Key takeaways:

Current Price: $242 Price Target: $255 (NEW)

Position Size: 2.48% 1-Year Performance: +4.3%

- Total company sales +7.7% with both segments doing better than consensus

- Beer sales increased by 14% (pricing +3.5%)

- Beer shipment volume growth of 9.9% was above consensus and on top of last year high volume of +15.9%

- The company is building this coming summer inventory level at the distributor level

- Wine & spirits grew +5% organically, driven by high end portfolio (pricing +7.5%), but overall sales -6.9% due to divestitures. The company is adding ready-to-drink cocktails to the portfolio.

- Hard seltzer: still an opportunity although the market changed faster than they anticipated. They see growth going forward (change of tone from last quarter there…). They are reworking the packaging.

- Consumer consumption on-premise (outside the home) is strengthening but somewhat uneven, while at-home remains resilient

- The company’s focus remains on higher-end price points both in beer and wine & spirits

- Beer operating margin improved thanks to higher pricing and lower advertising expenses, expanding 240bps for the beer segment – in an environment that has most companies seeing shrinking margins due to high costs.

- One-time charge regarding hard seltzer inventory obsolescence ($0.25 EPS impact a 2-3% impact for the year) impacted gross margins 350bps

- Wine & spirits operating margin expanded by 280bps thanks to pricing & mix

- With share repurchase back on the table this quarter, STZ is focusing back on capital allocation in a way that make investors happy (rather than the Monster/STZ potential merger that wasn’t well received due to little synergies between the two). There has been talks about the share class change as well for the Sands family to swap their class B shares (carrying 10 votes each) into a class A share for a 35% premium, a move to alleviate the dual-share class governance risks. The move would cut the family control from 59.5% to 19.7%. Here’s the proposal from the family: “intended to enhance the attractiveness of the common stock to investors and to enhance the strategic flexibility of the Co. for the long term and was not made in connection with or with the intention of facilitating any specific corporate transaction.”. The proposal would dilute the share count but allow a better governance rating and open the door to potential M&A discussions.

- Guidance for fiscal year FY23:

- Share repurchase of $500m in Q1 – with refocus on returning cash to shareholders

- Beer net sales +7-9%

- Beer margins to grow 2-4%, although we think this is conservative due to high inflation

- Wine & Spirits sales -1% to -3% and operating margin +4% to +6%

- EPS guidance of $11.20-$11.50 (+3.3% growth), but doesn’t account for all share repurchase that will/can be made during the rest of the year (only $500M in Q1).

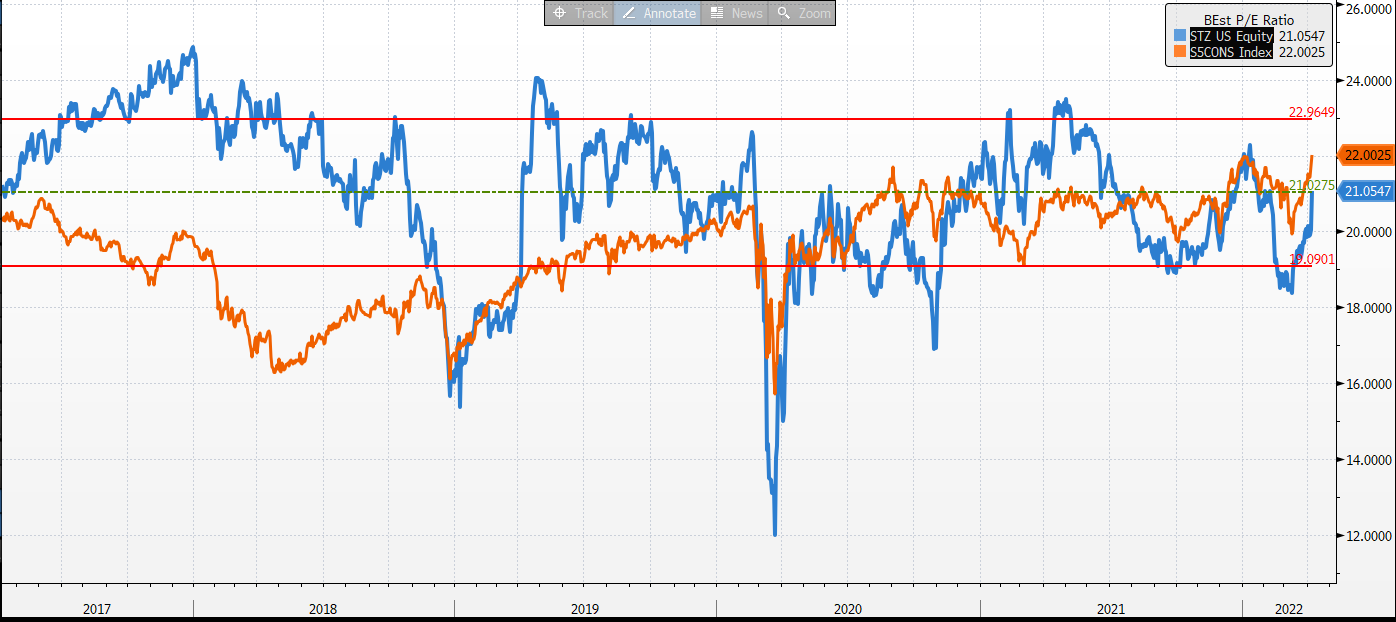

- Valuation: trading slightly below peers and doesn’t look expensive vs. historical trend. Updated DCF gives us $255 after updating for the new fiscal year, and better top line in FY23 than previously thought.

Investment Thesis:

- STZ helps position our portfolio to be more defensive at this stage of the economic cycle

- Management team focused on high quality brands and innovation

- STZ continues to have HSD top line growth and high margins that should incrementally improve going forward

- STZ comes out of a heavy capex investment cycle to support its growth: FCF margins are set to inflect thanks to lower capex

- Growth optionality from cannabis investment

[tag STZ] [category earnings]

$STZ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109