Key Takeaways:

Current Price: $55 Price Target: $61

Position Size: 1.47% 1-year Performance: +26%

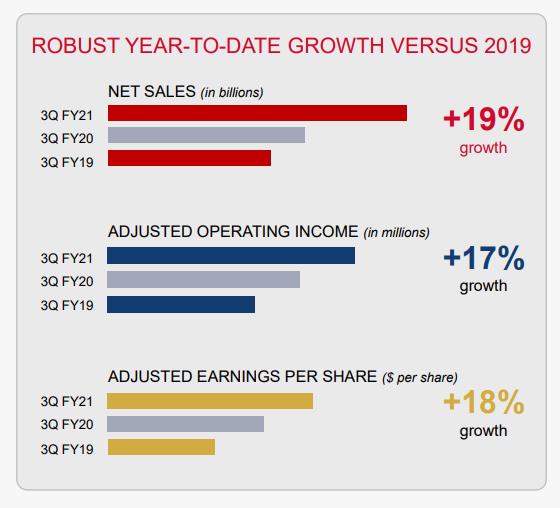

Sensata released an overall good 3Q report.Sales were +21% overall (~17% organic), with growth by segments as follow:

• Automotive organic sales +5.2%: ST outgrew the market by 1,150bps

• HVOR organic revenue +59% y/y: outgrew the market by 2,400bps

• Aerospace/Industrial sales +8%/+18%, driven by defense product launches and electrification/HVAC

Volume and productivity had a 310bps positive impact on operating margin, while supply chain constraints were a 80bps headwind, and will have a greater impact in Q4 (100bps). Because of its solid cash position, Sensata is reinstating its share buyback program in Q4, which we view a bullish for near-term performance. Sensata recently won some new contracts in the EV (electric vehicle) space: electronic stability in brake sensing (supplier Continental), pressure and force sensors in brake system with a leading EV OEM. Those a just a couple of examples of what Sensata sees in content growth in EV in the next 5 years, planning to double its EV content per vehicle vs. a traditional internal combustion engine vehicle, with a dollar content usually 20% higher as well. EV wins have been 50% of new business wins so far in 2021.

The new acquisition of Spear Power Systems will enable ST to offer full energy storage solutions. Fun Fact: Spear is enabling the Washington State Ferry system to go electric with battery energy storage.

2021 guidance update:

- 4Q guidance is below expectations due to supply chain constraints worrsening

- OEM production outlook for 2021:

- Auto production to contract 3% overall (worse in every regions)

- The aerospace sector overall is expected to contract 8% vs 4% previously guided in July.

- Industrial looks stronger at 13% vs 12% in July

- HVOR is expected at 25% vs. 23% in July.

- Sensata did not provide a 2022 guidance, but believes the IHS view of ~10% auto production growth is too optimistic as the supply chain constraints could continue into 2022.

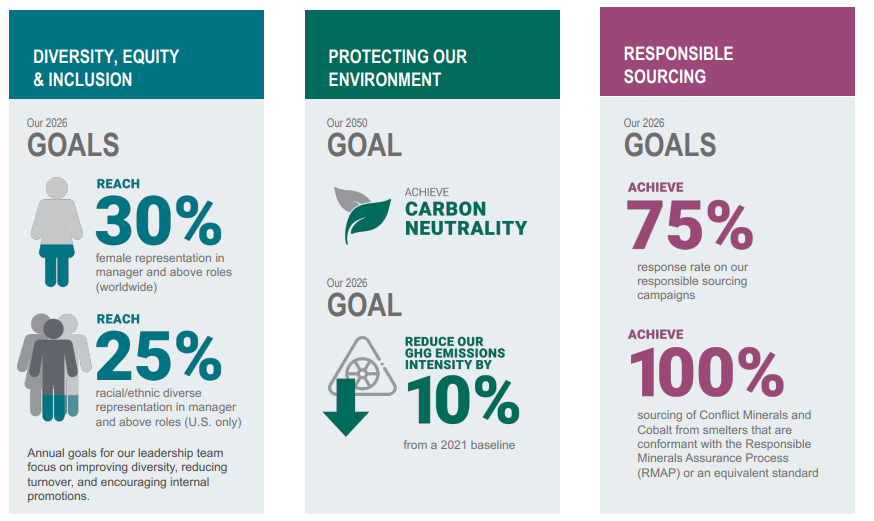

To finish, Sensata published its first Sustainability Report!

The Thesis on Sensata

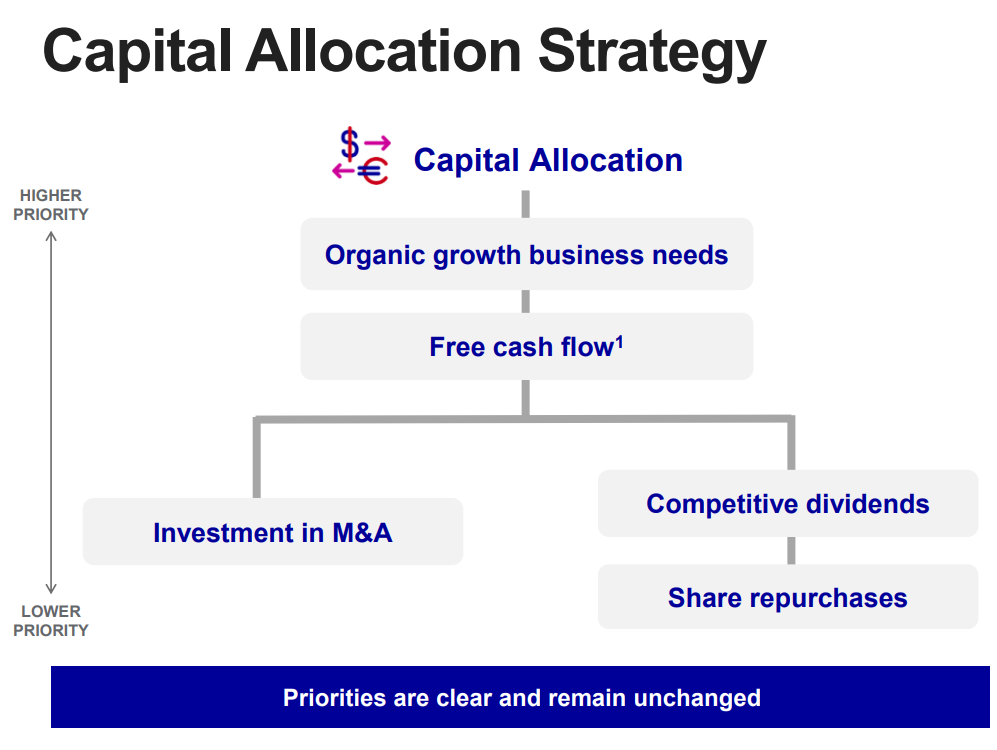

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109