TIREX – Q2 2018 Commentary

The TIAA-CREF Real Estate Securities Fund lagged its benchmark during the quarter but has greatly outperformed YTD. REITs bounced back in a major way during the quarter with all sectors posting positive returns. The team continues to invest in quality companies with long term growth opportunities and higher credit ratings.

Market Overview:

– The FTSE NAREIT All Equity REIT Index returned 8.5% during the period compared to the S&P 500 posting a return of 3.42%

– REITs outperformed the broader stock market as the appeal for defensive assets increased during the quarter

o US REITs proved to be safe haven for value as domestic bonds, international currencies, and emerging markets sold off during the quarter

– Healthcare, hotel, and retail REITs delivered the highest total return while residential, office, and industrial REITs fared the worst

– All 11 major REIT sectors advanced during the period

Performance Overview:

– The fund’s underperformance during the period was generally do to its focus on long-term growth oriented REITs with higher credit ratings

o Examples include single-family homes, industrials, and data centers

– During the period, the typically higher-yielding sectors including health care, self-storage, and lodging performed the best

– The fund took profits from holdings in the infrastructure sector and strategically allocated proceeds across a number of sectors including diversified, specialty, and shopping centers

– Major contributors included GDS Holdings, a provider of data center infrastructure in China and a stake in National Storage Affiliates Trust, an owner of self-storage facilities

– Also, underweighting American Tower added to relative returns

– Detractors included an overweight to single-family-home-rental operator Invitation Homes, Inc.

– Second largest detractor was Healthcare Trust of America, Inc., a national owner and operator of medical office buildings

Market Outlook:

– Interest rates will increase progressively in the second half of 2018, albeit at a slower pace than during the first half

– Negative sentiment around retailers and increased propensity of store closures should continue to negatively impact owners of low quality real estate in the country

o Improved capital markets access should facilitate accretive transaction activity among owners of high quality real estate in the country

– Cash flow growth remains stressed in the retail REIT sector

– Cash flow growth within self-storage, rental housing, and industrial REIT sectors remain strong

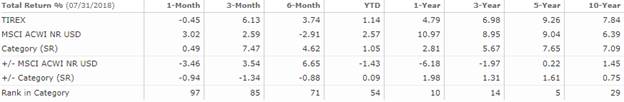

Performance Review:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!