Below I discuss the real estate sector and address the reasons for its recent underperformance. Additionally, I look at REIT performance during periods of rising rates and increased inflation.

Key Takeaways:

1.) Thesis intact – we still like REITs as a long term, strategic asset class that adds diversification to our asset allocation and has opportunity to improve risd-adjusted returns

2.) Performance During Rising Rates – the positive economic backdrop during rising rate environments acts as a tail wind for REITs as they tend to outperform over the full period of rate increases

3.) Inflation Protection – as we begin to see increased inflation, real assets should maintain pricing power

The broad real estate sector has underperformed over the past 18 months, driven by a few different factors:

1.) U.S. Real Estate cycle is in the later innings; similar to the earnings cycle, it is nearly impossible to know exactly how far along we are

2.) We are now in an the midst of an increasing rate environment; at the beginning of periods of rate increase, REITs tend to underperform

3.) Secular changes have driven down certain sub-sectors within real estate, most notably retail

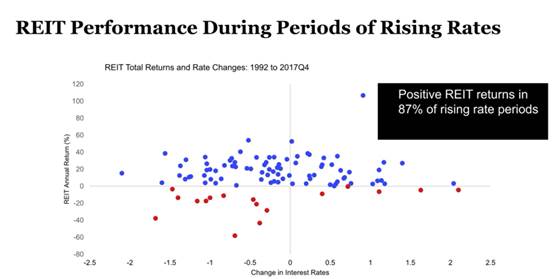

Performance during rising rates: REITs have positive returns in 87% of rising rate periods

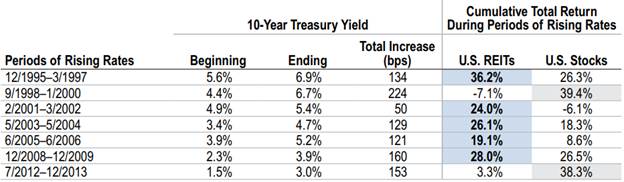

Extended rate increases: Over the full period of interest rate increases, REITs tend to outperform

Why a rising rate environments should not worry Real Estate Investors:

1.) Fed rate increases come during periods of economic growth (as we are currently experiencing); a strong economy is generally positive for real estate as occupany rates and rents increase

2.) While REITs are income generating assets, they do not act as a direct bond proxy; REITs provide growing cash flow streams as opposed to fixed payouts provided by bonds. This means that real estate assets should not be negatively affected by rising rates the same as fixed income.

3.) REIT selloffs at the beginning of rising rate environments have become almost a self-fulfilling prophecy as investors believe they should shed real estate assets. History has shown, however, that over the full period of rate increases, real estate assets initially selloff but then recover. REITs have generated positive returns during 87% of rising rate periods and have outperformed the S&P 500 more than 50% of the time.

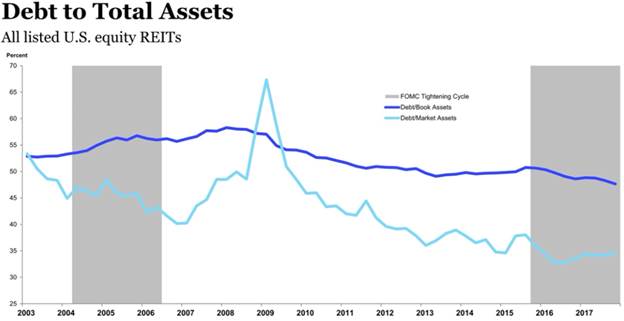

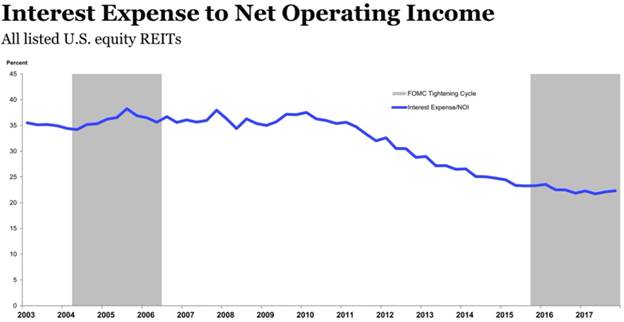

4.) Broadly speaking, REIT fundamentals are currently in a vergy good position. Companies have cleaned up balance sheets by reducing leverage and increased profitablity by decreasing interest expenses. Additionally, they have extended maturities on their internal contracts as well as their debt issuance.

Cleaning up balance sheets: REITs have reduced leverage ratios

Improving fundamentals: broadly, interest expenses have come down

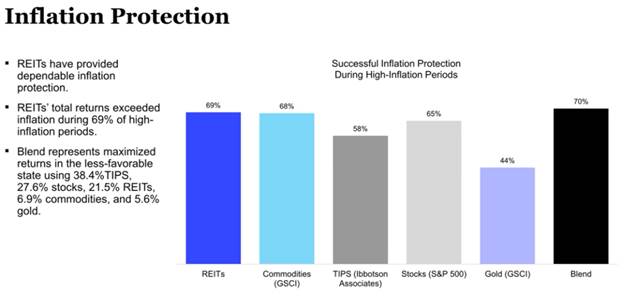

As we experience a pickup in inflation, REITs provide relatively strong protection:

1.) Over the past 20 years, REIT dividend growth rate has outpaced inflation in all but 2 years

2.) Real estate acts as the prototypical inflation hedge as real asset prices increase with jumps in CPI

3.) Dating back to 1978, REITs have outperformed the broader market in nearly 70% of high-inflation periods

Inflation Protection: REITs have outperformed in 69% of high-inflation periods

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!