The stock is up today after releasing good earnings with EPS of $1.69 vs consensus $1.61, and thanks to disclosing more information around their PBM business. Their 3Q18 EPS guidance is below consensus, but the focus is on the Aetna transaction closing in the coming 2-3 months. The Aetna deal is expected to close in Q3 or early Q4, pointing to higher confidence the deal will go through. A “substantial” number of states have approved the deal. MinuteClinic is introducing video visits through the CVS Pharmacy app 24 hours/day, leveraging Teledoc’s technology platform.

Author: Julie Praline

EOG 2Q18 earnings recap

Key Takeaways:

EOG reported good 2Q18 earnings and provided an update to their 2018 outlook. The full year production guidance was raised to 717.5MBoe/d – with capex unchanged – but it is now just in line with consensus. 3Q18 oil production guidance is ~1% below consensus but 4Q18 oil production implied guidance is above expectations. They still target to reduce costs by 5% this year. EOG continues to increase its dividend, pushing 2018’s increase to 31%, way above their historical average of 19%. This is a good sign that management has a positive view of the future cash flows of the company.

Resmed (RMD) 4Q18 earnings recap

Key Takeaways:

· Resmed is winning shares in the US: devices +9%, masks +12% (better than last quarter, and removing our fear of share loss to competitor Philips)

· Rest of the world devices sales +6% slower than last quarter as fleet upgrade slows down (big boost last Q in France & Japan not repeated this Q). Rest of the world masks sales still impressive at +16% (upgrade in masks)

· Acquisition of HEALTHCAREfirst (software of home health/hospices) during the quarter will add growth to Brightree (sales +12% this Q). Terms of the deal not disclosed. We like Resmed push into Saas (software-as-a-service), as a way to increase recurring revenue and diversify from the cyclicality of devices/masks sales due to introduction of new models

· Margins in line with their guidance at 58.1%, but below consensus: lower prices were offset by better manufacturing & procurement efficiencies. We like the recent trend of gross margin stability, which combined with lower SG&A expenses as a % of sales (thanks to scale benefits and cost reductions), will help boosts RMD’s operating margins

· FY19 guidance introduced:

ü Gross margin consistent with 4Q18 of ~58%

ü SG&A 24-25% of sales – lower than FY18 and the lowest of its history

ü R&D 6-7% of sales (a good rate to maintain top line growth)

ü Tax rate 22-24%

While we still like Resmed’s company profile and growth trajectory, the shares appear fully valued today. Our updated price target is $109, assuming continued double digits growth in the next 4 years and FCF margin stability. Current position size: 2.56%, current price: $108.6.

Sanofi (SNY) 2Q18 earnings recap

Key Takeaways:

Sanofi reported in-line revenue and a slight beat on EPS. Sales were +0.1% y/y, due to lower Vaccines sales. EPS grew +1.5% (ex-FX). The company raised the lower end of its 2018 EPS guidance from 2-5% growth to 3-5% (ex-FX impact of -6%). R&D expenses increased 13% (ex FX) due to the acquisition of Bioverativ and Ablynx, and investments in immuno-oncology and diabetes. 2H18 should have a better growth profile, however 2018 is not a very exciting growth year for Sanofi. On the bright side, we are pleased to see good growth in its consumer healthcare business, as many peers have been struggling there. We are maintaining our price target.

Fortive (FTV) new deal announcement: acquisition of Accruent

This morning Fortive announced the acquisition of Accruent, owned by the private equity group Genstar Capital. Conference call at 8:30am.

Deal details:

· $2B in cash, financed by cash & debt

· expected to close in 3Q18, accretive to FCF and EPS in 2019

· fits Fortive’s strategy to add recurring revenue businesses, in the connected devices & IoT/data analytics

· 10% ROIC by year 6

· Synergies possible with Fluke and recently acquired Gordian

Company description:

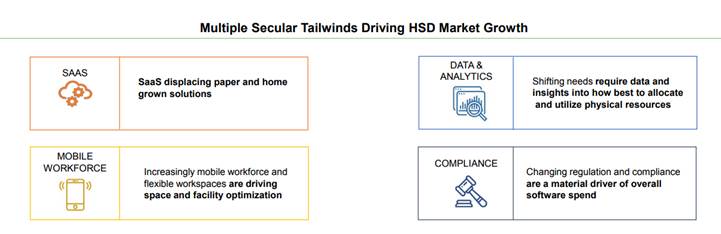

· Accruent is a global software company that provides resources to companies to manage their facilities/real estate/physical assets in a cloud-based framework. This software tracks the full life cycle of real estate and facilities: capital planning, lease accounting, space management, field service management

· employs 1,100 employees and serves 10,000 global customers across a wide range of industries

· 20% of its revenues is international (serves 150 countries)

· total addressable market for Accruent’s software is $7B, #1 in this market

· revenue of $270M in 2018, 50% software-as-a-service, 70% recurring revenue base, high revenue retention and low cyclicality

· Adjusted EBITDA margins of 37%

· Long runway for additional M&A in that market

$FTV.US

[tag FTV]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!

Exxon (XOM) 2Q18 earnings recap: lack of management team transparency leads to production “miss”

Key Takeaways:

Exxon reported disappointing 2Q18 results, with lower production than expected due to heavy maintenance activity, leading to an earnings and cash flow miss. During 1Q18, the company had called for 2Q18 to show lower production rate, however expectations were for a higher number. This quarter, the management team sees 2Q18 to be the bottom in Downstream production, while Upstream should see a gradual improvement (thanks to maintenance recovery and Permian growth). Permian and Bakken production were up 30% y/y (and 45% sequentially). FY18 production guidance is now -4.5% (prior guidance was for production to be flat) on asset sales impact, maintenance outages and reduction of lower value exposure (US gas). On the positive side, XOM guided to production growth in 3Q and 4Q. We remain cautious however on how transparent this management team wants to be, as their positive outlook for downstream during their latest Analyst Day never mentioned the heavy maintenance activity that was scheduled for this past quarter. During the call, the analyst community requested to the company to provide more transparency on scheduled maintenance projects, so that production forecasts can include those outages. We maintain our $86 price target after review of our model.

Fortive (FTV) 2Q18 earnings recap: 2018 guidance lifted on better growth forecast

Key Takeaways:

Fortive released good 2Q18 earnings, showing an acceleration in its organic growth rate into the high single digits (+5.3%), acquisitions added +7% to growth and FX +1.6%. While gross margin expanded 120bps, SG&A expenses impacted operation margin by 210bps (mostly from new companies having lower margins with a total impact of -70bps, and transaction costs lowering margins by another 60bps). Fortive’s core margin (removing the impact of M&A) expanded by 50bps, a good sign of the business’s strength. EPS grew 28% y/y. However, its 3Q18 guidance is below expectations (tariffs impact) and explains today’s stock weakness.

· 2Q18 comments showing the strength of the business: 5 out of the 6 platforms had positive pricing and core margin gains.

· Updated 2018 guidance: organic growth rate increase by 100bps (now 4-5%). As a result, core margins expected to gain 75bps (50bps prior guidance). EPS guidance raised as well on the lower end ($3.42 from $3.40). The updated guidance includes the $0.08/share impact from its mandatory convertible preferred stock offering, which should be offset by the strong operational improvements.

· Tariffs: $0.06/share negative impact in 2H18. This is higher than previously expected by management, but it should be offset. Tariffs explains the weaker margin outlook for 3Q18. Mitigation of tariffs will come from pricing (40%) and operational actions (60%) such as alternative sourcing, moving regional production and supply chain actions. So far they have seen no impact on the demand side. 2 sets of tariffs impacts them: steel (use for making the tool boxes for example) & electronics.

· M&A: the acquisitions from last year are finally lapping, and will be included in Fortive’s core organic growth, which should boost the growth profile of the firm by 20bps. M&A pace: CEO doesn’t think there is limitations right now. FTV always build capacity for deals from a talent perspective: they funnel talent to take on new opportunities. They have the people and financial capacity to bring on more businesses on board.

· ESG: CEO James Lico started his opening remarks on the call by mentioning the publication of their first CSR (Corporate Social Responsibility) report.

After review of our model, we are raising our price target to $87.

FTV Thesis:

– Market leader:

· Leadership position in most of the markets they serve

· Experienced leadership team

· Above industry margins with strong cash flows

– Quality:

· FCF yield ~5%

· Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

· M&A strategy to enhance top line growth

· Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

– Shareholder friendly:

· Management team focused on shareholder wealth creation through top line sustainability and margin expansion

$FTV.US

[tag FTV]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!

Lockheed Martin (LMT) 2Q18 earnings: good quarter leading to increased 2018 guidance

Key takeaways:

Yesterday LMT released strong 2Q18 earnings with sales +6.6%, operating margin +20bps, and EPS +31.5%. The sales beat came from more wins and faster conversion rate of orders into revenue. It is important to note that this is not a pull forward of orders from 2H into 1H, but rather driven by better business fundamentals. We are maintaining our favorable view on the stock.

Important points following the conference call were:

· LMT’s prior 2018 guidance was increased:

o The sales forecast raised by 2.5%: this is pretty significant compared to prior raises, and is broad based across the portfolio, thanks to strong new wins. Some orders came ahead of planning thanks to earlier than planned Department of Defense awards. The management team sees this strong growth as sustainable beyond 2019.

o EBIT margin forecast increased by 5%. Profitability should further improve as the F-35 ramps up (see margin progression in chart below). The production of the F-35 is expected to double from 2017-2019, and represents close to 30% of sales (of which 30% comes from foreign demand).

o EPS forecast raised by 6%, primarily due to better operational performance, and secondly due to more favorable tax rate.

o Cash from operations increased to $3.3B from $3B.

· The management team hinted at revenue toward the high end of its 3-5% growth target beyond 2018 (more to come in October during 3Q18 earnings).

· Free cash flow was negative this quarter, as another $2B were allocated to its pension plan ($1.5B additional will be added in Q3). As a reminder this is related to the tax law changes. 4Q18 will show significant FCF improvement.

SYK 2Q18 earnings recap: 2018 outlook raised

Key Takeaways:

After a strong quarter of earnings and market share gains, management raised its 2018 outlook for organic sales growth by 50bps to 7-7.5%, and EPS by 1%. Overall the quarter was solid and consistent with its history, showing a top line growth of +6.9% organic, adjusted operating margin +70bps (30bps above consensus) and EPS +15%. We maintain our positive view on the stock.

Why is the stock down today?

· Stock was up >10% YTD, trading at a 1.7% FCF yield and 27.5x current P/E

· 3Q18 guidance came below consensus numbers

· Their Knee business missed consensus by a small 0.5%, but as a well-publicized driver of growth for the company, and with recent competitors’ weakness in that space, expectations were high. Still, we argue that Mako showed a utilization rate growth of 55% y/y.

Market share progression for Stryker (Bloomberg data):

SYK Thesis:

- Consistent top and bottom line growth in the mid and upper single digits respectively

- Continued operating leverage of current infrastructure

- Strong balance sheet and cash flow used in the best interest of shareholders

$SYK.US

[tag SYK]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

PLEASE NOTE!

We moved! Please note our new location above!

ST 2Q18 earnings recap: good growth momentum

Key Takeaways:

Sensata (ST) reported strong 2Q18 earnings, with sales up +6.4% on an organic basis (+8.8% reported), EBIT margin expanding 100bps and adjusted EPS up 14.8%. Higher volume, lower integration costs and acquisition synergies were cited as driving those results. The management team lifted 2018 organic sales guidance to +5-7% (from 3-5%) and EPS guidance to +14-15% (from +9-13%), thanks to better underlying business trends. The 2H18 run rate is expected to be better than 1H18 (~4%). The company will be able to offset the Section 232 tariffs (steel & aluminum) impact on EPS by the end of 2018 (worth $0.03-0.04/share in 2018). ST has a global supply chain and has been proactive in working with customers before the tariffs implementation. We can expect another share repurchase program to be voted early 2019, as the remaining $400m share repurchase should be done in the next 6 months. The company is reducing its cash balance in China to mitigate the currency risks. After this quarter, we remain confident in Sensata’s growth trajectory and maintain our price target.

Continue reading “ST 2Q18 earnings recap: good growth momentum”