Key Takeaways:

Current Price: $81 Price target: $120

Position size: 2.66% 1-year Performance: +7%

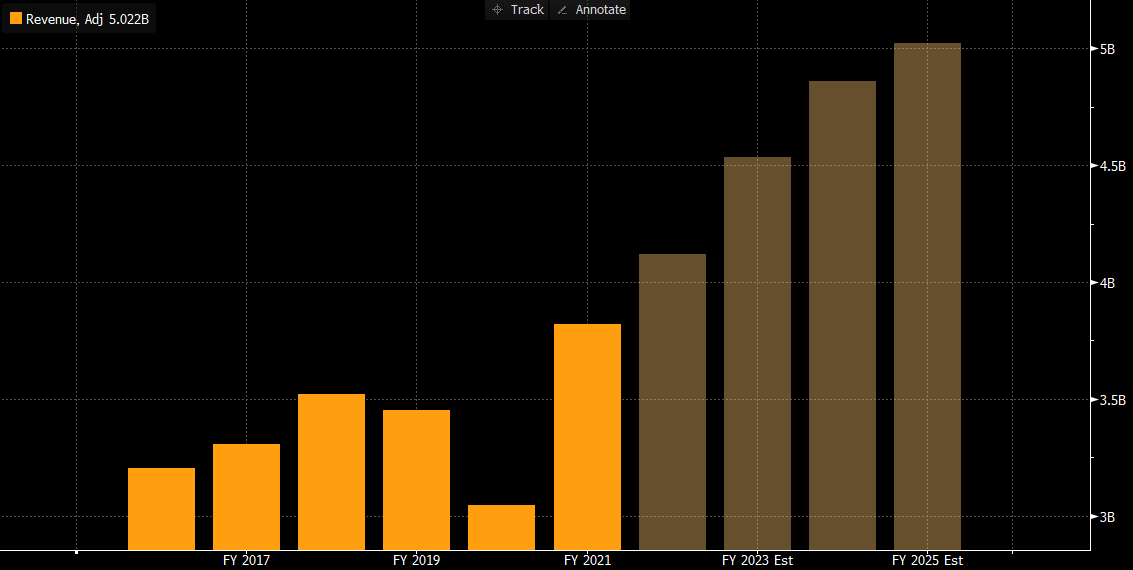

- Core sales +20.5% missed the street estimates due to FX impact, lower reimbursable expenses and faster wind down of some covid projects. The positive side of this is better profitability as mix improved.

- Total sales $1,373M vs estimates of $1,407M

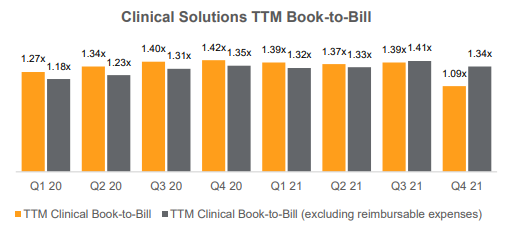

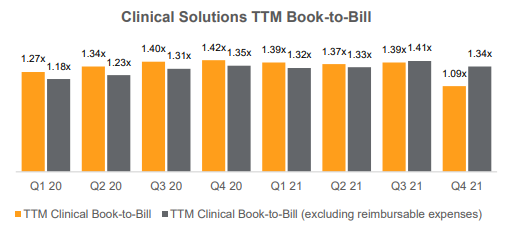

- Clinical trials new business awards grew 17.5% à book-to-bill now 1.34X (above 1X is positive for future growth) which is stable y/y although a slight decline from Q3

- Clinical revenue +20.7%

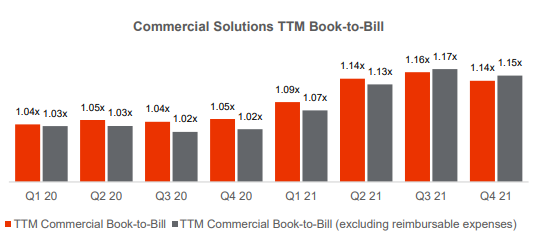

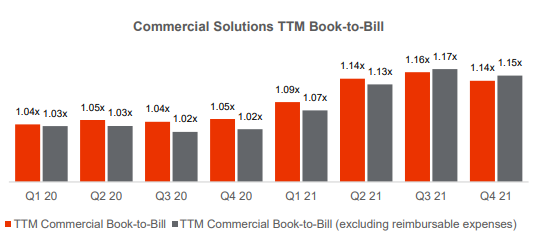

- Commercial net new business awards grew 25.6% à book-to-bill 1.15X has improved y/y

- Commercial sales +19.8% y/y

- Gross margin contracted by 20bps y/y

- Adjusted EBITDA margin of 17.3% grew 20bps, where higher than consensus of 16.8%

- Operating margin contracted 10bps y/y

- Adjusted EPS of $1.48 beat consensus and was up 33% y/y

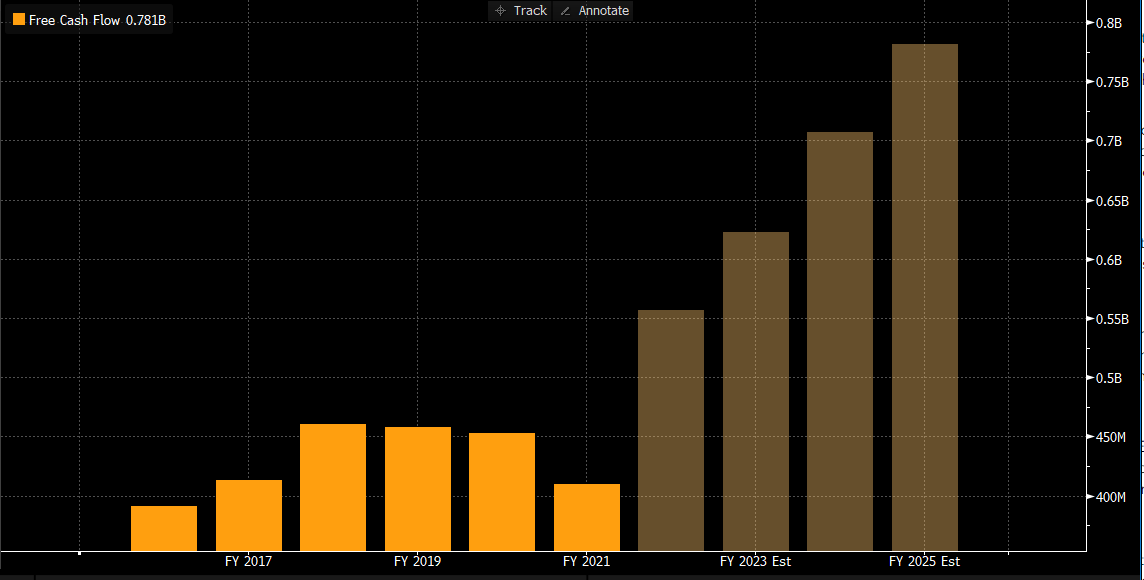

- Free cash flow was $159.1M, growing ~55% y/y

- Net leverage stands at 3.6X, lower from 3.8X 6 months ago and within their target range of 3.5-4X

2022 Guidance in line with expectations:

- Revenue growth of 7.4% – 10.3%

- Adjusted EBITDA margin 15% – 15.3%

- Adjusted EPS $4.98-$5.24 (+11.7% to +17.5%)

Why is the company seeing lower reimbursable expenses since the start of the covid pandemic?

- lower travel expenses for SYNH staff, due to sustained levels of remote monitoring

- investigator meetings remaining virtual

- reduce costs for study medications

This trend is expected to continue and as such, SYNH is changing its backlog reporting, which has no impact on demand or profitability, but a reflection of how business is done.

Competitors have released earnings earlier than Syneos, mentioning some weakness in SMID biotech funding. Syneos does not expect the same level of weakness, as their customers have incredible levels of funding (through private equity for example). They also have a solid RFP flow, a good predictor of future demand. The Syneos One offer is also very attractive to smaller companies who do not want to build a whole commercial structure.

CEO quotes from the call:

- “we see great strength in the SMID at the moment, we’ve seen that across both kind of ends of the SMID as well, the emerging biotech, as well as the more mature larger customers in the SMID that we’ve kind of do the majority of work”

- “We are proud of the the progress we have made over the past several years as we have continued to evolve our business model by developing innovative integrated offerings enabled by data and technology to position our business for long-term growth. Dynamic assembly investments that are fueling growth include Kinetic, our modern customer engagement capability and the expansion of our DCT solutions through Illingworth and study kick. Specifically in our clinical business, we’ve expanded our digitally enabled delivery and response to the pandemic, which catalyze the rapid deployment of decentralized trial capabilities and drove greater acceptance of these methods by regulators, customers, sites, patients.”

- “While these innovations streamline the clinical development process for our customers, they also result in a lower mix of reimbursable expenses, a dynamic that we now expect to have a lasting impact on our revenue profile.”

- “our commercial solutions business continues to demonstrate strong performance, with our full-service approach resonating with customers and the Syneos portfolio beginning to achieve commercialization milestones, resulting in 19.8% revenue growth. With deployment solutions ending back while growth of 20.9% for 2021, our commercial business remains well, positioned for low teens growth in 2022. T

In addition to Syneos One, the company is developing a very interesting business, helping customers with an integrated offering. We think this could help retain relationships with customers, especially smaller biotech firms who might not have the internal capabilities to navigate the complex landscape of drug development/approvals.

“We recently introduced a full-service medical affairs offering, […] Similar in concept of Syneos One, this unique approach combines our medical affairs capabilities from across all parts of our business, into an integrated offering, connecting our real-world evidence, health economics, outcomes and research, medical science liaisons, medical communications, and specialized consulting disciplines. Today, customers have had limited access to medical affairs outsourcing alternatives, which are growing in importance as better evidence is required to ensure relevance with payers providers and patients.“

ESG developments: recent commitment to net zero emissions by 2040 and participation in the human rights campaigns corporate equality index.

Overall we remain confident in Syneos to continue to grow, and take shares from competitors as they offer more than clinical trials, with commercial efforts and medical affaires options. We think the stock is down on readjusting the top line profile as the mix of reimbursable expenses adapt to remote monitoring – but which ultimately is a benefit to the industry: more patients enrollment, higher stickiness of patient profile, lower cost for biotech/pharma companies to run trials.

Investment Thesis:

I. Secular growth:

- Increasingly sophisticated and highly-regulated environment with government increasingly focused on drug pricing à biotech and large pharma need to reduce fixed costs

- Growing research and development (R&D) spending environment:

- Growing portion of R&D outsourced to Contract Research Organizations (CROs)

- Pharma/biotech clients choosing fewer & higher quality CROs (expertise and scale)

- Syneos has robust backlog predicting good growth for next 2 years

- Recovery in clinical trials post-covid

II. Competitive advantages:

- Only company integrating clinical trials (Contract Research Organization -CRO) and commercialization solutions (CCO):

- Offer customized solutions and possibility to lower time to market

- Top 3 market share within fragmented CRO market

- Global scale – allows to compete for larger trials, with expertise in complex diseases

- Diverse client base (large to small pharmaceuticals)

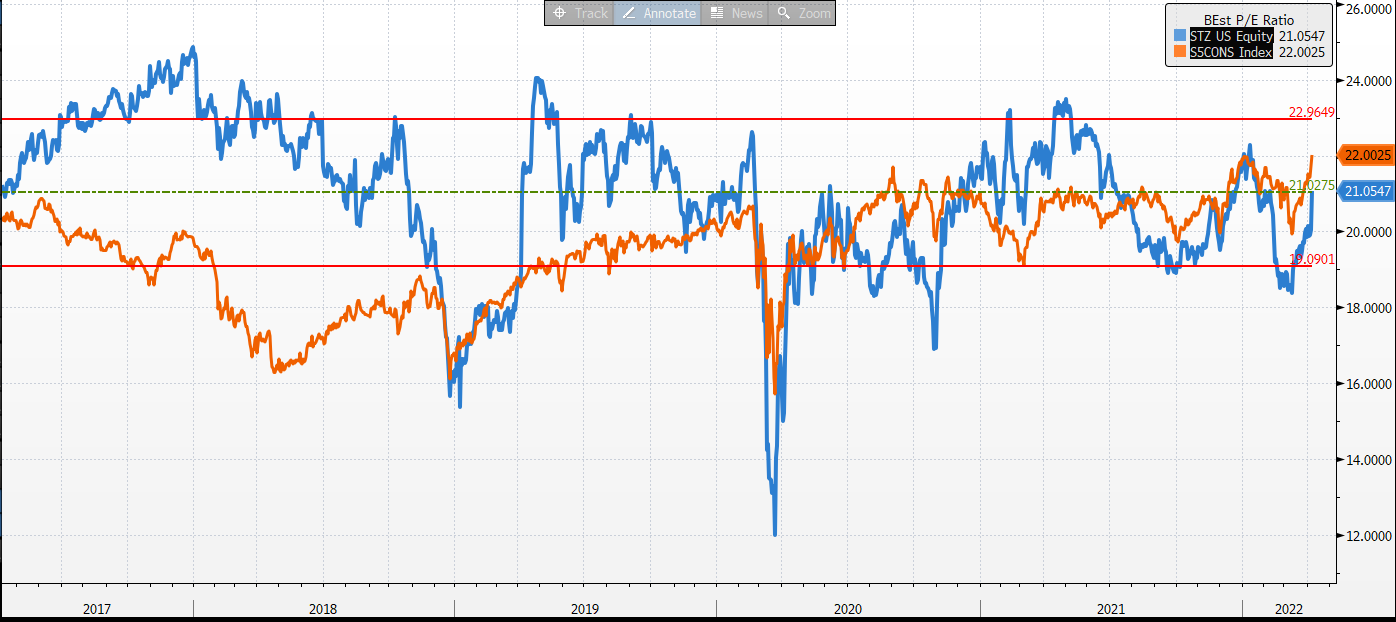

III. Attractive valuation: 45% upside

- Driven by secular growth drivers and margin expansion

$SYNH.US

[category earnings] [category equity research] [tag SYNH]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

www.crestwoodadvisors.com