Good Afternoon,

Attached is the September Chart Pack from SSGA. Below are graphs that discuss equity market returns and flows, inflation and the Fed, and current bond asset class positioning.

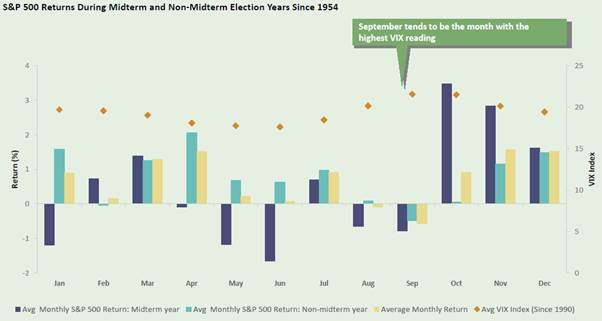

Equities During Midterm Election Years: The fourth quarter months tend to have very strong performance during midterm election years.

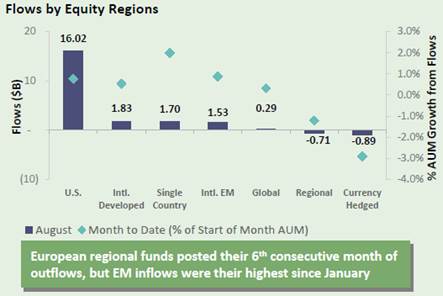

Asset Flows: Investors continue to pile into U.S. equities given the supportive economic backdrop.

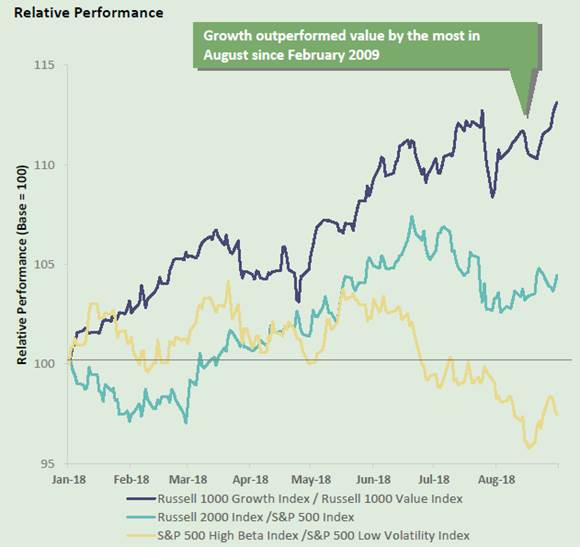

Stressing Growth vs. Value: growth outperformed value by the most in August since February 2009.

The Fed and Inflation: Given that the core PCE inflation rate reached the Fed’s target level, the probability of another rate hike in September is near 100%.

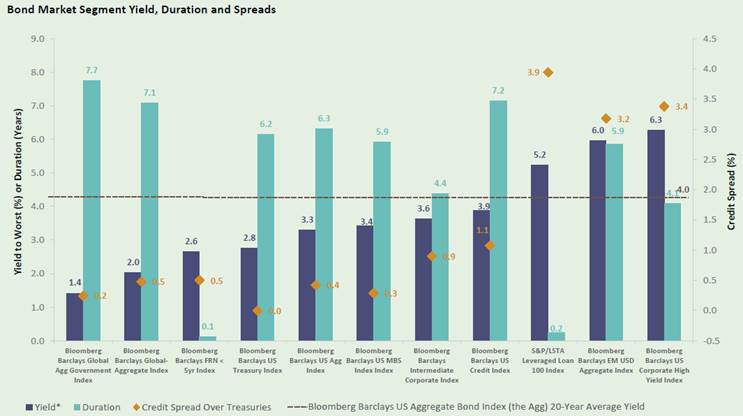

Bond Market Yield, Duration, and Spread: yields of traditional bonds remain below historical averages while average duration continues to increase.

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109