- S&P Revenue up 12% with solid growth in all four segments

- Generated $3.5b in free cash flow, yielding 3.72%

- Operating margins expanded 190 basis points to 53.2%

- Expect IHS Markit merger to close Q1 2022.

- Raising slight market angst, SPGI did not issue guidance for 2022 as they will wait until after mergers closes.

Current Price: $407.29 Price Target: $480

Position Size: 2.82% 12 Month Performance: +23.7%

2021 Q4 Highlights:

- S&P Dow Jones Indices

- Asset-linked fees ETF AUM increased up 40%!

- Revenues benefited from strong price appreciation and inflows

- Revenue grew 16% and operating profit rose 17% Y/Y

- Margins rose +80 bps to 69.9%

- Ratings

- Global bond issuance increased 15%, with strong growth in high yield, Bank Loans and CLOs

- YoY revenue grew 14% and operating profit rose +17%

- Margins rose +180 bps to 64.2%

- Non-transaction revenue (not related to bond issuance) is over 40% of ratings revenue

- Market Intelligence

- Revenue grew +7% Operating profit rose +13%

- Margins increased +190 bps to 34.3%

- Platts

- Revenue grew +8% and operating profit rose +9%

- Margins increased +40 bps to 55.1%

IHS Markit merger update

- IHS Markit will divest OPIS, Coal, Metals & Mining (CMM), and PetroChem Wire businesses to News Corp and Base Chemicals business

- S&P Global will divest CUSIP Global Services and Leveraged Commentary and Data, together with a related family of leveraged loan indices.

- Despite divestitures, S&P has raised cost synergies to $530m-$580m (from $480m) and revenue synergies to $330m-$360m (from $350m)

Growth initiatives

- Implementing new ESG offerings across platform – ESG revenues up 40%

- Technology expertise – Kensho AI initiatives

- RiskGuage, ProSpread, Riskcasting Indices, Moonshot index, Kensho Scribe and many others combining data and analytics

- Merger with IHS Markit

Capital allocation

- SPGI has a current yield of .78%

- SPGI has repurchased 14% of outstanding shares over past 5 years

- Currently, share buybacks are on hold with the pending merger of IHS Markit. SPGI has $6.5b of cash piled up on the balance sheet and generated $3.5b in free cash in 2021. Expect ~85% to be returned to shareholders post-merger. Could repurchase 5%-6% of shares!

S&P Global Investment Thesis:

- S&P Global is a highly profitable company that has established businesses with deep moats in attractive industries

- S&P Global is focused on shareholders and returns 75% of free cash flow in dividends and share buybacks

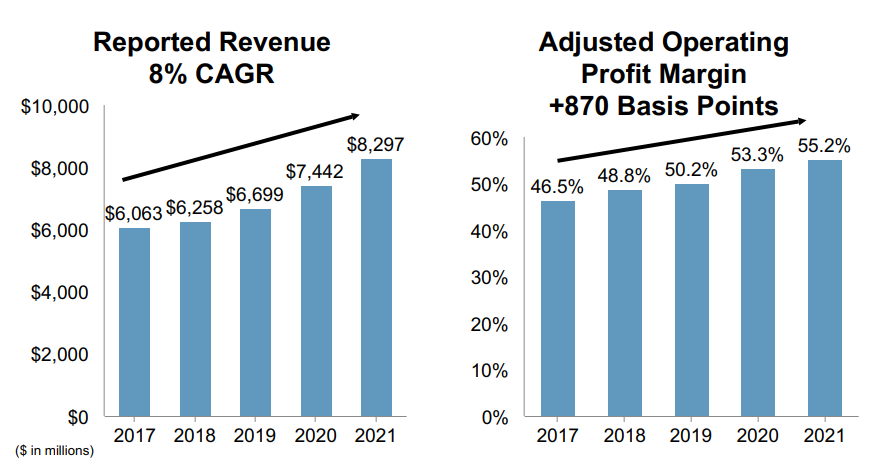

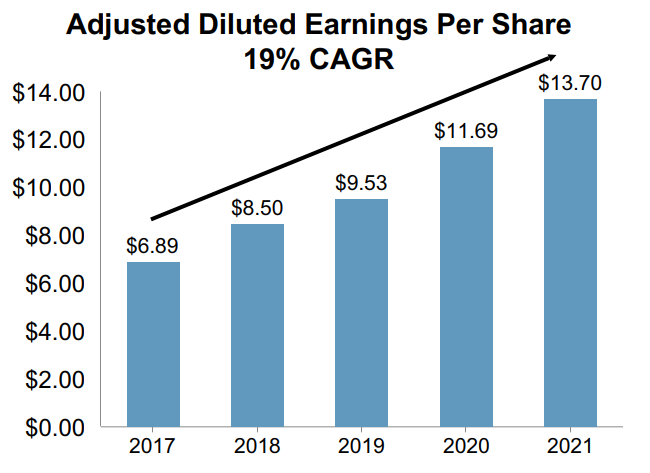

- Over the past several years, S&P Global has demonstrated an enviable history of revenue growth and margin expansion

- With the merger of IHS Markit, S&P Global will combine many unique data sources, enhance data analytics capabilities, and broaden addressable markets.

Please let me know if you have any questions.

Thanks,

John

[category Equity Earnings]

[tag SPGI]

$SPGI.US

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109