Key Takeaways:

Current Price: $74.3 Price Target: $88 (from $83)

Position Size: 1.91% 1-year performance: +24%

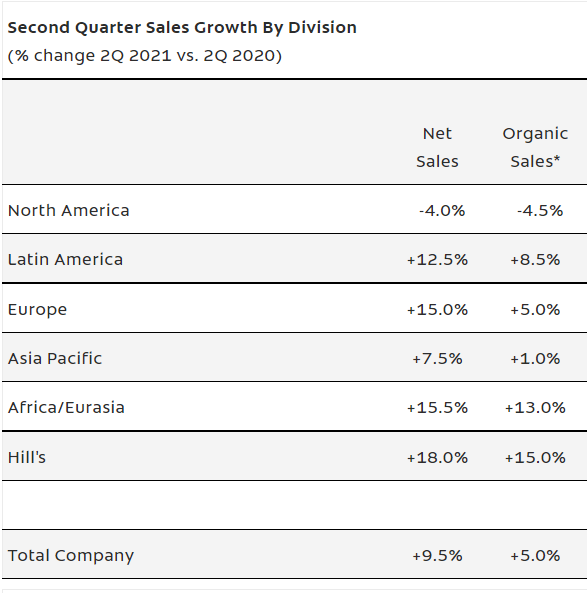

Fortive reported 2Q earnings above expectations and raised its 2021 guidance.

- Organic growth of +21.3% (+26.7% reported includes FX and acquisitions). Compared to Q2 2019, sales grew 13%

o All three segments had positive sales growth:

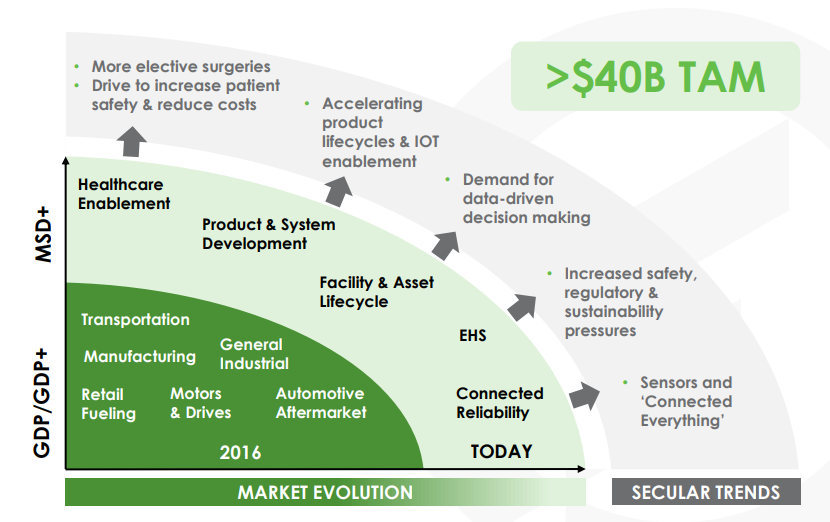

Ø Advanced Healthcare Solution +11% organic (24% of revenue): slower recovery of elective procedures business, but is expected to improve in 2H21 – and 4Q growth rate expected to be 26-27%. Hospitals allowing vendors back in, increasing activity

Ø Precision Technologies +22.2% organic (36% of revenue), led by growth at Tektronix that introduced new products (automated test solutions for high-speed data centers)

Ø Intelligent Operating Solutions +26.8% organic (41% of revenue), led by growth at Fluke

- Software-as-a-service grew in the low double-digits

- Adjusted gross margin 57.3%, +100bps y/y, with 130bps coming from price increase, especially in their hardware business

- Adjusted operating margin 22.2%, +240bps

- Adjusted EPS $0.66, +53.5% y/y

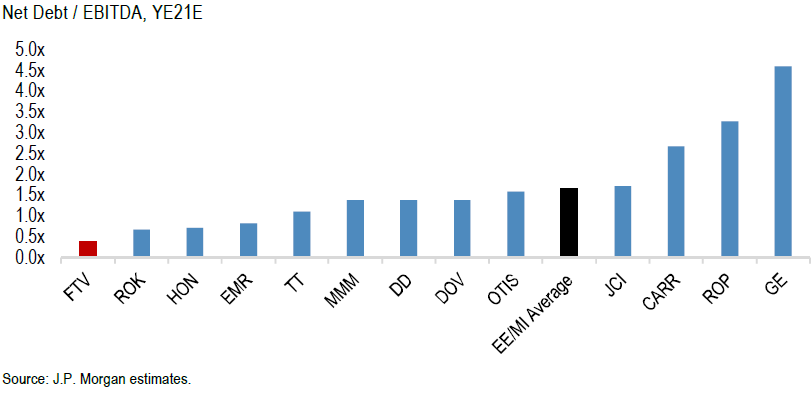

Fortive has significantly reduced its leverage post Vontier spin-off:

- Net debt/EBITDA stands at 1x, with expectations to be at 1.2x by year end

- Recent acquisition of ServiceChannel (announced in early July): high growth software business, enhancing FTV’s ability to service needs of facility owners. Closing of the deal is expected in Q3.

FY21 guidance:

- Organic growth raised to +10.5% to +12% (vs +7% to +10% previously)

- Reported sales to be +13.5% to 15%

- Adjusted operating margin of 22.5-23.5%, up 50bps

- Adjusted EPS raised to $2.65-$2.75 from $ (+27-32% y/y growth) from $2.50-2.60

CEO quotes:

- “We still are in a very good shape relative to price cost, not only because of price, but also because we’ve done a nice job on the cost reduction side as well“

- “I think sustainability is becoming such an important topic for companies around the world and not just large cap. I mean, just about every company in the world now is trying to understand their carbon footprint, they are trying to understand how to action sustainability work and we’re just so well positioned with Intelex, ehsAI around those trends, I think it’s hard to call out anything better than that, just given the massive amount of work and effort that’s been going into sustainability everywhere in the world. So I think that’s certainly a secular driver that we knew was good a few years ago when we bought into Intelex.”

We are raising our price target to $88 based on good results and comments for the rest of 2021 and early 2022 expectations. As the company continues its Software-as-a-Service portfolio, it deserves a higher FCF margin in the out years, which we updated in our model.

FTV Thesis:

- Market leader:

- Leadership position in most of the markets they serve

- Experienced leadership team

- Above industry margins with strong cash flows

- Quality:

- FCF yield ~5%

- Organic growth target of 3-3.5% (4-5% in last 2 quarters after being under the target in prior quarters)

- M&A strategy to enhance top line growth

- Margins expansion from new products introduction, continued application of the Fortive Business Systems and M&A integration

- Shareholder friendly:

- Management team focused on shareholder wealth creation through top line sustainability and margin expansion

$

FTV.US

Category: earnings

Tag: FTV

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109