Key Takeaways:

· Sales and margins decreased were better than feared, thanks to recurring revenue base, resilient retail fueling business in North America (+MSD growth) and good performance at the recently acquired ASP business

· Strategy of targeting recurring revenue base is proving its value: now 35% of revenue base is providing some stability

· 3Q sales guided to 5-8% decrease, and ~35% decremental margins

· Vontier spin-off on hold until market conditions improve

Current Price: $71 Price Target: $78

Position Size: 2.14% 1-year performance: -7%

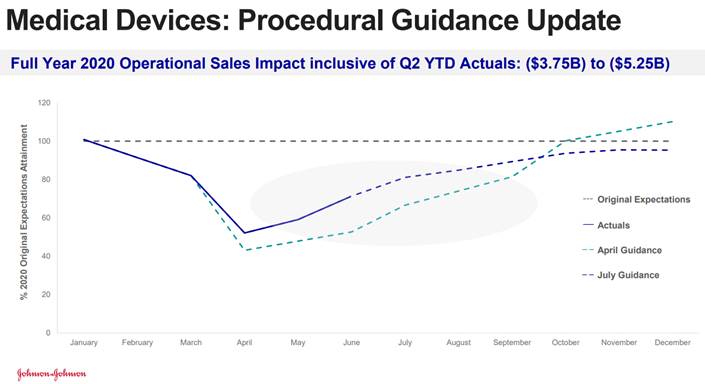

Fortive released its 1Q20 earnings last night, with core sales contraction of -16%, higher than the 20-25% decline projected by management in Q1. Decremental margin of 33% was also better (company was guiding to 35-40%) as sales exceeded plans and costs cutting action. Free cash flow has been resilient too, thanks to working capital management (+93% increase y/y). The company noted that their ASP elective surgeries business was back to 90% of pre-COVID levels in China, ~85% in Western Europe and ~85-90% in North America, and they had a great opportunity with the N95 respirator reprocessing. Matco (automotive hand tools) saw a direct impact from the stay-at-home orders but a bounce back once local economies reopened towards the end of the quarter. GVR (retail fueling business) was impacted by COVID (social distance requirement and lack of access to customer sites). This segment did well in the US and better than expected in W. Europe but saw significant pressure in India (lockdowns in place). On the positive side, bookings are up mid-single-digits in 1H2020, a good sign of upcoming sales if lockdowns lift near term. In its comments, the management team remains cautious on the 2020 outlook as the US sees increased COVID cases.

Overall, Fortive printed good results with margins impacted less than expected. Its strategy to acquire businesses with recurring revenues is showing its value by providing some revenue stability.

FTV Thesis:

– Market leader:

· Leadership position in most of the markets they serve

· Experienced leadership team

· Above industry margins with strong cash flows

– Quality:

· FCF yield ~5%

· Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

· M&A strategy to enhance top line growth

· Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

– Shareholder friendly:

· Management team focused on shareholder wealth creation through top line sustainability and margin expansion

$FTV.US

Category: earnings

Tag: FTV

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109