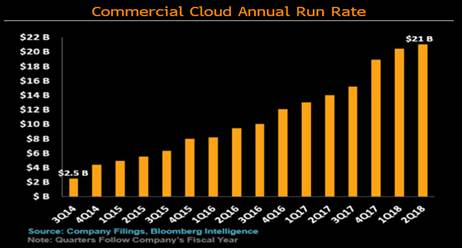

Microsoft reported solid 3Q results beating on the top and bottom line and delivering strong guidance. Overall revenue grew 16% aided by the weaker dollar which added 3pts to the top line. They saw strong growth across all 3 segments with cloud continuing to be the key the driver of growth. Commercial Cloud (Office 365 commercial, Azure, Dynamics 365) revenues were $6B, up 58% (an acceleration from last quarter) and accounting for over 22% of revenue in the quarter. Despite the higher mix of lower gross margin cloud, their operating margin improved 200bps as the top line beat resulted in better leverage of opex and better than expected EPS. While cloud margins are a drag now, they will help drive better FCF margins as the business scales. Within Commercial Cloud, Azure grew 93% – estimates are for this business to be about $8B in revenue this year and for commercial cloud to be $22-23B or about 20% of total revenue. They are the number two cloud player behind AWS. The “More Personal Computing” segment which includes Windows, Xbox, Surface, and all other hardware showed meaningful improvement. That segment, which has been in decline, grew 13% to nearly $10 billion on solid results from the Surface and gaming. This segment performance is in line with their comments last quarter of a stronger than anticipated commercial PC market and that the consumer PC market was “stabilizing.” Overall they are seeing positive demand across their business and are positioned to benefit from a strong IT spending environment with digital transformation, migration to the cloud (especially hybrid where they have an edge) and companies positioning their infrastructure for IoT. Free cash flow in the quarter was over $9B and they returned $6.3 billion to shareholders pretty evenly split between dividends and share repurchases.

Valuation:

· The stock is reasonably priced trading at close to a 5% FCF yield for a company with double digit top line growth, high ROIC and a high and improving FCF margin (~30%).

· They easily cover their 1.75% dividend, which they have been consistently growing.

· Strong balance sheet with about $132B in gross cash, and about $55B in net cash.

Investment Thesis:

· Industry Leader: Global monopoly in software that has a fast growing and underappreciated cloud business.

· Product cycle tailwinds: Windows 10 and transition to Cloud (subscription revenues).

· Huge improvements in operational efficiency in recent quarters providing a significant boost to margins which should continue to amplify bottom line growth.

· Return of Capital: High FCF generation and returning significant capital to shareholders via dividends and share repurchases.

$MSFT.US

[tag MSFT]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!