Hartford International Value Fund Commentary – Q4 2021

Thesis

Serving as a satellite holding, HILIX is a value style fund that takes advantage names that have underperformed recently and are cheaply priced. The team generates alpha by finding companies with strong fundamentals that are overlooked during times of low consensus expectations. We like that HILIX takes advantage of extremes and gains exposure to less efficient market caps by having more holdings and moderate active bets.

[More]

Overview

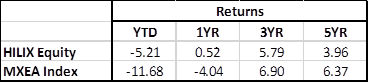

In the fourth quarter of 2021, HILIX underperformed the benchmark (MSCI EFEA Index) by 300bps. The quarter saw a spike in volatility due to the Omicron variant, increasing energy prices, supply chain disruptions, inflation, and other macro-economic factors. The fund’s underperformance was mainly driven by poor selection within Industrials, Health Care, and Consumer Discretionary, but was partially offset by Communication Services and Materials. Sector allocation also detracted from returns, specifically within Utilities and Communication Services, but slightly offset by Real Estate. Regionally, selection within the UK, and Developed European Union & Middle East ex UK weighed on returns, but was also slightly offset by selection in Japan.

Q4 2021 Summary

- HILIX returned (0.31%), while the MSCI EAFE Index returned 2.69%

- Top issuer contributors

- GREE, Inc., SoftBank Group Corp., Westpac Banking Corp., UniCredit S.p.A., WPP Plc

- Top issuer detractors

- Pax Global Technology Limited, HSBC Holdings Plc, GlaxoSmithKline plc, Japan Airlines Co., Ltd., Fresenius SE & Co. KGaA

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109