WATFX – Q2 2018 Commentary

The Western Asset Total Return Bond Fund slightly underperformed the Agg during the quarter but remains ahead year to date. The team does not predict any sudden spike in interest rates or inflation, but they believe that the synchronized global growth from the beginning of the year has tempered. Western Asset maintains a diversified portfolio that is positioned to perform well in a variety of market environments.

Market Overview:

– Overall U.S. bond market modestly declined during the second quarter

o Generated mixed results relative to equal duration Treasuries

– Yield curve flattened during the period as short-term yields rose more than their longer term counterparts

– GDP growth of 2% for the first quarter announced, more modest than Q4 2017

o Reflects lower personal consumption, exports, state and local government spending

o These were partially offset by a smaller decrease in private inventory investment and larger increase in non-residential fixed income investment

– Labor market continued to be an area of strength for the economy in the second quarter

o Unemployment fluctuated but remained low from a historical perspective

– Manufacturing sector continued to expand and support the economy

o PMI expanded for a 22nd consecutive month in June

– Housing market data also improved during the quarter

– Fed raised rates .25% in June pushing its range between 1.75 – 2.0

o Marked the seventh rate hike since December 2015

o Plan is to hike two more times this year

– Both the short and long ends of the curve increased with the front increasing relatively more

Performance Overview:

– Allocation to investment grade U.S. dollar denominated debt detracted from performance

– Yield curve positioning was also a headwind for returns

– Number of individual investment grade corporate bonds that were negative for results

– Overweights to commercial mortgage-backed securities and TIPS modestly contributed to performance as their spreads generally tightened

– Individual investment grade corporate bonds that added most value were Texas Instruments, Union Pacific and Walmart

– Number of adjustments were made to the portfolio during the quarter

o Reduced allocation to U.S. Treasuries

o Added to structured product allocation, namely non-agency mortgage backed securities

o Increased our exposure to investment grade corporate financial bonds as their spreads widened and their valuations became more attractive

Market Outlook:

– Optimism for synchronized recovery at the beginning of the year has given way to anxiety over potential emerging market and European crises

o Divergence in performance between the U.S. bond market and markets in the rest of the developed world has been breathtaking

– The team’s investment thesis has been that as global growth improves spread products would continue to outperform U.S. Treasuries and sovereign bonds

o Global deflation fears of 2016 have subsided and inflation is currently in its early stages

– General tone of the June Fed meeting was hawkish but some aspects were a bit more balanced

o Chairman Powell outlined a very practical approach of conducting monetary policy in response to the incoming data

o Fed is not committed to the idea that unemployment is too low

– Ten years into recover, economy has been hit with meaningful fiscal thrust in form of tax cuts and greater government spending

o Core PCE inflation has now hit the Fed’s 2% target

– They believe a sharp rise in interest rates is unlikely

o See little chance of either a sustained or substantial rise in U.S. core inflation

– They believe the Fed understands the long term challenge facing underlying U.S. growth and it has no interest in pursuing a policy that might short-circuit that expansion

– Believe that the low inflation world we are currently in is not going to change

o Portfolios need buffers against adverse events and Treasury securities remain the best diversifying hedge

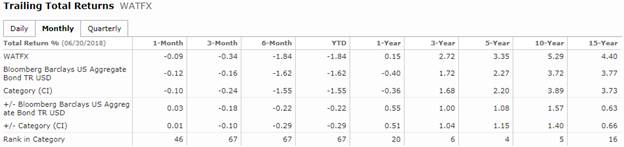

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!