Westwood SmallCap Fund Commentary – Q1 2021

Thesis

WHGSX is our only active manager in the small cap U.S. equity markets and applies a quality and value tilt to their investment strategy, holding between 60 and 80 companies. By utilizing bottom-up fundamentals and focusing on companies with strong balance sheets, high ROIC, and consistently high FCF yield, the fund generates alpha especially during market downturns. We continue to hold WHGSX because of the team’s ability to find cheap valued stocks in the small cap space enabling them to generate strong returns over the long run.

[more]

Overview

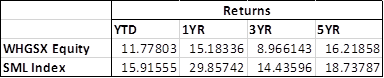

In the first quarter of 2021, WHGSX underperformed the benchmark (S&P 600 Index) by 131bps largely due to overall allocation and selection in more cyclical areas of the market. Businesses with higher-quality fundamentals, which held through the worst of the pandemic much better, underperformed in the most recent quarter. Selecting weighting in Consumer Discretionary and Industrials were the largest detractors, while favorable stock selection in Financials and Utilities contributed to returns.

Q1 2021 Summary

- WHGSX returned 16.93%, while the S&P 600 Index returned 18.24%

- Financials – leading contributor

- Utilities – strong stock selection

- Consumer Discretionary & Industrials – leading detractors

- Consumer Discretionary saw strong rebound in industries hit hardest by pandemic: department stores and specialty retail establishments

- Industrials saw a cyclical recovery, especially business with large operating and financial leverage

- Real Estate – detracted due to unfavorable stock selection

- Hotels and retail properties saw a strong rebound

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the value and quality tilt strategy that has a bottom-up, fundamental focus around ROIC, FCF yields, balance sheet metrics, and companies trading at a discount

- Companies with strong financial positions and solid fundamentals are well positioned to take advantage of the recovering economy and market

- Corporate profits will be a key watch item

- Higher taxes could be temporary headwind

- The fund will continue to focus on quality companies that are trading at a relatively attractive valuation – strong return and cash generation

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109