Current Price: $298 Target Price: $410

Position size: 3% TTM Performance: -3%

Key Takeaways:

- Better than expected results and raised guidance – SSS were +2.2% w/ inflation as a tailwind. Sales guidance was raised from “slightly positive” to +3%. Record quarter despite a slower start to the spring in many areas of the country (had negative double digit SSS in seasonal categories) and lapping tough compares from last year given more favorable weather, stimulus and a surge in home improvement sales w/ the pandemic.

- Long-term growth drivers for home improvement sector remain intact – while rising rates may be a headwind to affordability and turnover (new & existing home sales), strong supply demand dynamics supports prices (millennial household formation, years of underbuilding and low inventory for sale). And, importantly, home prices are more correlated w/ home improvement spending than turnover. That combined w/ an aging housing stock all drive repair & remodel activity.

- Pro sales growth outpacing DIY – Pro is now ~50% of total, increasing as a part of the mix as consumers resume large projects and return to pre-pandemic activities.

- Well positioned in the current inflationary environment – inflation is a tailwind to SSS (inflation in things like lumber and copper added 240bps in Q1). If inflation recedes, lower freight will be a tailwind to margins and lower inflation fears should reduce the impact of rising rates on housing turnover (aiding demand).

- Valuation: cheaper than the S&P with high moat, strong balance sheet, very high ROIC, benefiting from strong housing trends but also has defensive qualities and a reasonable valuation, trading at >5% forward FCF yield and increasing dividends and buybacks.

Additional Info…

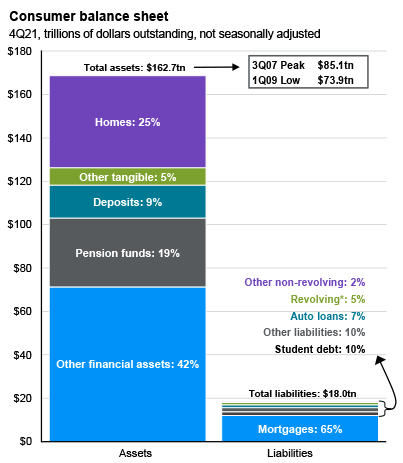

- Housing is a bigger driver of consumer wealth for the average household than the stock market…

- In aggregate, housing is 25 % of consumer balance sheets…but housing is a far higher % for the average family b/c equities are concentrated among the wealthy.

- The top 5% of US households own 71% of US equities, while the top 20% of US households own 93% of US equities (source: Survey of Consumer Finances, Federal Reserve Board).

- Quotes on demand and the health of the consumer:

- “we continue to see outsized demand for Home improvement projects”

- “our customers continue to trade up for premium innovative products”

- “Big ticket comp transactions or those over $1,000 were up 12.4% compared to the first quarter of last year.”

- “We’re encouraged by the momentum we’re seeing with our pros and they tell that their backlog are strong.”

- “Over our history, we’ve seen that home price appreciation is the primary driver of home improvement demand. When you’re home appreciates in value, you view it as a smart investment and you spend more on it.”

- “So let’s talk about interest rates, I think it’s important to remember that our addressable market is the 130 million housing units occupied in the US. Plus 40 million to 50 million more in Canada and Mexico. Of those 130 million housing units, on any given year, only about 4% or 5% are sold. That means that over 95% of our customers are staying in place. They’re not shopping for a mortgage. Nearly 40% of those homes are owned outright. Of those who have mortgages, about 90% of those mortgages are fixed rate. So, when you think about our addressable market, the vast majority aren’t really paying attention to mortgage rates. And what’s interesting about that is what we heard when they do look at moving. They’re actually more and more tempted to stay in their low fixed-rate mortgage and remodel their home instead. So these low, locked in, mortgages are probably a benefit on home improvement.”

- Secular tailwinds persist…more homes need to be built. This should be a LT secular driver for HD.

- Undersupply of homes continues to support pricing and years of underbuilding has shifted the age of the existing US housing stock – both of which support home improvement spending.

- According to a recent study by the National Association of Realtors, due to years of underbuilding, the US is short 6.8 million homes.

- Building would need to accelerate to a pace that is well above the current trend…. to more than 2 million housing units per year vs a ~1.8m annual rate for starts to close the gap in 10 years.

- From the NAR report released last June…“Following decades of underbuilding and underinvestment, the state of America’s housing stock, which is among the most critical pieces of our national infrastructure, is dire, with a chronic shortage of affordable and available homes to house the nation’s population. The housing stock around the nation has been widely neglected, with a severe lack of new construction and prolonged underinvestment leading to an acute shortage of available housing, an ever-worsening affordability crisis and an existing housing stock that is aging and increasingly in need of repair.”

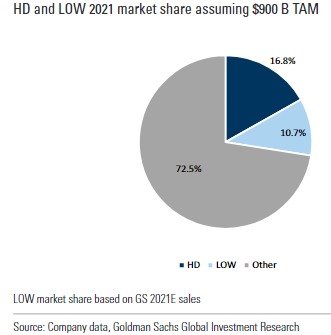

- They recently updated their total addressable market (TAM) estimates…

- They updated their N. American TAM estimate from $650B to $900B with Pro and DIY each representing 50% and with MRO accounting for $100B of Pro. They also provided a long-term sales target of $200B. At a mid-single-digit CAGR, they would hit this in 2029. HD has about 17% share and LOW has ~11%… the other ~72% is pretty fragmented providing lots of opportunity to take share which is supportive of their LT growth targets.

· Multiple long-term growth drivers: durable housing trends, taking share in a fragmented home improvement market w/ DIY & Pro, and growing their more nascent MRO business (particularly after HD Supply acquisition) and leveraging their best of breed omni-channel model.

· Best of breed omni-channel model drives productivity:

o By adding specialized warehouse capacity and enhancing digital capabilities (online and in the store), HD is uniquely positioned to leverage their existing retail footprint (not really growing stores) and drive steadily high ROIC that is ~45% (which is incredible). They continue to add new bulk distribution centers (used replenish stores with lumber and building materials), flatbed distribution centers (which are often tied to the bulk distribution centers), MDOs (market delivery operations are used to flow through big and bulky products, particularly appliances) and adding direct fulfillment centers for e-comm fulfilment which will allow them to cover 90% of the country in same or next-day delivery.

o They dominate the category, are the low cost provider, have a relentless focus on productivity and can continue to flow an increasing amount of goods through their big box stores w/ omni-channel. This is a highly efficient model as >50% of online sales are picked up in-store which HD can fulfill from the store or nearby warehouses.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

$HD.US

[tag HD]

[category earnings]