Good Morning,

Attached is the Monthly Market Monitor from Eaton Vance. Below are four graphics that look at yield spreads, U.S. equity returns and earnings, and the broad diversification of GDP contribution globally.

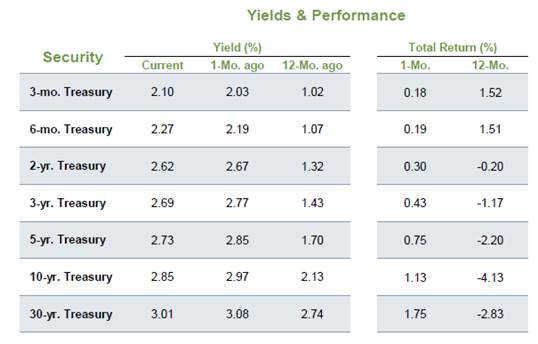

Treasury Yields: short term rates continue to rise faster than long term, thus flattening the yield curve. As rates rise, longer duration fixed income is more negatively affected, and our relative short duration positioning has benefited the bond portion of our portfolios.

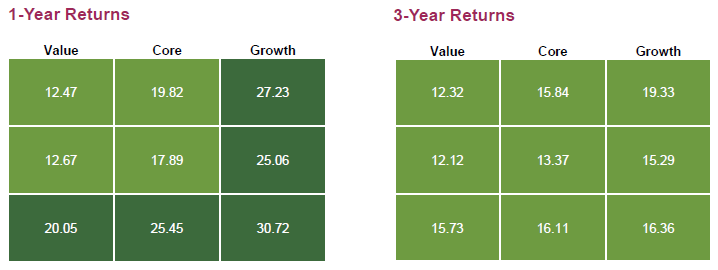

U.S. Equities: The gap in performance between growth and value continues to widen. Annualized large growth returns over the past 3 years has been 19.33%. Small cap equity performance has been extremely strong YTD and over the past calendar year.

Corporate Earnings Growth: Earnings growth over the past year has been extremely high across nearly all sectors (in grey). Forward earnings forecasts expect quality growth but at a slower pace than the last twelve months.

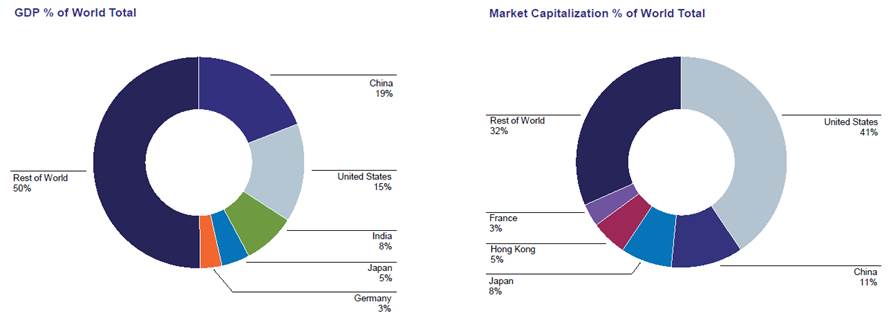

Global GDP vs. Market Cap: The United States GDP accounts for approximately 15% of global GDP but U.S. companies account for approximately 41% of global market cap.

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109