Lazard International Strategic Equity Fund Commentary – Q4 2021

Thesis

LISIX is a bottom-up, growth-based fund that completes the core satellite strategy within global equity. The fund is unique in that it focuses on individual stocks rather than markets and looks for reasonably priced companies with strong growth potential. We like LISIX because of the managers’ expertise in various market caps, geographies, and sectors which helps keep the fund diversified while providing strong upside and downside capture over time.

[More]

Overview

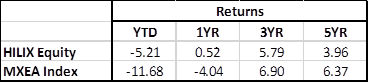

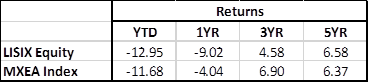

In the fourth quarter of 2021, LISIX underperformed the benchmark (MSCI EFEA Index) by 349bps. Even with the volatility, the MSCI EAFE index closed near a high. As for the fund, exposure to names that were vulnerable to concerns around the normalization of economic activity caused performance to lag. Strong selection in Industrials, Consumer Discretionary, and Health Care contributed to returns, though.

Q4 2021 Summary

- LISIX returned (0.80%), while the MSCI EAFE Index returned 2.69%

- Contributors

- Kobe Bussan, Linde, Accenture, Suncor

- Detractors

- CAE, Ryanair, Suzuki, Medronic, Lojas Renner

2021 Performance Comparison

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109