Current Price: $1,896 Price Target: $2,400

Position Size: 3% TTM Performance: 18%

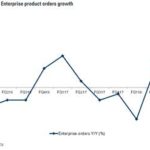

· Revenue (+20%) and EPS (+36%) were better than expected, but guidance was a disappointment. Gross bookings were basically in line with consensus at $23.9B, up 15% (11% constant currency).

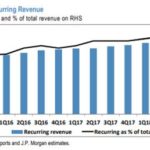

· They saw EBITDA margin expansion this quarter, but guided to weaker than expected margins next quarter.

· Though they do have a track record of guiding conservatively (see below), their expected deceleration in gross bookings to 5% to 8% constant currency growth is meaningful.

· In general, these results are very similar to last quarter as they continue to prioritize profit over growth. Part of the disappointment is that weak room growth is happening while the global travel market is extremely healthy. Though, this disruption to room night growth is somewhat self-inflicted.

· Room night growth slowing due to reduced ad spend:

o Current quarter was good, but they guided to a slowdown in Q3. Room growth for Q2 was +12% ahead of the high end of their +7-11% guidance. Guidance for next quarter is 6-9% (consensus +13%). They blamed the deceleration on the World Cup and weather (heatwave) in Europe.

o Ad spend has been part of their engine of growth and their ability to spend at scale has enabled their success. They have been trying to dial this back for several quarters.

· They want people to go directly to them to book in the same way they go directly to Amazon to buy something. This means less performance ad spend and more general brand advertising like TV. They are seeing an increase in direct booking as a result.

· On the call they said “I think we are in a fairly good position in terms of our optimization right now in terms of the balance between growth and profitability but there are always areas where we’re experimenting constantly in these channels”

· If they succeed in making the shift to higher ROI brand ad spend and continue to increase direct traffic as a % of the mix that should help margins long-term. But if this experiment doesn’t start paying off, I expect they re-adjust ad spending. Whether or not they need to back track on this calculated bet, the long-term thesis is still intact.

· They continue to work on a local experience product through both organic investment and acquisitions.