on our strategies for brand building […] continue to be supportive of growth. “

- Pricing action: “for the volume impact at a total company level to be more flattish to low-single-digit decline. We have modeled in elasticity, but not as the rates that we’ve seen historically. I do think that we’re new and uncharted territory versus all of the elasticity models. At least from the actions that we’ve taken so far. […]. And that’s what we seem to be experiencing. If anything we may be seeing slightly even less elasticity than we’ve assumed“.

The Thesis on MKC:

- Industry Leader: McCormick & Company (MKC) is a leading manufacturer of spices and flavorings. MKC has been in business for 120 years and the founding family still has ownership interest

- Growth opportunity: Spice consumption is growing 3 times faster than population growth. With the leading branded and private label position, MKC stands to be the biggest beneficiary of this global trend

- Offense/Defense: MKC supplies spices to major food companies including PepsiCo and YUM! Brands giving it a blend of cyclical and counter-cyclical exposure

- Balance sheet and cash flow strength offer opportunities for continued consolidation through M&A in the sector

$US.MKC

[tag MKC]

[category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109