Current Price: $94 Price Target: $100 (NEW)

Position Size: 2.96% TTM Performance: +7.8%

Key Takeaways:

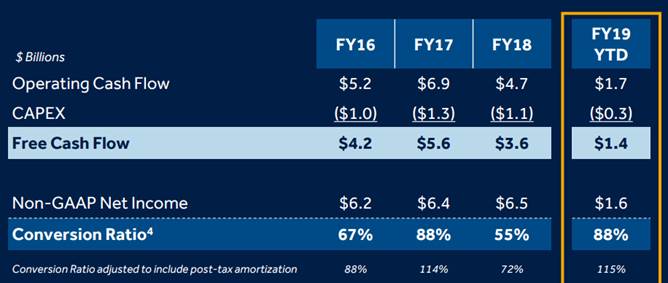

Medtronic released their first quarter fiscal year 2019 results this morning. Both revenues -all 4 segments- and EPS beat consensus, but the FY19 organic growth and EPS guidance raise, in addition to upbeat comments from the management team regarding their pipeline, is driving the stock higher today: “we’re executing on the strongest pipeline in Medtronic’s nearly 70-year history”. An increased focus on cash flow generation is positive, with 1/3 of the managers’ compensation tied to free cash flow results. Medtronic can now track free cash flow to a more granular level thanks to a new IT system. The US tax overhaul is increasing MDT’s access to cash to 100% vs. 55% before, opening the door for M&A. On the margin front, the 80bps expansion is good, especially knowing that some of the operating leverage was actually reinvested in the business, pushing R&D higher in cardiovascular and diabetes, which in turn should support organic growth. Their new diabetes pump & glucose monitors were up 26%, lifting the segment’s growth to 6.8% this quarter. We are updating our price target to reflect better focus on FCF, but still think it will be difficult for MDT to get back to past high level of FCF margin as the company needs to spend more on R&D to fight off competitors and sustain top line growth.

Revenue growth results:

Total company sales growth of +6.8%

· US: +6.4% underlying

· Non-US developed +5.5% underlying

· Emerging markets: +11.2% underlying

New FY19 guidance:

Organic growth now 4.5-5% (increased by 50bps)

EPS (ex-FX) 9-10% (from 8-9%)

MDT Thesis:

· Stands to benefit from secular trends (1) increased utilization from Obamacare (2) developed populations age

· Strong balance sheet and cash flows. Increased access to non-cash should allow MDT to meaningfully increase their dividend

· 6% normalized Real Cash yield provides solid total return profile over next 2-3 years

· Ownership interest aligned. Management incentivized to maximize shareholder returns – 14% 10yr average ROIC

[tag MDT]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!