Current Price: $106 Price Target: $120 (updated price target)

Position Size: 2.3% TTM Performance: 48%

TJX reported a great quarter, beating on revenue and EPS ($1.17 vs consensus $1.05) and gave a very positive view on the retail environment. The beat was driven by significantly better than expected SSS (excludes c-commerce).

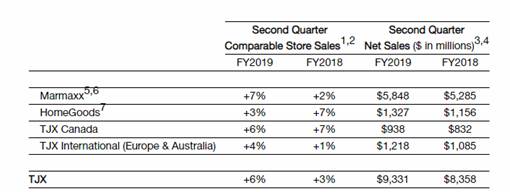

· SSS were an impressive +6% vs. consensus of +2% & +1-2% guidance. This was a big acceleration from +3% last quarter. Traffic was the biggest driver. They saw an acceleration across all divisions, with their core Marmaxx division (60% of revenue) delivering SSS growth of 7% (above even the highest estimates).

· Performance was solid across all divisions and geographic regions.

· They noted a “very strong start” to Q3. Not to apply Fed-like word parsing, but this was apparently the first time they used “very” in this outlook commentary in over 3 years.

· Canada SSS were +6%. They mentioned significant wage pressure in Canada.

· Europe is doing well and they are taking share. International (Europe & Australia) SSS were +4% an improvement from 1% last quarter and a big change from last quarter’s commentary of a “challenging retail environment” in Europe (where they have over 500 stores). They are taking share in European retail market – “we believe the gap in comp performance between us and many other major retailers has continued to widen.” In mainland Europe, they are in only 4 markets: Austria, Germany, Poland and the Netherlands. They also have stores in the UK, which is where they saw the biggest positive inflection in performance.

· Full year EPS and SSS guidance raised. Full year EPS guidance is $4.12 at the midpoint vs $4.07 previously (excluding benefit from a lower tax rate).

· SSS now expected to be +3-4% vs +1-2% previously (in their 40+ yr. history they’ve had only 1 year of negative SSS).

· They again made a point about their ability to attract a younger customer to validate the sustainability of their business model. “We are particularly pleased that we have been attracting a significant share of millennial and Gen Z shoppers among our new customers”…”the majority of new customers at Marmaxx, are these younger customers which indeed bodes very well for our future.” There were several minutes of discussion around this, so they must be getting a lot of questions from investors.

· Merchandise margin was down, but would have been up significantly excluding freight costs – i.e. they are not “buying” this better growth with deeper discounts. Inventory grew in line with sales, a positive indicator for future merchandise margins.

Management was again resoundingly positive regarding inventory availability. A key concern with the stock is that the structural changes we are seeing in the retail landscape will limit supply and that they might see a permanent shift in inventory availability and quality. They said they continue to see “abundant” availability of supply not just of inventory generally, but of better brands. E-commerce only retailers are a source of product, not an existential threat to their inventory sourcing model. Another concern from investors is whether the mix of inventory is shifting more towards private label from branded. This is something to keep an eye on, but based on management comments, is not an issue at this point – “our branded mix is better than it’s been in a long time.”

They have an opportunity to continue growing abroad and grow their home concept in the US. TJX sees the potential to add 2,000 stores globally across its banners (6,100 store target), including 400 for the new HomeSense concept in the U.S. Their e-commerce platform, while small now, should also be a future source of growth – they operate Sierra Trading Post, tkmaxx.com and tjmaxx.com and are investing heavily in technology.

Valuation:

· Balance sheet is strong. They have no net debt.

· Store openings will bolster top line growth.

· They have been steadily FCF positive, even through the financial crisis they posted 3% FCF margins. LT FCF margins are 6-7%.

· Assuming a normalized FCF margin, they trading at about a 4% forward yield.

The Thesis on TJX:

· Market leader: opportunity to benefit from a lasting paradigm shift in consumer frugality. Treasure hunters – TJX has strong brands that attract cost conscious consumers– evident through consistently strong customer traffic.

· Strong bargaining power with suppliers due to size.

· Quality: Solid and consistent execution and top line growth driving strong margins through cost cutting/inventory control.

· Shareholder returns: Strong returns (ROE +50%) balance sheet and cash flows being used for share buyback program, dividend, and store expansion.

· Attractive long term EPS growth of 10%+.

$TJX.US

[tag TJX]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!