Last week, the Federal Energy Regulatory Commission changed a ruling that will affect the revenue and cash flow for a few MLPs. Below discusses the policy change and what it means for the industry going forward.

The general consensus is that there will be a limited number of companies directly affected by the change, and the market selloff in the space was an overreaction. Nearly all management companies have provided commentary to this point, with the majority downplaying the negative effects of the ruling.

1.) What was the policy change that took place?

On March 15th, the Federal Energy Regulatory Commission (FERC) ruled that FERC regulated MLP owned pipelines can no longer recover the cost of income taxes in setting tariffs on interstate pipelines. Even though MLPs do not pay taxes, they were able to add in the tax rate of shareholders. Airlines fought this rule and won a change to the tax law. Therefore, the rate that MLP owners of FERC regulated natural gas and oil pipelines can charge customers must be lower to solve for the same ROE, reducing some MLPs’ cash flow and dividends.

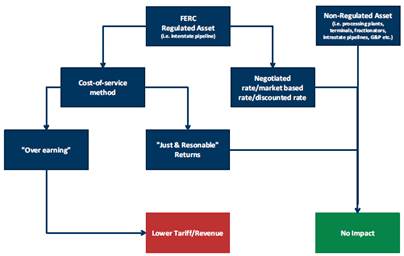

There are four different price rate methodologies used currently. Only companies using the cost of service method will be affected. The cost of service is the revenue a regulated pipeline must collect from customers to cover its costs to operate. Following the announcement, income taxes will no longer be part of the total cost equation, implying that total cost of service will be lower, thus reducing cash flows from an asset.

2.) Which assets are impacted?

The only pipelines that will be affected are those which are currently regulated by the FERC and cross state borders. Additionally, these assets must use the cost-of-service method for pricing in order for the ruling to have a negative impact.

Management companies have come out and downplayed the effects of the change, noting that only a small portion of assets would be impacted. Based on a few different estimates, a worst case scenario would lead to an approximately 4.5% reduction of income due to decreased pipeline tariffs. Below is a flow chart showing the assets that will be negatively affected.

3.) How will TORIX be affected and what are their thoughts moving forward?

Looking at their holdings, Tortoise estimates the EBITDA reduction will be 2% or less. These numbers are based on current EBITDA and do not account for any new projects. Because new projects have tended to use market-based rates, they would generally not be affected by the ruling.

Tortoise MLP and Pipeline fund holds 25% (or less) of MLPs and owns 75% (or more) of C-Corp companies, so they have lower exposure to MLPs than the Alerian Index which is 100% MLPs. If a pipeline is publicly owned, it can be structured as a MLP (Master Limited Partnership) or a regular corporation (C-Corp). MLPs have a tax advantage when raising capital as the MLP does not pay taxes and can yield more.

This FERC tax rule change and Trump’s Tax Cuts and Jobs Act of 2018 have reduced the tax efficiency of MLPs relative to C-Corp firms, but have not eliminated the advantage. Depending on a MLP’s assets and finances, it may make sense for some of them to convert into C-Corps. Tortoise can own MLPs or C-Corps and can take advantage of any mispricing around potential changes in corporate structure.

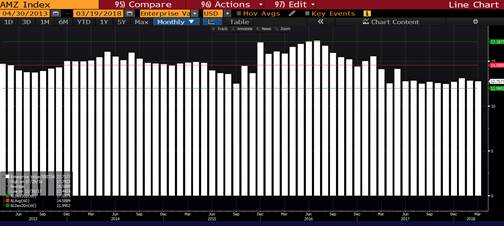

With the selloff in the MLP space last week, we believe that Midstream energy company valuation are very compelling and continue to offer attractive yields. The yield of the Alerian MLP index is now at approximately 8.5%, which is compelling given REIT and utility yields are below 4%. While TORIX yield (3.16%) is lower than AMJ’s, the fund has outperformed the index by over 30% during the past two calendar years, showing the benefits of owning C-Corp midstream firms.

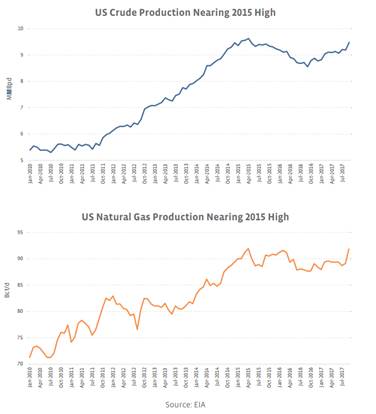

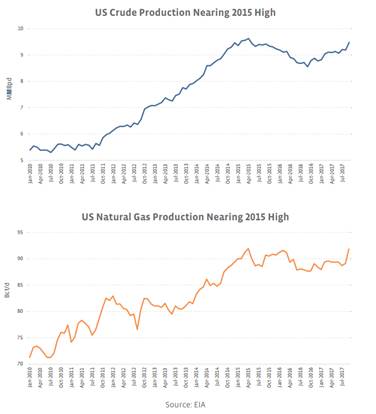

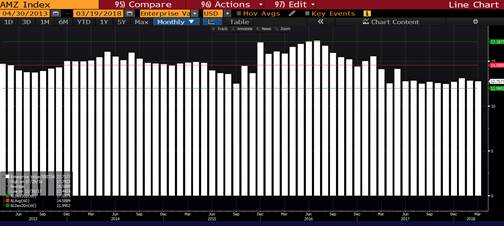

Currently, these tax law changes have placed a cloud over MLPs and the midstream energy space for investors. Despite this fog, fundamentals remain strong as the price of oil is above $60, gas and oil volumes continue to grow and MLP enterprise value to EBITDA valuation is attractive (see below charts). While we are disappointed in year-to-date performance, we are being patient and waiting for investor sentiment to improve.

US production of crude oil and natural gas has been strong:

MLP valuations remain low – close to 2 standard deviations below the mean:

Peter Malone, CFA

Research Analyst

Direct: 617.226.0030

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square

Suite 500

Boston, MA 02109

www.crestwoodadvisors.com

PLEASE NOTE!

We moved! Please note our new location above!