Good Afternoon,

Below I address the recent performance of Market Neutral and why we are comfortable holding this fund long term.

We still believe that owning market neutral is a strong investment over the long term. The main pillars of our thesis remain intact.

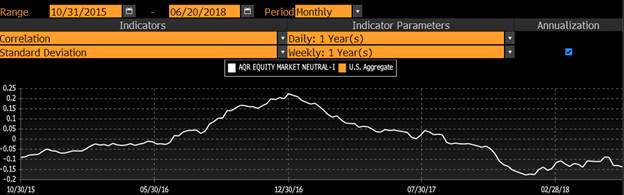

1.) Diversification Benefits: The fund’s return correlations to traditional asset classes should be very low, targeting a beta of zero over time.

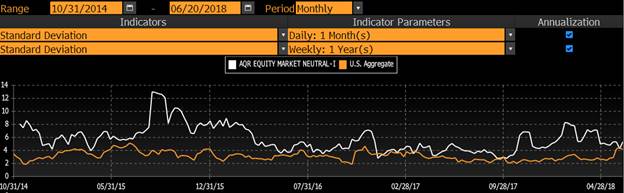

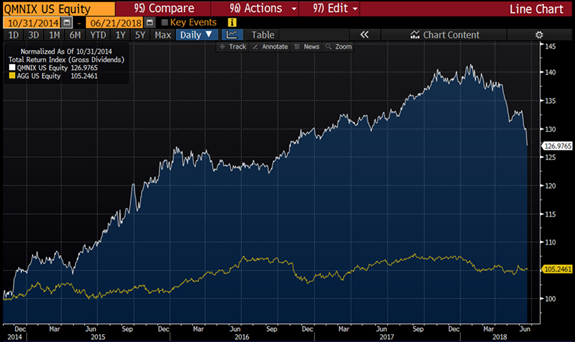

2.) Alternative to Fixed Income: Based on its risk parameters and expected return profile, QMNIX should provide an alternative to core bonds.

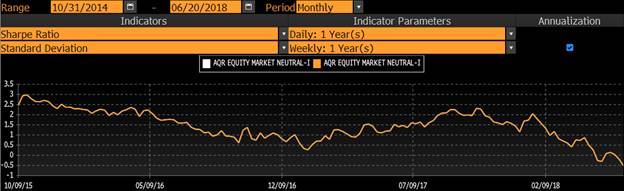

3.) Opportunity for positive risk adjusted returns: The fund seeks long term Sharpe Ratio of approximately 0.7 – 1.0.

What has gone wrong recently?

The underperformance in the stock selection model has mainly been a Value story across the board at AQR. Securities that they deem expensive have been outperforming the securities that they deem inexpensive. It’s a big component of QMNIX, 30% of the model, so a severe decline by value will have a large impact. Momentum on the other hand, has been doing well, and is also 30% of the model, but it hasn’t been doing well enough to completely offset the losses value has been contributing. Importantly, the strategy does not change factor weights based merely on recent performance, limiting the likelihood that the strategy gets whipsawed on both sides of a trade.

Growth vs. Value YTD

The performance has been atypical in direction, magnitude and duration, especially based on the last couple years for the strategy. But it’s not abnormal as we can expect to see performance like this 4-5% of the time with a 0.7 Sharpe Ratio strategy that targets 6% volatility. In other words, it’s still within the returns distribution for the strategy, but certainly at the outer bands.

Main Pillars of our Thesis Remain Intact:

1.) Diversification Benefits: QMNIX has maintained low correlation to stocks and bonds while exhibiting a beta of approximately zero since inception.

– Rolling Correlation vs. Barclays Agg:

– Rolling Beta vs. S&P 500:

2.) Alternative to Fixed Income: The rolling standard deviation of QMNIX has continued to be above the Barclays Agg but below the S&P 500. Additionally, despite the fund’s recent underperformance, QMNIX has outpaced bonds since inception, outperforming the majority of the time based on weekly returns.

– Rolling Standard Deviation vs. Barclays Agg:

– How has QMNIX performed relative to the Agg?

3.) Opportunity for Positive Risk Adjusted Returns: Until the fund’s recent underperformance, QMNIX has been able to provide positive one year Sharpe Ratio on a rolling basis since its inception. Additionally, total return has largely outpaced bonds since inception.

– Rolling Sharpe Ratio

[Mutual Fund Commentary]

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!