Since the stock is down ~30% since the virus hit, you might wonder why this consumer staples stock doesn’t act more defensive. Here are some explanations:

· Other beer competitors have cited lower consumptions outside of home due to less attendance in bars and restaurants because of the virus.

· A reminder that STZ products are consumed only in the US, and as of last week the company has not seen any change in consumption levels in the US. This of course can change at any time.

· The Mexican president will get to vote in a couple weeks on the new brewery plant in Mexicali. Local activists have been protesting the plant for the past 4 years as they argue it will put a strain on water availability for Mexican residents. STZ has been pushing back, saying they are not the major water user (agriculture is), and that they might look to build the plant somewhere else. This plant delay could be a risk for producing enough beer to support demand in the future.

· Some survey was published showing Americans are less likely to buy Corona due to its name…. I’ll leave it at that…

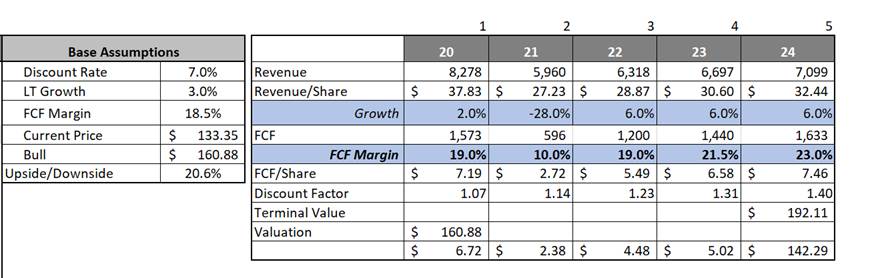

Here’s a quick scenario analysis of what valuation looks like if this year’s top line growth and FCF margin drops to similar levels as 2008 (in FY21)> As this model illustrate, even with a big drop in demand and a FCF margin cut nearly in half, STZ has upside from today’s lows.

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109