Key takeaways:

· Sales impacted by decline in out of the house consumption, but at-home consumption remains good

· Temporary delays in Mexican production plant due to Covid is over (for now!)

· Hard Seltzer launch is a success, now #4 brand in that category while launching in the middle of a pandemic

· Sale of lower priced wine and spirit brands to close at the end of Q3

Current Price: $184 Price Target: $226

Position Size: 2.52% 1-Year Performance: -11.8%

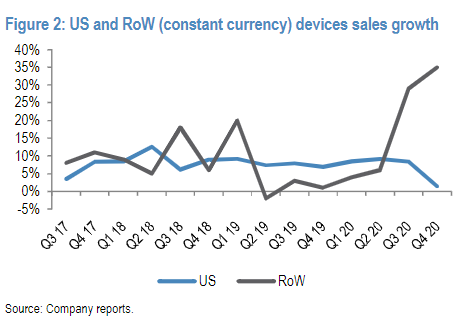

Constellation Brands reported a sales decline of 4% as the quarter was impacted by lower sales in its on-premise channel down -50% y/y in Q2 (consumption in restaurants, bars, etc) as well as some temporary out-of-stock at retail from its earlier in the year production disruption in Mexico.

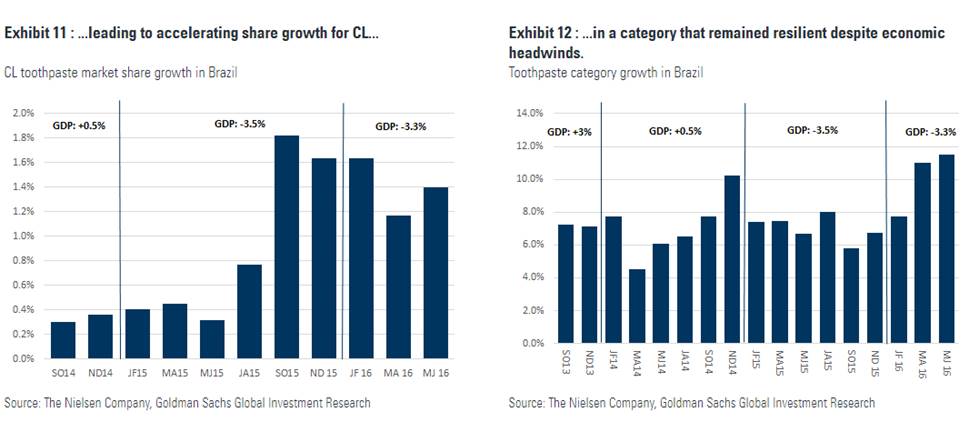

Beer organic sales were +1%, but mostly depletion volume was positive at +4.7% (sales at retail to end consumer). This shows that at home consumption offsets the reduction in on-premise consumption. Corona Seltzer is growing nicely, helping the Corona portfolio grow double-digits. This new seltzer offering holds the #4 position in the category (6% market share), after less than a year after its launch, and in the middle of a pandemic! It is the second fastest moving Hard Seltzer on the market.

In addition, with its higher exposure to the Hispanic population (est. 15-20%) than other Seltzer brands (at ~10-15%), we should see continued growth longer term as that demographic grows faster than others.

The Covid impact on beer production in Mexico seems behind them now, with inventory levels expected to return to normal by the end of next quarter.

Regarding production capacity, they are still working with the Mexican government to find a solution to the now defunct Mexicali plant. To offset that void, they do have the Obregon brewery expansion, which once completed by the end of the fiscal year, will cover consumer demand over the medium term. This also includes a doubling of its seltzer capacity.

STZ announced taking a minority stake in Booker Vineyard’s, a “super-luxury, direct-to-consumer wine company”, reinforcing the company’s direct to consumer/e-commerce strategy. Organic sales in wines was -9%, as the lower end brands continue to underwhelm (the never ending divestment of most of those brands are scheduled for the end of next quarter).

And to conclude…I would trade places with him right now….

Investment Thesis:

· Adding STZ helps position our portfolio to be more defensive at this stage of the economic cycle

· STZ is down ~20% YTD, giving us a good entry point

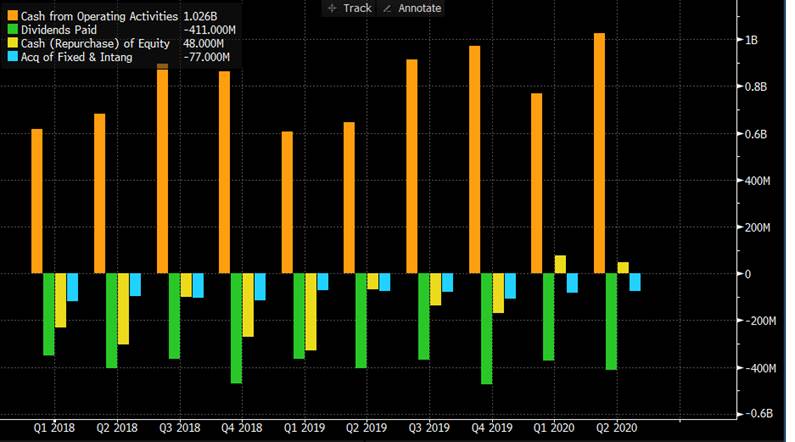

· STZ continues to have HSD top line growth and high margins that should incrementally improve going forward

· STZ comes out of a heavy capex investment cycle to support its growth: FCF margins are set to inflect thanks to lower capex

[tag STZ] [category earnings]

$STZ.US

Julie S. Praline

Director, Equity Analyst

Direct: 617.226.0025

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109