Current Price: $432 Price Target: $480

Position Size: 2% TTM Performance: 25%

· Sherwin reported better than expected revenue and EPS for 2Q and guidance for the year was raised, aided by a lower tax rate. FY18 EPS for core business expected to increase 24% at the midpoint.

· Margins impacted by raw material costs (mainly propylene) that are trending slightly higher than the 5-6% that was expected.

· Volumes were strong across segments – they are taking share. Competitor PPG reported earnings recently and is losing share in architectural paint to SHW particularly at Lowe’s.

· Commentary around demand trends improved sequentially – last quarter they talked about a “slow start to the painting season in North America” and “choppy global economic growth.” This quarter they saw positive demand trends that were “broad-based across most businesses and geographies.”

· Housing turnover is low, but rising demand and low inventory have led to higher home prices which helps demand.

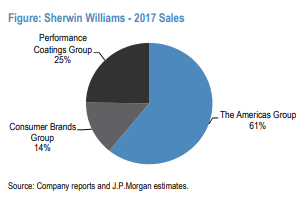

Pro forma sales (adj. for Valspar acquisition) were up 7.5%. Despite higher than expected raw material costs (mainly propylene), guidance for the year was raised though largely driven by a lower tax rate, but does assume some sequential gross margin improvement. Excluding all the moving parts with Valspar, YoY 2018 EPS of the core business at the mid-point is expected to be up 27% vs previous guidance of up 24%. Gross margins are improving as price increases are catching up with input cost increases. Raw material costs inflation was slightly higher than the 5-6% they were expecting and will remain higher than they previously anticipated. As seems to be a recurring theme across sectors in earnings so far, they are seeing strong demand but higher input costs. The Americas Group segment (60% of rev and includes no Valspar) sales were +7.7% driven by +6.8% SSS (4.3% volume; 2.5% price/mix) – this is an acceleration from +5.2% last quarter. Trends improved as the quarter progressed and the weather improved. They are seeing stronger demand in their chain of paint stores from contractors than DIY customers. Consumer Brands Group (15% of rev) sales were +1.5% (new rev recognition accounting, ASC 606, reduced this by 5pts) and Performance Coatings Group (25% of rev) sales were +11%. Q3 will be the first quarter that they fully lap Valspar, so pro-forma estimates will stop obscuring comparability starting next quarter. In general, the integration seems to be on or ahead of schedule, at least in the sense of recognizing synergies.

The thesis is intact and the long-term demand picture looks strong. About two-thirds of Sherwin’s revenue is from architectural paints (SHW has leading market share at 45%) and close to 80% of that is tied to the residential housing market. The housing market is seeing increased prices due to low inventory and rising demand from increased household formation. Rising prices tend to increase remodeling activity and spur new housing starts both of which benefit SHW. June showed a slight inflection (we’ll see if it persists) in housing inventory which has been at historic lows – 3 months’ supply vs LT average of 6 months’ supply. This is good news for SHW because existing home sales also drive paint sales, and I do not view a potential increase of supply as a big threat for home prices because rising wages, higher lumber prices and buildable land scarcity countervail this by increasing the cost to build a home. Architectural paints is typically a good leading indicator of industrial paint demand, which means the overall LT demand picture for SHW looks robust.

Valuation

· Expected free cash flow of $1.8B in 2018, trading at a 4.4% forward yield. Dividend yield <1%.

· Given growth prospects, steady FCF margins and high ROIC the valuation is still reasonable.

· Balance sheet is fairly levered from the Valspar acquisition, but they expect to get to 3x by the end of the year.

Thesis:

· SHW is the largest supplier of architectural coatings in the US. Sherwin-Williams has the leading market share among professional painters, who value brand, quality, and store proximity far more than their consumer (do-it-yourself) counterparts.

· Their acquisition of Valspar creates a more diversified product portfolio, greater geographic reach, and is expected to be accretive to margins and EPS. The combined company is a premier global paint and coatings provider.

· SHW is a high quality materials company leveraged to the U.S. housing market. Current macro and business factors are supportive of demand: High/growing U.S. home equity values. Home equity supportive of renovations.

o Improving household formation rates off trough levels (aging millennials) .

o Baby boomers increasingly preferring to hire professionals vs. DIY.

o Solid job gains and low mortgage rates support homeownership.

o Residential repainting makes up two thirds of paint volume. Homeowners view repainting as a low-cost, high-return way of increasing the value of their home, especially before putting it on the market.

$SHW.US

[tag SHW]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!