Headlines over the past few days have been celebrating the current bull market as the longest in history. However, there are some that would argue that this is not truly the case.

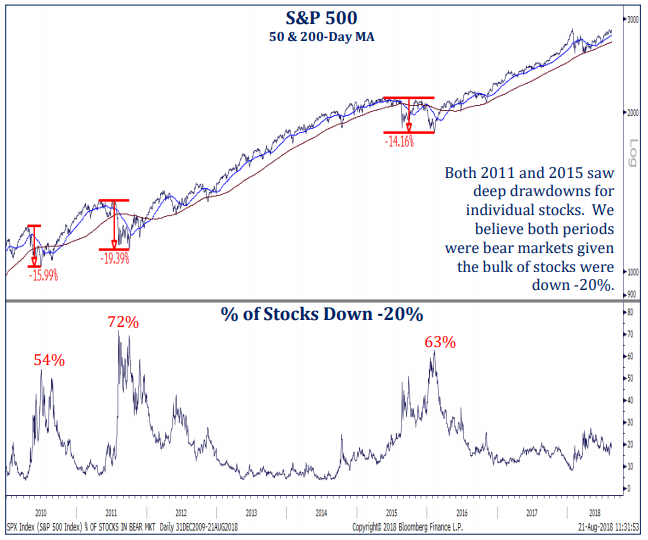

A bull market begins at the bottom of a bear market, which is widely accepted as a 20% drop from the latest peak in the cycle. The argument can be made that in October 2011, during intraday trading the S&P 500 reached a 20% decline relative to the most recent post crisis high.

This is not meant to truly dispute the “record” but rather to point out that this continued rise in the S&P 500 was not a straight line upward. This is another example to our clients that remaining invested over time provides a much greater opportunity for positive returns. It is easy to look back now at the extreme highs reached since 2009 and forget the major drawdowns in 2011, 2015, and even earlier this year.

Below is a link to a WSJ article discussing this point and a chart from Strategas depicting the different highs and lows since 2009:

https://www.wsj.com/articles/calling-bull-on-the-longest-bull-market-1534940689?mod=hp_lead_pos6

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!