MWTIX Commentary – Q4 2020

Thesis

MWTIX is an actively managed fund that provides a sector-based strategy while still maintaining fundamental research driven through issue selection. When compared to the benchmark (Barclays U.S. AGG), the holdings have similar duration and exposure, yet selection is focused around areas where other managers are not looking. Through sector rotation and active weighting, we expect MWTIX to generate alpha over time.

[more]

Overview

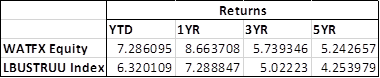

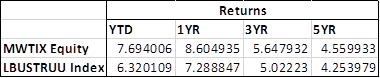

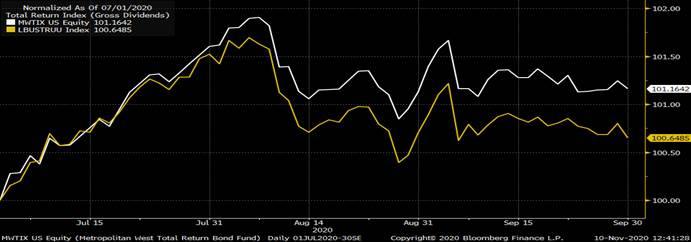

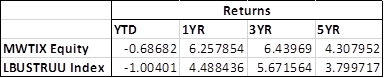

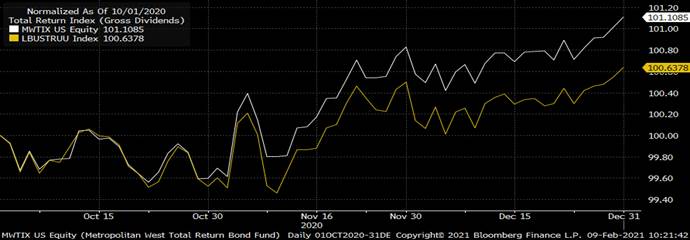

In the fourth quarter of 2020, MWTIX outperformed the benchmark (Barclays U.S. AGG) by 53bps, largely due to issue selection across corporate credit – specifically consumer non-cyclical, communications, and energy. Selection in EM, municipal exposure, and allocation to low coupon agency MBS TBAs also positively attributed to returns. A strong annual return of 9.12% can mostly be contributed to Non-agency MBS exposure as the asset class saw strong recovery throughout 2020. CMBS and ABS were trimmed during the year and had minimal impact on the fund’s performance.

Q4 2020 Summary

- MWTIX returned 1.20%, while the U.S. AGG returned 0.67%

- Quarter-end effective duration for MWTIX was 5.66 and 6.22 for the U.S. AGG

- Duration was trimmed during the year and was maintained at a range of 0.5-0.6 years short of the benchmark

Outlook

- We continue to hold this fund and believe in our thesis due to the fund’s defensive approach and minimal exposure to more vulnerable issuers and industries

- Opportunities

- Pass-through pools – TBAs

- Larger spread corporate bonds

- Securitized credit – legacy non-agency MBS, high-rated CMBS

- EM debt

- MWTIX has positioned itself to take advantage of relatively attractive prices during times of high volatility to generate strong returns

[Category Mutual Fund Commentary]

Micah Weinstein

Research Analyst

Direct: 617.226.0032

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109