JPMorgan Diversified Return International Equity Commentary – Q4 2020

Thesis

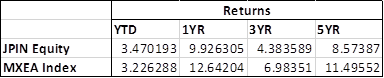

JPIN’s focus on risk weighting enabled us to replace a market cap weighted index while still gaining exposure to international developed equity markets without deviating too far from the benchmark. Utilizing a multi-factor approach of value, quality, and momentum, JPIN has generated alpha through strong stock selection over time. Additionally, the fund helps diversify risk by weighting across 40 regional/sector buckets based on rolling risk statistics, which ultimately increases our exposure to active share and our risk-adjusted returns.

[more]

Overview

In the last quarter of 2020, JPIN underperformed the benchmark (MSCI EAFE Index) by 220bps largely due to factor exposure to Quality and Momentum. Value’s strong rebound did contribute to returns, though. Overweight to oil & gas benefited returns while and underweight to financials detracted. The fund’s overweight to Asia ex-Japan were also beneficial, yet the overweight to Japan detracted from overall performance.

Q4 2020 Summary

- JPIN returned 13.85%, while the MSCI EAFE Index returned 16.05%

- FTSE Developed ex North America Index returned 17.26%

- Contributing sectors included oil & gas as the sector recovered during the quarter, while financials detracted

- South Korea and New Zealand contributed to returns, yet Japan detracted

Optimistic Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s multi-factor approach, consistency in asset allocation, and historically strong stock selection

- Going forward JPIN continues to see Momentum, Value, and Quality all as profitable factors

- Value and Quality appear to be relatively cheap

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109