Current Price: $142 Price Target: Raising to $160 from $135

Position Size: 3.3% TTM Performance: 41%

· Reported better than expected quarter and raised EPS guidance. Full year EPS growth expected up low 30% vs prior up high 20%.

· Visa Europe accretion quicker than expected. They expect double-digit accretion this year which is two years ahead of plan.

· Broad based growth in global purchase volume, +11%.

· Client incentives lower as a % of revenue, reversing longstanding upward trend.

· Stronger dollar caused slight deceleration in cross border volumes (+10%). Highlights the impact on their business to a strengthening dollar –i.e. not just translation but also transactions.

· B2B initiatives progressing – 11% of volume now, growing at a faster rate than the overall business. Retail payment market is $45 trillion; B2B market is $120 trillion.

o Blockchain and “B2B Connect”: Processing speeds make blockchain impractical for low-value high-volume transactions (most of their existing business), but it is applicable for high-value, low-volume cross-border B2B transactions. These transactions are “one of the largest single pain points in B2B payments today” – Visa is piloting a blockchain based technology to address this called “B2B Connect.”

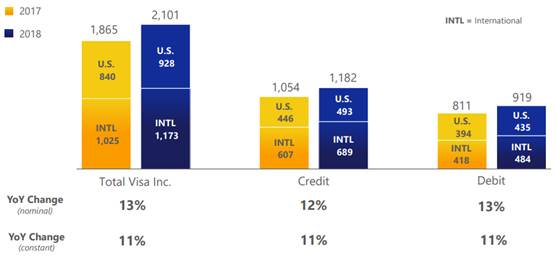

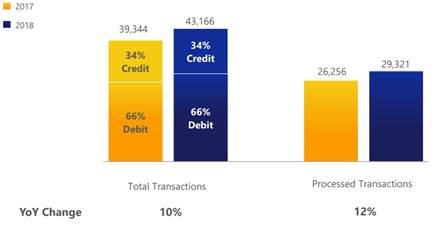

Visa reported very strong 3Q18 results and raised guidance. Beat driven by higher data processing revs and lower client incentives. Net revenues were up 15% and full year revenue growth guidance maintained at up low-double-digits. Guidance includes lower incentive outlook and lower projected tax rate of 20.5% – 21.5% (from 21-22%). In a reversal of last quarter trends, they saw weakness in cross-border volume driven by a stronger dollar. Because so much of Visa’s revenues (almost 28%) are generated from cross-border (spending in a country different than the card’s origin) their business is susceptible to currency fluctuations. Constant currency payment volumes were up 11% and processed transactions were up +12%. The integration of Visa Europe is progressing ahead of expectations and nicely accretive to margins. Cards outstanding grew 4% (to 3.3B), with 4% growth in credit cards and 4% growth in debit cards.

Visa is continuing to develop new avenues for growth as the payments industry changes. Contactless payment penetration continues to rise globally (e.g. FitBit and Garmin embedding Visa tokens in devices). They are positioning themselves to grow in the evolving P2P and B2B markets. For example, in March they acquired Fraedom to help expand their B2B business. This expands their addressable market from the $45 trillion retail payment market to the $120 trillion B2B market and the $60 trillion P2P market. Visa is also in the early stages of standardizing their digital checkout with the “Common Button” – an association with Amex and MasterCard to offer a common user interface for digital payments. The platform will create a single button checkout across sites and devices, eliminating the friction of online checkout across various sites.

QUARTER ENDED PAYMENT VOLUME (billions)

QUARTER ENDED TRANSACTIONS (millions)

Valuation:

· FCF for the quarter was $3.5B and YTD is $8.7B. Trading at a 4% FCF yield.

· They’ve returned most of their YTD FCF to shareholders through dividends ($1.5B) and buybacks ($5.55B). They have $5.8 billion remaining for share repurchase.

Thesis:

· Visa is the number one credit and debit network worldwide – accounting for about half of all credit and roughly three fourths of all debit card transactions.

· We are still in the earlier innings of the digitization of electronic payments. This is a secular tailwind supporting Visa’s growth as 1.) Electronic payments continue to replace cash 2.) Commerce moves online 3.) Consumer spending grows globally

· Visa’s asset light “toll both” business model is characterized by recurring revenues, high incremental margins, low capital expenditures, and high free cash flow.

· Visa’s recent acquisition of Visa Europe should be a nice tailwind over the next few years as the European market is in the earlier stages of electronic payment adoption and Visa is well positioned to gain market share and improve margins in the region.

$V.US

[tag V]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!