Key takeaways:

· Company is seeing little impact from COVID-19 on its business

· 2020 guidance mostly unchanged (top line reduced by <1%)

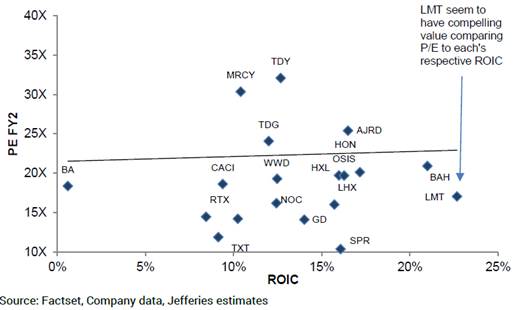

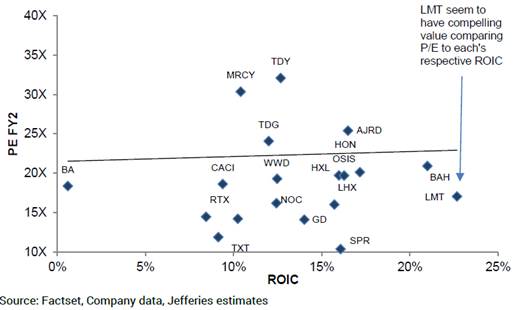

· LMT continues to be best-in-class defense company with high cash generation and ROIC

Current Price: $373 Price Target: $469

Position Size: 4.35% 1-year Performance: +22%

Lockheed released its 1Q20 earnings results this morning, with organic sales +9%, segment operating margins -100bps, and EPS +1.4%. The business has been insulated from the COVID-19 crisis in Q1, although the rest of the year should see some impact such as supply chain issues due to distancing at facilities, supplier tier hierarchy disruptions and some shipping constraints. While the F-35 contributed to most of the quarterly growth in Aeronautics (contributed 12 points of the 14% segment growth), some delays in deliveries in Q2 and beyond is possible. Cash from operations was up 40% y/y. Lockheed’s current backlog ($144B, up 8% y/y) supports near-term growth.

2020 sales guidance was decreased slightly by ~1% due to reduced production and supply chain delays highlighted above, but profitability, EPS and cash from operations were maintained. With interest rates lower, pension expenses will be a greater headwind to profitability than initially guided earlier this year (~30bps).

Regarding LMT’s quality, its best in class ROIC still holds true, with a lower P/E than peers:

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

[category earnings] [tag LMT] $LMT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

www.crestwoodadvisors.com