Key takeaways from the quarter are as follows:

- Berkshire reported $7.28b operating earnings versus $5.02b from prior year, up 20.4%

- Buffett repurchased $6.8b of shares in Q4 and $27.1b for 2021 representing 3.7% of shares

- Cash and shares of Apple represent 40% of value of firm.

Current Price: $330 Price Target: $370 (raised from $330)

Position Size: 3.6% TTM Performance: 26.9%

Highlights from quarter – solid cyclical rebound

- Railroads – YoY revenue rose 11.6% and earnings rose 13.3%

- Berkshire energy – YoY revenue up 9.6% and earnings up 15.7%

- Manufacturing, service and retail – Profits rose 22.9% YoY

- Insurance revenues rose 4.29% and profits fell -2.3% YoY though BRK’s insurance profits are very lumpy.

Greg Abel, Buffett’s appointed successor, published a note on Berkshire’s ESG endeavors in the appendices of the annual report.

- They target cutting BHE’s greenhouse emissions from a baseline of 80 metric tons to 40 in 2030.

- Berkshire Hathaway Energy will retire 16 coal units between 2022-2030 and all coal units by 2049 achieving net zero emissions by 2050!

- For Burlington Northern Santa Fe, they target a 30% reduction in greenhouse gases by 2030.

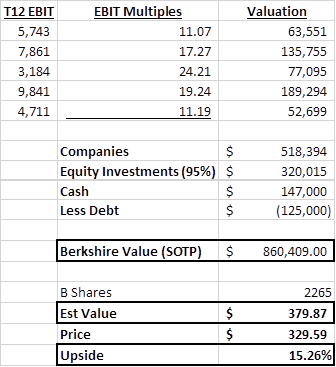

Valuation: Berkshire is selling at a 15% discount to intrinsic value using sum of the parts. Their cash of $145b and Apple representing $150b comprises 40% of the company’s valuation.

Berkshire’s top 5 holdings:

Berkshire remains a core holding, is currently undervalued, defensively positioned and cyclically sensitive to the economic recovery.

Please let me know if you have any questions.

Thanks,

John

($brk/b.us)

John R. Ingram CFA

Chief Investment Officer

Partner

Direct: 617.226.0021

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109