Key Takeaways:

Current Price: $54 Price Target: $61

Position Size: 2.18% 1-year Performance: +17%

Sensata released its 4Q2020 earnings this morning. Organic sales were up 5.3% (+7.1% including FX benefit) but operating income margin decreased due to Covid-related costs, higher incentive compensation and “Megatrend” investment spending (electrification, smart & connected).

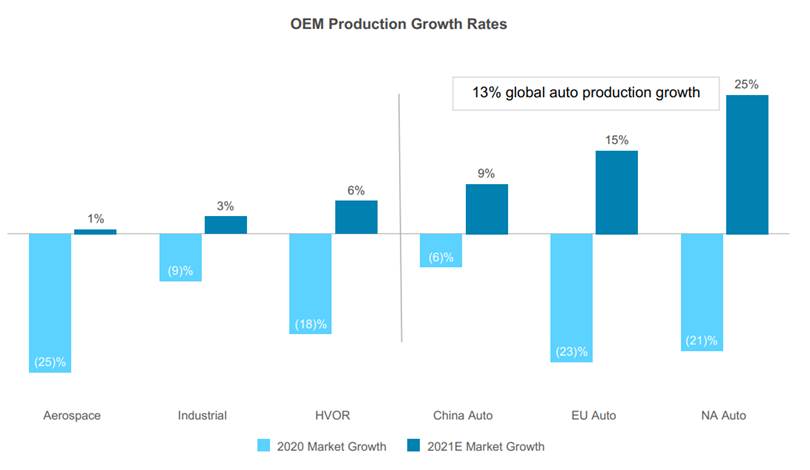

Sales growth by segment was as follow:

- Automotive organic sales +4.4%: ST outgrew the market by 970bps – growth from emissions, electrification and safety

- HVOR organic revenue +16.2% y/y: outgrew the market by 990bps – growth from China VI emissions regulations, operator controls

- Industrial & other: organic revenue +7.7%: growth from HVAC, 5G and supply chain restocking

- Aerospace organic growth -25%

Free cash flow increased throughout the year, thanks in part to better working capital management (better management of inventory levels), and a recovery in top line growth.

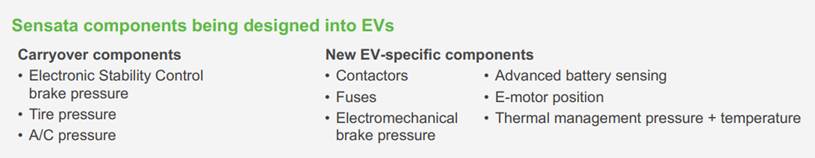

Sensata’s content in electric vehicles represents a 20% lift from traditional internal combustion engines. The components made allow longer range and faster charging times, critical for EV increased adoption. In the chart below we can see on the left components that carryover from traditional engines, while on the right, new components specific to EV:

Sensata continues to expand its electrification capabilities beyond electric vehicles, such as charging infrastructures, energy management expertise, industrial and grid opportunities. As such, they just acquired Lithium Balance, to expand into battery management and energy storage solutions in the heavy vehicle and industrial markets.

For 2021, Sensata expects a return to growth for all their end markets, especially North America autos. Organic revenue growth is expected to be between 10-15%, operating margin to expand from 18.5% to 20.7% due to volume and productivity improvements. Their 2021 margin guidance would be below 2019 levels, but reflect the current shortage in semiconductors globally (25-50bps impact).

Overall the quarter is as expected, seeing a recovery in most segment, except aerospace. The stock underperformed the market today as guidance for the year did not beat expectations. We still believe the long-term thesis is intact.

The Thesis on Sensata

- Sensata has a clear revenue growth strategy (content growth + bolt-on M&A)

- ST is diversifying its end markets exposure away from the cyclical auto sector over time through acquisitions, also expanding its addressable market size

- ST is a consolidator in a fragmented industry and still has room to acquire businesses

- Margins should expand as the integration of the prior two deals is under way, regardless of top line growth, and efficiencies in manufacturing are continuously pursued as they are gaining scale

- ST is deleveraging its balance sheet post acquisitions, leaving room for future M&A or a return to share buybacks, and improving EPS growth

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109