Attached is a piece from Strategas that discusses repatriation, fiscal policy, and global tariffs. While many of these numbers are forward projections or estimates, Strategas does make a few major points:

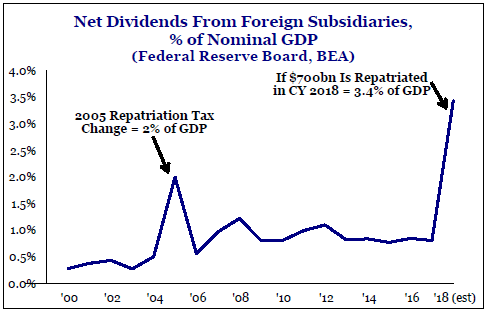

1.) Total Repatriation: they estimate that U.S. companies repatriated $200 billion in Q2 bringing the total amount for the calendar year up to $500 billion; based on these projections, they are trending at $1 trillion of fiscal policy for 2018

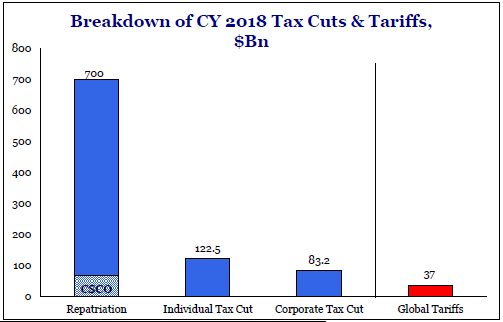

2.) Repatriation & Tariffs: tariffs are broadly poor economic policy and can have long term effects on the global economy; however, in the short term, approximately $38 billion in global tariffs will be implemented in 2018 while Cisco alone has repatriated $67 billion so far this year. The potential for shareholder return and/or corporate growth driven by repatriation far exceeds the dollar effects from tariffs to this point

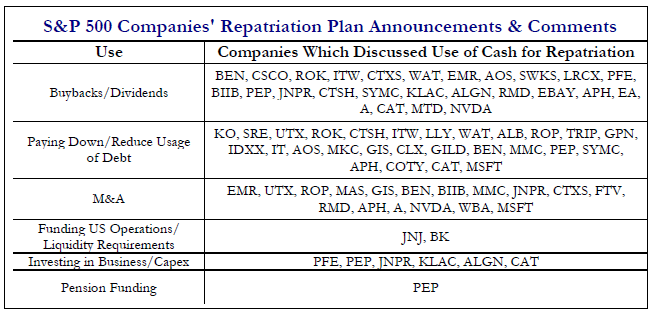

3.) Use of Cash: while some money is being given to shareholders in the form of dividends or buybacks, paying down debt is the most cited use of cash by companies in the S&P 500; this includes increased pension contributions (closing the gap for underfunded pensions) as the tax bill let companies make pension contributions through September at a 35% tax reduction (2017 rate)

Net Dividends from Foreign Subsidiaries – up to 3.4% of GDP if $700 billion gets repatriated

Calendar Year 2018 – Tax cuts vs. tariffs

Use of Repatriation – Announcements from S&P 500 Companies

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!