Below is the summary of the positive data points that came out of yesterday’s analyst day:

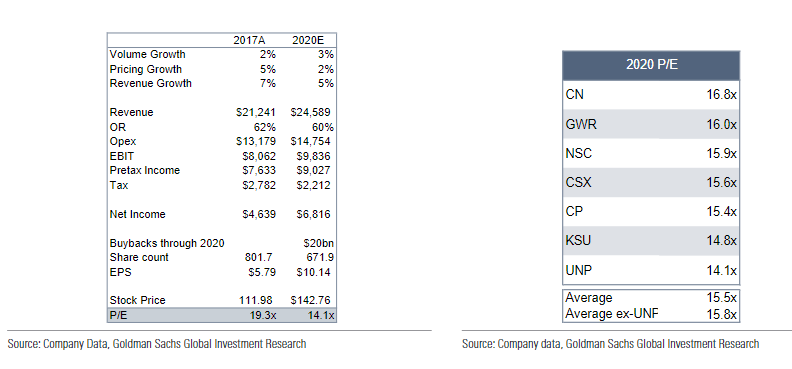

· Management initiated a 60% Operating Ratio in 2020 (they walked away from their prior 60% by 2019 last quarter)

· Cadence of share repurchase is more aggressive than previously announced: $20B through 2020, and funded mostly from free cash flow

· Lower capex results in higher free cash flow conversion

· Dividend increase (implied to go to 2.5% from 2%)

· Leverage is going up from 2x to 2.7x. Management was reassuring that this increase would be gradual, and that they would remain prudent if the macro environment turns negative.

All these positive news might seem aggressive knowing that UNP didn’t meet its latest volume and operating ratio guidance, but we would assume they learned from that mistake and provided an update on guidance they feel comfortable achieving.

Below is GS valuation analysis, which shows UNP as being cheaper than peers assuming UNP meets its guidance on volume, pricing, OR and buybacks:

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!