Key takeaways:

Current Price: $117 Price Target: $130 (NEW from $117)

Position Size: 2.87% 1-year Performance: +80%

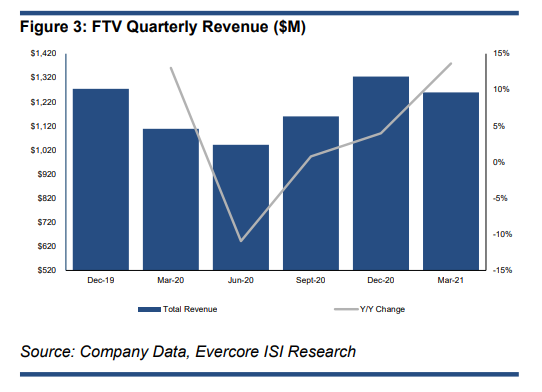

Xylem reported its 1Q 2010 earnings yesterday, largely above consensus both on sales and EPS front. Organic growth of +8% reflects the recovery across end markets, as company guidance was looking for +1% to +3%. Organic orders are up 19% and backlog up 23%. Good productivity efforts drove 510bps EBITDA margin improvement, offset partially by 210bps of cost inflation. All in, EBITDA margin expanded by 480bps. Price increases were announced (similar to peers, facing inflation), and we should this come in Q3 and Q4. On the balance sheet front, net debt/EBITDA is healthy at 1.6X. Regarding guidance, the management team raised its revenue growth prospects although the electronic chip shortage could pose some shipment delays and limited the upside in EBITDA margin upside potential. The US Utilities have shown resilient maintenance spending on wastewater/mission critical applications, and new projects are coming back online with bidding pipeline building back up.

Sustainability continues to remain in focus, with further executive compensation linked to sustainability performance and 2025 goals. We revised our price target to reflect faster recovery in end markets and margin upside potential.

CEO quote:

- “Productivity gains this quarter is helping offset early impact of rising inflation”

- “I think many of us worried that the cause of sustainability might suffer setbacks through the economic hardships of 2020. However, instead of a retreat, we’ve actually seen a broad and energetic global embrace of sustainability. As an enterprise over the last year, we’ve taken several meaningful steps toward our signature 2025 sustainability goals.”

Additional 1Q21 results:

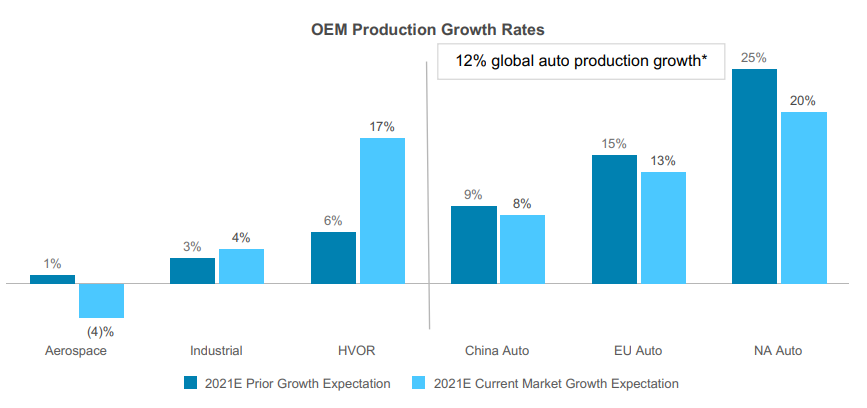

Organic growth by end-markets:

- Utilities: +3%

- Industrial: +14%

- Commercial: +5%

- Residential: +31%

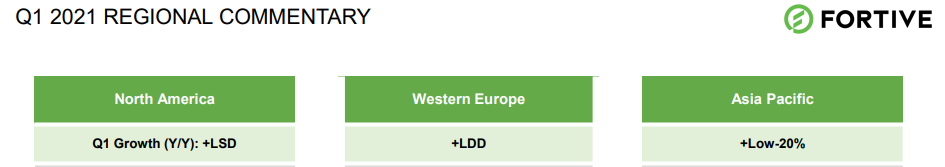

Organic growth by regions:

- US: -1% but orders up high-teens

- Emerging markets: +33% – China +90% on easy comps

- Western Europe: +11%

2021 guidance:

- Organic sales lifted from +3% to +5% to +5% to +7%

- Adjusted operating margin raised from 11.5% to 12.5% to 12% to 12.5% from cost benefits with favorable volume/price/mix, offset partially by rising inflation and growth investments

- The order trends appears to be recovering, and backlog growth is significant (+16%)

- End markets outlook:

- Wastewater utilities (28% of revenue): modest growth expected, with healthy pipeline in US, robust bid activity in China and India (although India most likely to experience lumpiness due to current Covid situation)

- Clean water utilities (27% of revenue): global chip shortage could pose some constraints. Recent contract wins should provide some growth in 2021, good momentum in test business. Utilities companies continue to show desire to increase technology exposure with smart water solutions and digital offerings.

- Industrial (30% of revenue): light industrial activity rebound globally, dewatering business showing signs of growth due to ease of site access

- Commercial (10% of revenue): new commercial building expected soft this year, recovery in new construction late 2021. In Europe, healthy levels of activity as their supply chains proved resilient vs. peers, eco-friendly products and smart drives

- Residential (5% of revenue): work-from-home in US and Europe pushing demand, high secondary water supply demand in China

Xylem’s investment thesis is:

- Xylem has strong sustainable secular growth drivers in a fragmented industry:

- Access to clean water is a necessity

- Population growth & urbanization

- Aging infrastructure

- More defensive sales base thanks to:

- 50% of sales to utility sector

- sticky client base due to high switching costs

- high level of replacement parts demand

- Long-term contracts with ½ of the revenue base recurring

- Margin expansion overtime from productivity efforts

- M&A strategy has increased their scope in the water cycle

- Valuation is attractive today

XYL.US

Category: earnings

Tag: XYL

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109