Apple reported slightly better than expected Q1 results, though expectations were based on lowered guidance given by the company on Jan 2. Management cited four main factors that negatively impacted their 1Q results: iPhone launch timing vs a year ago, FX headwinds, supply constraints, weakness in emerging markets especially China. The last factor was given most of the blame. iPhone upgrades were also weaker than expected in part because the relative strength of the US dollar has made their products more expensive in many parts of the world. Revenues were down 4.5% (-3% constant currency). The decline was due to 15% lower iPhone revenue which makes up a little over 60% of sales. Though iPhone sales were down, the rest of the business grew 19%. The stock is likely up because Q2 guidance was not as bad as feared and the earnings call focused on opportunities for Apple beyond the iPhone.

Key Takeaways:

· Weakening iPhone sales and no more unit numbers – this is the first quarter where they are not reporting unit numbers. Different iPhone launch timing from a year ago impacted their results. The iPhone X launch fell into Q1 last year, instead of Q4 making the comparison tough this quarter. It is likely that average selling prices (ASPs) dropped a little this quarter because they are lapping the iPhone X launch, so the down 15% is a combination of lower units and lower ASPs. Unit sales have been a major concern given a mature smartphone market. 2018 was the 2nd year in a row of global unit declines in smartphones. The industry is expected to return to modest growth this year and next year aided by 5G compatible phones and foldable phones.

· Weakness in China –Over 100% of their worldwide YoY revenue decline was driven by their performance in Greater China. Mgmt said revenues were down $4.8B YoY, which implies revenue down 27% – despite that¸ revenues in China did grow for the calendar year. China is the largest smartphone market (30% share) and sales in 2018 were down high single digits.

· 900 million active iPhone installed base – this is a new disclosure and an important one. While units only grew 0.5% in fiscal 2018, and were in decline in 1Q19, their active base of iPhone users actually grew 9% because people are keeping their phones longer and there is a secondary market for phones. Growing their active installed base (which is now 1.4 billion devices including 500 million non-iPhone devices) is key to growing their services business.

· Non-iPhone revenue was strong – Services grew 19%, Mac revenue grew 9%, iPad sales grew 17% and the Wearables business, which includes the Apple Watch and AirPods, surged 33%.

· Gross margin disclosure – Apple is now breaking out separately gross margins of products and services. The faster growing services business has 63% gross margins vs 34% for products.

· Future beyond the iPhone – ApplePay, Apple News, Apple Music (50 million subscribers vs 87 million paid subscribers for Spotify), health tracking, AppleTV. Management also spoke of “some exciting announcements coming later this year” which I think is likely related to AppleTV.

Valuation:

· Strong balance sheet and FCF generation continue. $130B in net cash or 17% of their market cap.

· The stock is undervalued and the substantial buyback will support valuation. Management’s commitment to be net cash neutral “over time” would mean either returning to shareholders or spending on M&A their current $130B of net cash plus annual FCF production of around $60B. That’s about $300B over the next 3 years or 40% of their market cap.

· Trading at close to a 1.8% dividend yield, an 8% FCF yield and ~13.5x P/E.

The Thesis for Apple:

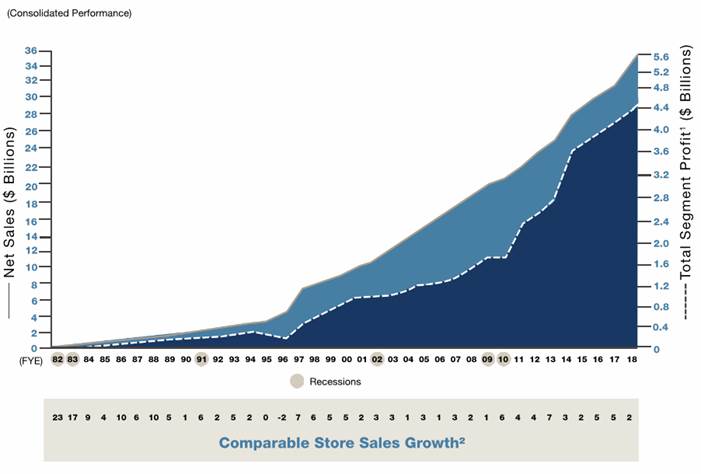

- One of the world’s strongest consumer brands and best innovators whose product demand

has proven recession resistant.

- Halo effect -> multiplication of revenue streams: AAPL products act as revenue drivers

throughout portfolio – iPhone, iPod, MacBooks, iPad > iTunes, Apps, Software, Accessories,

- Strong Balance and cash flow generation.

- Increasing returns to shareholders via dividends and buybacks.

$AAPL.US

[tag AAPL]

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109