TIREX – Q1 2018 Commentary

During the first quarter, the TIAA CREF Real Estate Securities Fund outperformed its benchmark despite the negative return for the quarter. The team remains focused on higher-quality growth oriented REITs with superior supply/demand dynamics. As of month end, the 30-day SEC yield on TIREX is 2.56%.

Market Overview:

– After notching nine straight years of gains, REITs got off to a negative start in 2018

o Asset class fell 2.95% in January

– Although fundamentals have remained strong late into the current investment cycle evidence of flattening property values and higher rate expectations led investors to other opportunities

– Rising rate environments generally coincide with inflation and many rent contracts are actually tied to inflation

o Strengthening economy should be a tailwind for real estate

– While REITs begin to sell off similar to bonds during rising rate environments, they are increasing cash flow vehicles while bonds pay out fixed rates

– The fund’s long term focus remains unchanged

o Seek higher quality growth oriented REITs with supply/demand dynamics

Performance Overview:

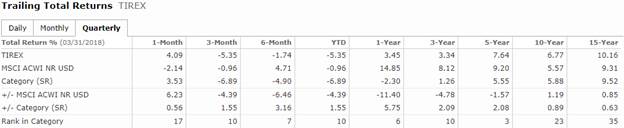

– The TIAA-CREF Real Estate Securities Fund outperformed its benchmark in the first quarter of 2018

o This marks the fifth consecutive quarter and sixth of the last seven in which the fund has outperformed its benchmark

– Fund’s first quarter outperformance was driven largely by security selection in diversified and industrial sectors

o The largest single contributor was avoiding diversified REIT colony NorthStar

– Two other key contributors were an overweight in Rexford Industrial Realty and an overweight in data centers

– Partially offsetting these positive contributors was a position in QTS Realty Trust, a data center REIT that announced an organizational restructuring during the quarter

– Also detracting was an underweight in American Tower which was up during the quarter

Market Outlook:

– REITs are currently trading at a discount relative to their underlying commercial property values

o Team expects real estate returns to be driven by market supply/demand dynamics and net operating income growth

– At this point in the commercial real estate cycle, the fund is emphasizing relative value opportunities within sectors and among individual REITs with outsized growth opportunities

– The largest sector overweight, manufactured housing, benefits from ongoing demand for affordable housing and limited supply growth

o Continue to find attractive REITs in single family rentals

– Reduced data centers but still investing in companies with footprints in Europe and Asia

o These regions are earlier in the cycle than their U.S. counterparts and remain attractive given the robust secular growth trends

– Office overweight has increased due to a niche-focused investment in medical lab office REITs

o Complements core office holdings

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!