Current Price: $285 Price Target: $340

Position Size: 7.9% TTM Performance: 40%

Key takeaways:

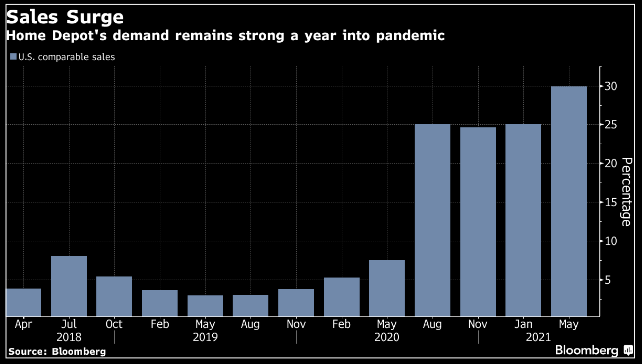

- Broad beat with 21% YoY revenue growth and +42% op. income growth.

- Azure continues to be key growth driver – Azure continues to take share in the public cloud with revenue growth of +51% YoY (+45% constant currency), similar to last quarter. Issued solid Azure guidance for next quarter.

- Teams gaining traction – they now have 250M monthly active users.

- CEO, Satya Nadella said…

- “We are innovating across the technology stack to help organizations drive new levels of tech intensity across their business.”

- “Hybrid work represents the biggest change to the way we work in a generation and will require a new operating model spanning people, places and processes. We are the only cloud that supports everything an organization needs to successfully make the shift. Microsoft Teams is the new front-end.”

Additional Highlights:

- Commercial cloud, which aggregates Azure, Office 365, the commercial portion of LinkedIn and Dynamics accelerated by 200bps sequentially to 31% YoY cc growth reaching nearly $80bn run rate (Azure is ~ $36-37B run rate, so approaching half). They saw significant growth in the number of $10 million plus Azure and Microsoft 365 contracts.

- While Microsoft benefited from accelerated digital transformation from the pandemic, they are well positioned to capitalize on a number of long-term secular trends that will continue to drive mid-to-high teens earnings growth. Secular driver include public cloud and SaaS adoption, continued digital transformation, AI/ML, BI/analytics, and DevOps. As organizations become increasingly digital, MSFT’s products are evolving from being primarily productivity tools to being more strategic tools. This suggests an improving value proposition to customers, which is key to the durability of their LT growth and profitability.

- Productivity and Business Processes ($14.7B, +25% YoY):

- LinkedIn – revenue increased 46% (up 42% in constant currency) driven by Marketing Solutions growth of 97%

- Office 365 Commercial (rev +20%)- driven by installed base expansion as well as higher ARPU.

- Dynamics 365 (rev +33%) – strong momentum in Power Apps and Power Automate, reflecting growing demand for their solutions to build apps and automate workflows.

- Teams continues to shine – they now have 250m monthly active users.

- Intelligent Cloud ($17.4B, +30% YoY):

- Server products and cloud services revenue increased 34% with Azure revenue growth of 51% (45% cc). Exceeded their expectations across consumption and per user Azure businesses as well as their on-premises server products business.

- An increasing mix of large, long-term Azure contracts can drive quarterly volatility in the growth rates. Leader in hybrid cloud and have more datacenter regions than any other provider – and continuing to add data center regions, including new regions in China, Indonesia, Malaysia, as well as the US.

- More Personal Computing ($14.1B +9% YoY):

- Surface was weak as they face ongoing constraints in the supply chain

- Gaming revenue increased 11% (7% in constant currency). Xbox hardware revenue grew a 172% (163% in constant currency), driven by demand for new consoles. Xbox and content and services revenue declined 4% against a high prior year comparable.

- Search advertising revenue improved (+53% YoY) as companies pick up spending on digital advertising ahead of re-opening.

- Valuation:

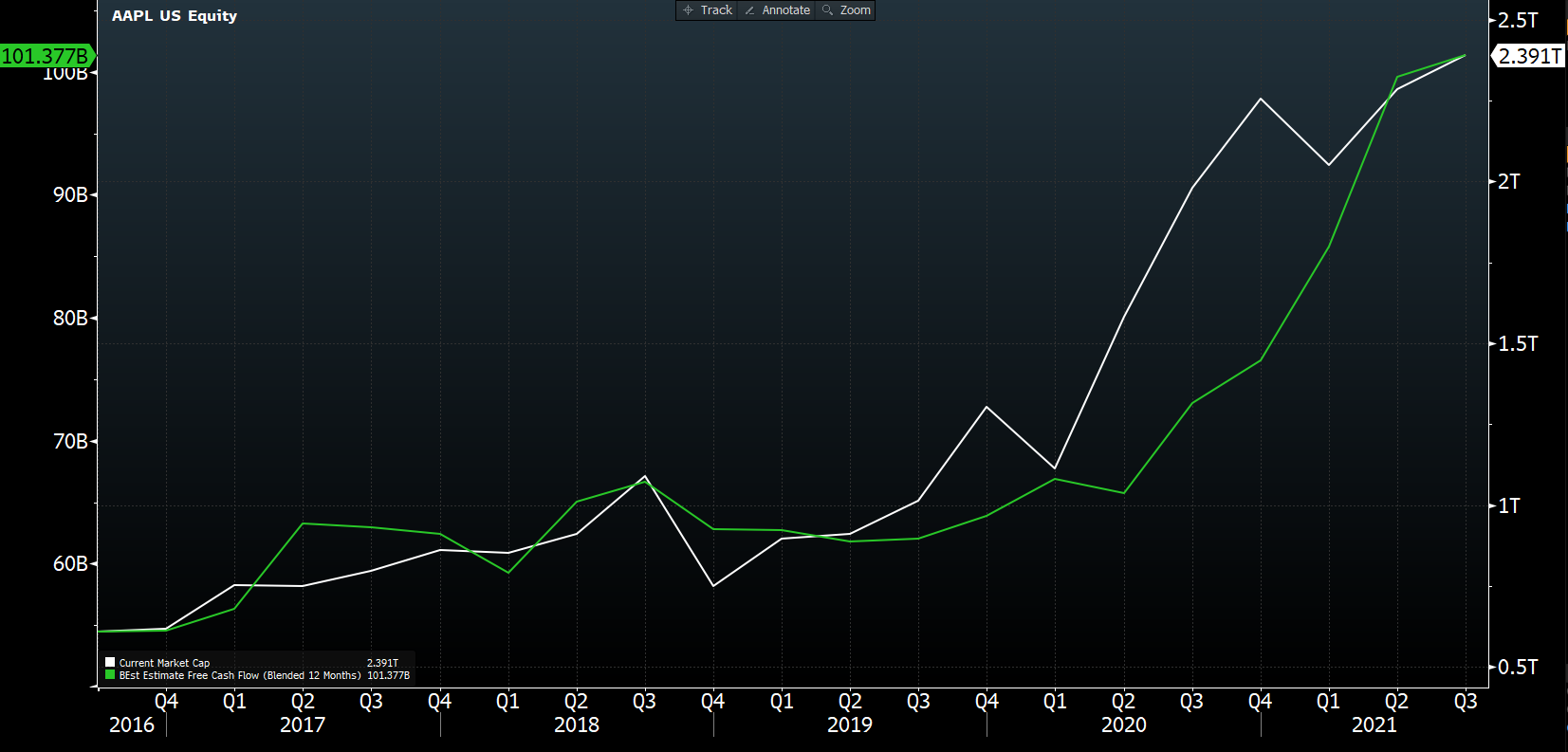

- For FY ’21, they generated over $76B in operating cash flow, up 26% YoY and over $56B in free cash flow, up 24% YoY.

- Recurring revenue is ~60% of total, underpins most of their valuation and is resilient and poised for additional growth. Particularly Azure, Office 365 and Dynamics 365. Stock is trading at ~3% forward FCF yield; a premium to the S&P, but supported by their high moat and solid secular growth drivers.

Sarah Kanwal

Equity Analyst, Director

Direct: 617.226.0022

Fax: 617.523.8118

Crestwood Advisors

One Liberty Square, Suite 500

Boston, MA 02109