Applied Finance Select Fund Commentary – Q3 2021

Thesis

AFVZX serves as our active manager in the large cap “value” U.S. equity markets and follows a concentrated (50 companies) investment strategy that focuses on firm quality and valuation. By utilizing DCF models, bottom-up fundamentals, and holding sector weights that are equivalent to their benchmark (S&P 500 Index), the fund generates alpha over time purely through stock selection. We continue to hold AFVZX because of the team’s ability to compare stocks across all sectors which enables them to generate strong returns over the long run.

[more]

Overview

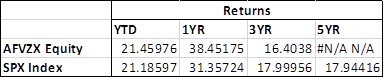

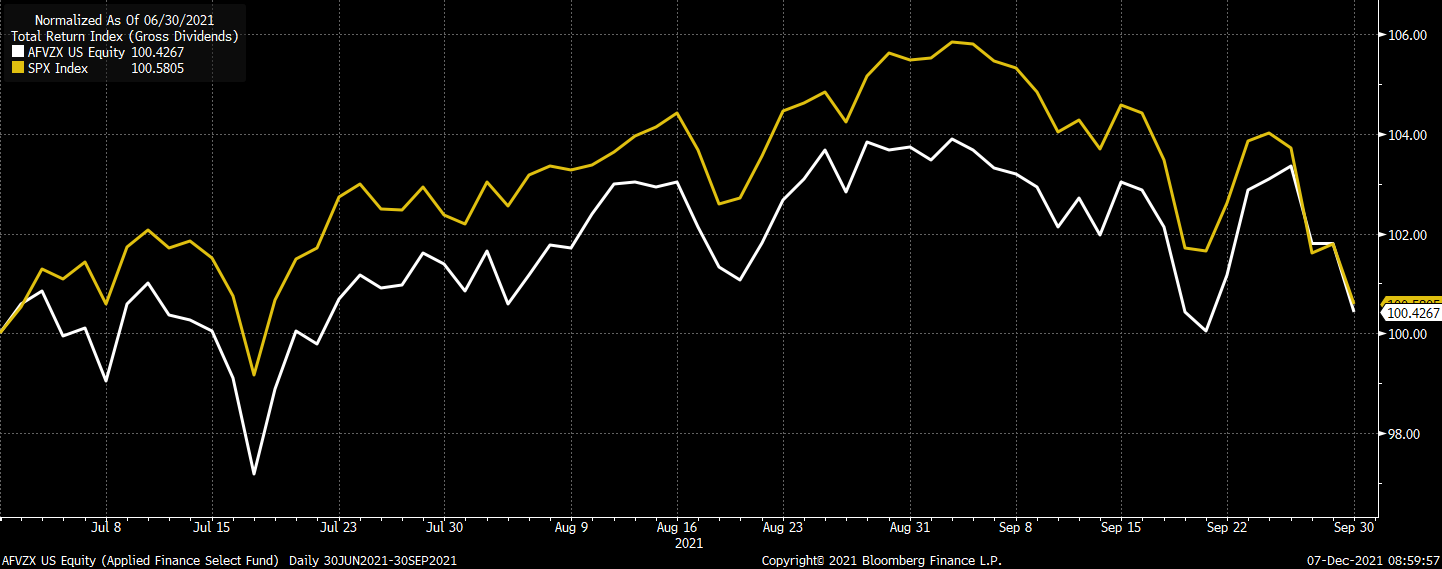

In the third quarter of 2021, AFVZX underperformed the benchmark (S&P 500 Index) by 17bps largely due to selection within Health Care, Industrials, Materials, and Energy. Within Health Care, strong growth numbers and promise around vaccines helped boost returns. M&A within Industrials and Energy had a positive impact on performance. Increased gas prices helped the Materials sector. On the other hand, selection within Consumer Staples and Information Technology detracted from performance. Inflation scares and skepticism around the booster shot hurt Consumer Staples, and poor growth numbers made for underperformance within Information Technology.

Q3 2021 Summary

- AFVZX returned 0.41%, while the S&P 500 Index returned 0.58%

- Top contributors

- Health Care – Danaher Corp, Thermo Fisher Scientific, Pfizer Inc

- Industrials – Quanta Services

- Energy – ConocoPhillips

- Materials – CF Industries

- Top detractors

- Consumer Staples – Constellation Brands, Walgreens Boots Alliance

- Information Technology – Intel Corp, HP Inc, International Business Machines Corporation

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s ability to outperform the index over the long run through strong stock selection and maintaining a quality and value investment tilt

- Replaced Unum Group with Metlife Financials in early October

- Continue to invest in companies with attractive valuation, credible management team, and a strong wealth creation track record and strategy

- Believe the fund’s holdings will continue to navigate the market well and positioned to perform strongly as the economy continues to reopen

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109