tag: MDT

Key Takeaways:

Current Price: $65 Price Target: $90

Position Size: 1.87% 1-year Performance: -13%

Segments update:

There are now 450 HealthHub across the US, in over 30 states. In 2021 CVS will expand the offering to add in-person behavioral health support. More visits are now to manage chronic services, which in addition to lowering ER visits and increase adherence to treatment will lower medical costs. Regarding its capital allocation, CVS continues to pay down debt, with the goal to achieve a low 3X leverage ratio.

Thesis on CVS

$CVS.US

Category: earnings

tag: CVS

Key Takeaways:

Share price: $172 Target Price: $182 NEW (from $177)

Position size: 2.36% TTM return: +46%

Updated guidance for 2020:

Revenue guidance increased now +7% to +8% (prior 3%-6%) due to better 3Q results than expected

EPS now $3.76-$3.81 from prior $3.52-$3.68

Zoetis investment thesis:

Reasons for the sale:

Risks are greater than opportunities:

While those two major risks to VNT are longer term in nature (short-term, the company could benefit from the increased sale of used cars due to COVID and emerging markets growth), it would require extensive M&A to shift the business towards the electric vehicle trend and/or the smart cities theme that is also growing but only 1% of sales today.

So what about Fortive now?

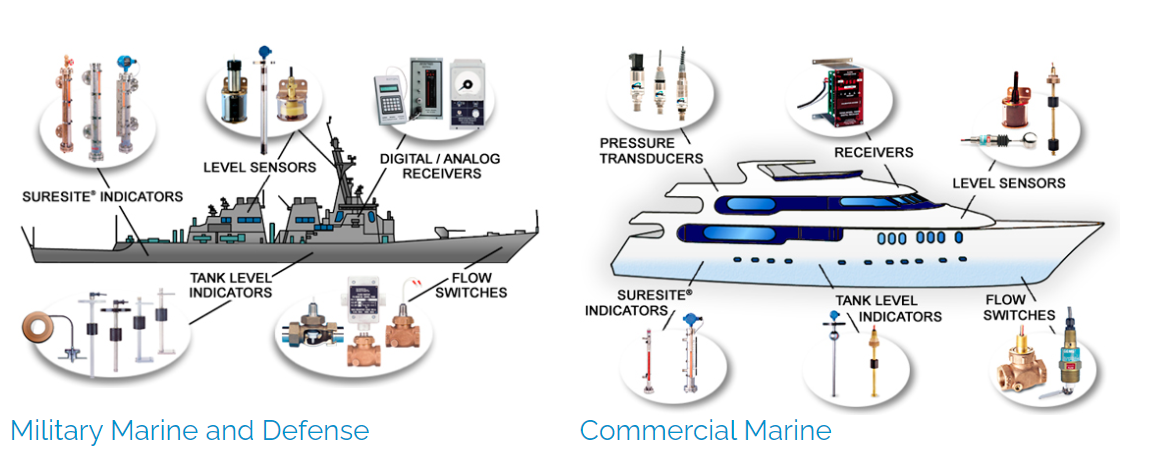

3 segments targeting the control/sensor/measuring of liquids/gas/electricity in various end markets:

Thanks,

Julie

Key Takeaways:

Current price: $78 Price target: $84 (from $82)

Position size: 1.68% 1 year performance: +12%

The Thesis on Colgate

$CL.US [tag CL] [category earnings]

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Key Takeaways:

Current Price: $61.4 Price Target: $72 (NEW – down from $78 on VNT divestment)

Position Size: 1.88% 1-year performance: +8%

Despite COVID, Fortive saw its sales jump 2.3% boosted by acquisitions, while margins increased nicely. Going forward, the company is focusing on adding more Software-as-a-Service businesses to complement its instrumentation products.

As for the use of cash, FTV remains committed to reducing its leverage and looking for M&A opportunities. We should expect additional debt reduction following the disposition of the 19.9% stake in Vontier (no date provided yet).

Q4 guidance is for a 0%-3% top line growth, and some margin expansion. Overall the quarter had no surprises, and we remain confident in FTV’s ability to generate shareholders returns over time. We are updating our price target to reflect the Vontier spin-off.

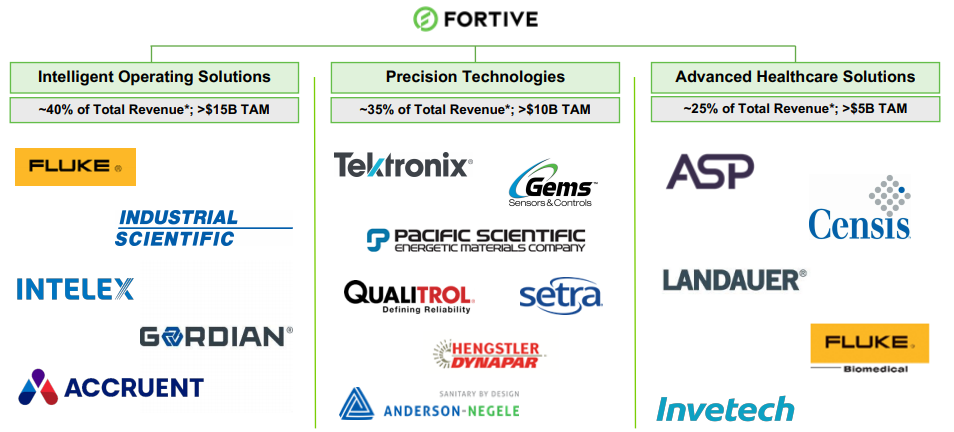

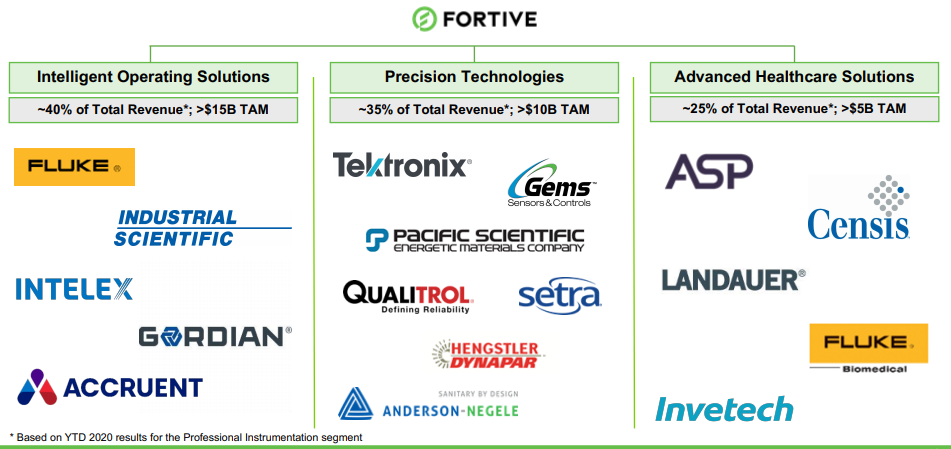

The company is updating its segments following the recent Vontier spin:

FTV Thesis:

$FTV.US

Category: earnings

Tag: FTV

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Key Takeaways:

Current Price: $44.5 Price Target: $53

Position Size: 2.08% 1-year Performance: -5.6%

Sensata released 3Q20 revenue that beat expectations (organic sales down 7.5% vs. down ~34% last quarter). Regarding its end-markets, the company believes the auto industry has consumed in Q3 the inventory built earlier in the year during the shutdown of the economy. In its HVOR segment, the company is starting an attractive recurring sales type of business with a large fleet manager (some potential leads they have manage over 10,000 vehicles). SO here is an example of where Sensata is moving parts of its business: this particular first client opted for a full subscription option, where ST builds the equipment and work with the client to install it. The client then pays for the equipment and data analysis on a subscription basis for the next 6-7 years. Other clients can opt to pay the equipment up-front and only pay for the data services. This looks pretty attractive, and will allow more regular revenue stream for the company (they typically have a more cyclical business with industrial/auto end-markets).

We think the stock was weak today due to the margins comments. While adjusted operating margin was above estimates at 19.6%, it is still a 390bps decrease y/y. Also, the want to continue investing in the megatrends (electrification etc) in the coming year. O offset some of that, the company is starting a new cost reduction program that should save $60-$65M next year. At the end of the quarter, ST had $1.6B of cash on hand. The management team is putting a priority in growing its megatrend business (through R&D and M&A).

We still believe in the long-term thesis of this company, and are not changing our view/price target or position size at this time.

Illustrations of the megatrends opportunities:

Segments review:

The Thesis on Sensata

Tag: ST

category: earnings

$ST.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Key takeaways:

Current Price: $375 Price Target: $469

Position Size: 3.51% 1-year Performance: -1%

Lockheed released its 3Q20 earnings results earlier this week. Sales were up 9% y/y and EPS +10%. Sales per segment were as follow:

Because of the continued strong results, the company raised its 2020 outlook, higher than the top end of its July’s guidance, for its sales, operating profit and EPS lines. Backlog was up 4.4%, driven by all segments (mostly Aeronautics, which includes their F-35 program). In 2021, Lockheed intends to repurchase over $1B shares. Its pension funding requirement amounts to $1B.

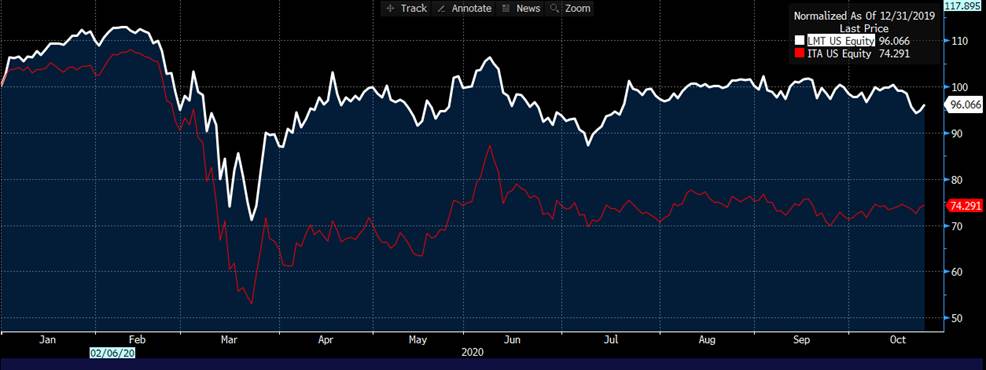

Overall, LMT continues to deliver strong shareholders returns. It has outperformed peers in the last 3 years and YTD.

LMT Thesis:

· Lockheed Martin is a primary beneficiary from the replacement cycle for aging military aircraft and ships

· Excellent management team focused on returning capital to shareholders

· Strong cash flow and financial position

[category earnings] [tag LMT] $LMT.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Every 2 years, Medtronic presents to the investment community a detailed list of the innovative medical tools they are developing. Here are the main take-aways from the virtual investor day held last week:

1/ CEO pushing for a change in the company’s culture: decentralization is the new operating model, where each segment will act as its own operating unit (20 of them), with its own P&L and sales team to react faster to changes in the market place. This model has been tested in their Restorative Therapies Group while the current CEO was then President of that group. He increased organic revenue growth to 6% and improved profitability. I always thought of MDT as this big boat steady in the storm but slow to navigate. The CEO seems to be addressing this issue by making the company nimbler.

On a side note, the company featured many diverse employees and patients during the presentation, a way to highlight their desire for inclusion and diversity, one of their 5 sustainability tenets.

2/ Innovation: 130 new products have been approved since January.

New opportunities:

Expanding into existing markets:

As a result of looking to increase top line growth, MDT will spend >$2.5B in R&D per year, above the $2.2-2.3B it has spent the last few years. This amount should grow with sales as well. Tuck-in M&A, venture investments are also part of this strategy. To offset some of the extra spending, the company continues on its cost savings program, as well as a newly launched “Simplification” program, looking to reduce SG&A expenses. So while we are pleased to see an increased sales growth target, earnings growth target does not increase in the same measure as additional investments are necessary.

Overall this was a bullish investor presentation, as most are. We hope to see the recent innovations and focus on growth come to fruition in the coming years.

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

Key takeaways:

Current Price: $148 Price Target: $175

Position size: 2.45% 1-Year Performance: +15%

Once more JNJ posted results better than forecasted, and raised its guidance for the year. While JNJ’s Medical Devices results were better than expected (beating consensus by 14%), it appears that the recent trend in September was for a flattening of the growth, which is not surprising considering the increase in COVID cases globally. They are not yet providing full 2021 guidance but guided to a strong double digits growth in Medical Devices and above market growth in Pharma. In Pharma, volume should drive growth, as pricing pressure remains (higher unemployment and potential for HC reform). Operating margins will remain at 2019 levels due to higher R&D expenses (Momenta acquisition bringing some potential blockbuster drugs in autoimmune disorders).

Some Covid vaccine news came yesterday that JNJ was pausing its vaccine trial as a person showed sign of an unexplained illness (similar to AstraZeneca a month ago). This is a normal process in any drug trial, and we think JNJ will ultimately continue its research on finding a reliable vaccine. Overall there is nothing this quarter that is changing our view on JNJ as a core holding in our healthcare portfolio.

Thesis on JNJ:

[category Equity Earnings]

[tag JNJ]

$JNJ.US